President Obama spoke Tuesday about how far housing has come from its pit in the middle of the crisis. The latest housing scorecard from the Obama Administration only strengthened the president’s statements, yet serves as a reminder that there is still a long ways to go.

“As the July housing scorecard indicates, the Obama Administration’s efforts to speed the housing recovery are continuing to build upon the progress that has been made over the last four years,” said U.S. Department of Housing and Urban Development Deputy Assistant Secretary for Economic Affairs Kurt Usowski.

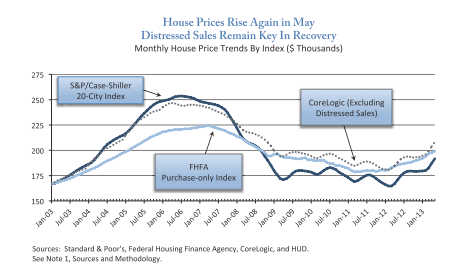

Home prices continue to trudge forward, with the S&P Case-Shiller home price index up from 152.4 in April to 156.1 in the latest report in May. Year-over-year the index is up from 139.2 in May 2012.

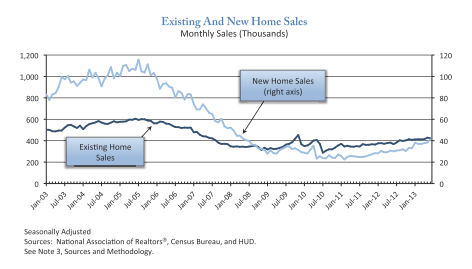

As rising mortgage rates begin to catch up with the housing recovery, less buyers are feeling the pressure to buy a home right now. According to the National Association of Realtors, existing-home sales fell from a revised 428,300 in May to 423,300 in June.

However, homebuilders can breath a sigh of relief, as new home sales continued to increase, up from 38,300 in May to 41,400 in June, according to data from the U.S. Census Bureau and HUD.

The pool of existing-homes for sale has continued to grow, a positive sign for potential buyers, with inventory up from a 5.0-month supply in May to a 5.2-month supply in June, NAR reported. Surprisingly, the supply of new homes for sale dropped slightly to 3.9 months, down from 4.2 months in May.

Foreclosure starts take the cake for the most notable change in this month’s housing scorecard. Foreclosure starts dropped from 72,700 in May to 57,300 in June, data from RealtyTrac revealed.

According to a report from Lender Processing Services, mortgage delinquency rates for prime borrowers made a turnaround, heading upward from May. June’s delinquency rate was 3.5%, up from 3.1% in May.

“The annual home price increases over the last several months remain at levels not seen since 2006 and newly initiated foreclosures are at their lowest level since December 2005. As we regain stability in our housing markets, it is time to begin the process of reforming the housing finance system to reduce the federal government footprint and ensure that private capital takes a sustainable central role,” Usowski added.