Gabe Medrano just started as the go-to guy for the correspondent lending division at NexBank, and already he is seeing something he doesn't like. In front of him early on a Thursday morning, on his computer monitor, the Dow Jones Industrial Average opened and began to tank. The ongoing conflict in Syria and threats of a Federal Reserve taper are putting negative pressure on the stock market. From Medrano's desk, it's also making rates fluctuate wildly.

Deals he closed the Thursday before were 80 basis points wider. But he gets on with it. Rates are rates and can’t be controlled. But what Medrano can control is his division. All shops are different, of course, and NexBank is no exception. Medrano keeps it small and sweet.

“We do not offer retail, nor do we re-solicit our portfolio,” says Medrano, who holds the title of regional sales executive. “We are building our correspondent business and we are comfortable with $100 million to $200 million a month. We want to make sure we are aligning ourselves with the right clients. We have learned how to crawl quickly and (we are) training for a marathon.”

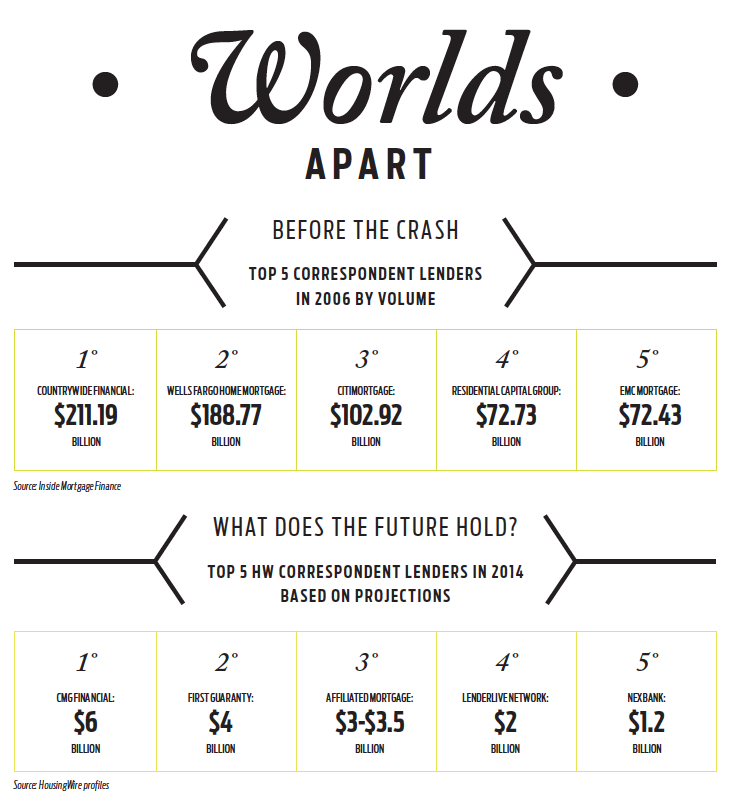

Others boast about their multibillion-dollar correspondent lending services; the model is robust enough to be modified to suit its purpose in the mortgage lending space. And it’s ever evolving. The latest popularity contest pendant goes to the mini-correspondent division, where the secondary market investor underwrites the mortgage.

It’s an easy shop for a correspondent lender to open, and the timing couldn’t be better.

Such success can come at a price. More and more, others are looking to get in on the action. It might not be such a good idea.

According to Andrew Peters, the CEO of First Guaranty back when they started the corresponding lending division in 2012, the space wasn’t as competitive as it had been. Bank of America and MetLife pulled out of the space and smaller players had yet to move in. Now with rates rising, the value of servicing is getting aggressive — and growing. Mid-size players are coming to the street and pricing thinner margins.

“They’re looking at this as a way to aggregate servicing,” said Peters.

“You’ve got a group of newer entrants, putting their feelers out to start but aren’t sure of where they want to be price-wise,” he said. “They’ve just seen some of their competitors get into CL. But they’re getting aggressive in a market where getting aggressive could mean not a lot of cash flow up front and just taking the long-term goal of building the servicing.”

Peters admits getting into correspondent lending at just the right time, but denies having a crystal ball on his desk. As he explains, FGMC fell into the business operation. When BofA pulled out, it presented the company with an opportunity to gain market share.

“In the past few years, we’ve witnessed an unprecedented withdrawal of liquidity from the correspondent lending market, as banks retreated from third-party lending,” said Rick Thompson, CEO of Envoy Mortgage, in a statement released when the company jumped into the correspondent lending space in January.

An executive working in the new division, Dan Hastings, added: “Mortgage servicing rights are more valuable today than in many years because of the high quality of loans. Plus, retaining the servicing on most correspondent loans enables us to maintain superior customer relationships.” Envoy declined to provide further updates to HousingWire on its correspondent lending efforts.

But the efforts of Envoy exemplify precisely the point Peters is trying to make about new players coming into the market. It’s a large temptation. Until now, Envoy Mortgage exclusively was a retail mortgage originator and servicer. Time will tell if it is a good decision, even if Envoy will not.

LenderLive CEO Rick Seehausen said his firm acquired Guardian Mortgage documents in order to aid this segment of the market. The decision to get into correspondent lending is, like anything else, to serve the needs of clientele.

“It became obvious to us that on one side of the spectrum, (there are) credit unions and community banks, and on the other side, investment banks that offer mortgages to private wealth management clients not only needed the back-office support we provide, but were also looking for a source of liquidity and certainty of execution for particular loan types,” he said.

“When the community banks and credit unions choose to sell, they would very much prefer to sell to a nonbank entity that will protect their customer relationship,” he adds. “Another bank may try to cross-sell competing bank products and services to the customer. However, price is important too, and the money center banks may have a price advantage that compels the community lender to sell to them.”

MINI-MORTGAGES

Not everyone is a big fan of mini-correspondents. Fans, on the other hand, often say that's what happens when brokers become bankers.

“The CL models work really well with brokers making the shift to correspondent,” said Thomas Wind, executive vice president of home lending at EverBank. Wind believes that community-focused institutions need to present themselves as being able to fulfill the transaction and close the loan in their name.

That’s where his operation comes in. EverBank is underwriting everything. And for the smaller organizations, they still want to present themselves as the sole lender, but don’t want to take on potential repurchase risk. So they can focus on the market and not have to worry about putting the infrastructure in place. EverBank delivers the loan to the secondary market.

“There are models out there where they can’t outsource everything, but then they feel like they lose control, and interaction,” Wind added. “So it’s the nice way to maintain control while allowing the corresponding partner to provide liquidity and take on the capital market responsibility, and still keep a piece of it.”

Credit unions and community banks are growing their market share, due in large part to the mini-correspondent model.

Second-quarter data from the National Credit Union Administration shows federally insured credit unions experienced brisk loan growth, reporting their highest net worth since 2008 and record membership levels in the second quarter. Loan activity increased 2.3% in the second quarter, and 5.5% over the past four quarters — the strongest growth for that length of time since the beginning of 2009. The net worth ratio rose to 10.5%, its highest level since 2008.

Membership in federally insured credit unions hit a record-high 95.2 million in the second quarter of this year — up by 560,670 members, or 0.6%. Nearly 2.1 million Americans have joined a credit union in the last four quarters, NCUA reported.

In the second quarter, first real estate loans rose to $253.8 billion, up 5.6% on an annual basis. But it hasn’t been a cakewalk. The displacement in the broker community means many mom-and-pop shops also need to evolve and become part of the mini-correspondent segment. Hence, the emergence of the broker-to-banker colloquialism.

In the second quarter, first real estate loans rose to $253.8 billion, up 5.6% on an annual basis. But it hasn’t been a cakewalk. The displacement in the broker community means many mom-and-pop shops also need to evolve and become part of the mini-correspondent segment. Hence, the emergence of the broker-to-banker colloquialism.

Opinions differ on whether this is a good thing.

First Guaranty’s Peters is not convinced this is the route all brokers should consider taking. His firm has not taken the view that come Jan. 1, 2014, brokers will need to be pushed into the correspondent space, as he reckons some of his competitors lead them to believe. He believes the majority of brokers in the country will be happy with making 2% to 2.25% per loan.

“I don’t think becoming a banker is the right move for a lot of the brokers; it’s not what they are used to, but FGMC will be there to support them if they do,” he said.

Peters said he finds brokers form one of the most robust segments in the nation. Most brokers doing conventional or government business are not setting compensation at 3% to 3.5%.

“Maybe if they do three or four loans a month,” he said. “The majority of brokers set their lender-pay compensation at 2% to 2.5%. They’re happy with that and not being beholden to the personal guaranty of a warehouse line of credit or working for a nonbank lender.”

Earlier this year, New Penn Financial tapped Lisa Schreiber to head its correspondent lending division. New Penn is headquartered in Plymouth Meeting, Pa., but its story is bigger. The nonbank entity is a subsidiary of Shellpoint Partners, the New York-based specialty finance company touting some high powered Wall Street types on its board — most notably securitization pioneer Lewis Ranieri.

The decision made sense. Schreiber served several executive positions across a wide array of mortgage finance firms — from Ellie Mae to Bank of America.

Late in the summer, Schreiber was travelling through Southern California, working her network and talking to clients. Earlier in the season, Shellpoint received the green light from the Securities and Exchange Commission to issue residential mortgage-backed securities, a bold move at this juncture.

The company funded itself to the tune of $2 billion of issuance capacity. The special-purpose vehicle is titled Shellpoint Mortgage Acceptance, which the company asked to be referred to as “Shelly Mac.”

Some considered the move daring, considering the total void of activity in the new issuance of private-label RMBS.

And Schreiber acts no less ambitious. New Penn is launching a mini-correspondent channel. As she zipped around SoCal, Schreiber took a moment to stop and take a call from HousingWire. To her, it isn’t an inconvenience, as everyone is talking about business opportunities in the correspondent lending space.

Why the support for mini-correspondent? Schreiber is confident that her counterparties are more than capable of adequately funding their loans, but need additional support around the process. That’s where New Penn will come in.

“Correspondent lending needs to fit a certain framework,” she said. “To be successful it has to contain structure for small mortgage bankers and banks with the ability to fund their products who are also risk-aware but don’t have the wherewithal to deal with that risk effectively. Investors providing services such as prior approval underwriting, doc prep and compliance reviews help to fit perfectly into this space.”

SNAPSHOT OF THE FUTURE

There is pressure on the big four to reduce the size of their footprint in the servicing space. There is regulatory pressure to sell mortgage servicing rights. These banks intend to focus on their retail mortgage customers for retention. More and more, they are downsizing wholesale channels, a clear sign they favor either retail or consumer-direct over correspondent business.

One exception is JPMorgan Chase, which still believes in the future of correspondent lending.

“The quality that you get through this (particular channel)has been and will be high. From a Chase point of view, it’s another way in which we garner customers — not just for our servicing book.

“The bank is always looking for customers and correspondent gives us the opportunity to supplement our retail and direct-to-consumer business,” said Greg Bellies, head of correspondent lending at Chase.

Chase uses nondelegated and delegated underwriting in its correspondent lending department. It also uses a system of random checks, for example, to determine potential trigger events that result in automated alerts.

When the alarm bells go off, Chase staffers pull and review the loan. Like all others, the business is uniquely nuanced. Chase does correspondent business with banks and independent mortgage bankers, but currently not brokers.

“There’s clearly a lot of change in the space; quality continues to improve. But even though you have a counterparty, you still need to know your customer and do your reviews to make sure the asset brought in passes muster,” he added. “It’s been a good business for us. It’s an important part of our overall mortgage strategy.”

According to Bellies, the mortgage industry in general does a better job of fully underwriting loan files and ensuring proper documentation. However, a constant stream of feedback to and from counterparties is essential to keep loan quality straight.

Yet, new regulations for the too-big-to-fails under Basel III alter treatment of capital. Looming restrictions under the Qualified Mortgage and Qualified Residential Mortgage rules mean some dislocation in 2014, though most of the big correspondent lenders appear confident they will not fear any downward pressure.

Fitch Ratings recently quantified the risk of QRM, saying that the industry more or less dodged a bullet.

Under the current incarnation, there is no requirement for a minimum downpayment under the draft QRM rule as long as the QM definition is satisfied and borrowers meet basic debt-to-income requirements.

The big fear, according to Fitch, would be the inclusion of an onerous down payment minimum of as much as 30%. That could lead to a tightening of credit, slowing the revival of the prime RMBS market. The market breathed a sigh of relief when the possibility did not come to pass. Some called it a mortgage-friendly regulation — as if more regulation can really be business-friendly.

The rule-making notice by federal regulators offers an alternative QRM proposal that would require qualifying loans to have a maximum LTV of 70%, while also meeting the existing QM definition.

“Fitch expects that the alignment of QRM with QM rules would help to ease the transition to the new rules for originators, as well as reduce the cost impact,” Fitch said in an email to clients. “Most of the existing prime jumbo originators have been implementing technology and internal methodologies to meet the requirements of QM. However, the uncertainty over QRM had posed some logistical challenges.”

For some, the uncertainty never even made them sweat. “We have a fairly significant initiative going on to prepare for QM and working closely with vendors to fulfill agency loans in a post-QM environment,” said EverBank’s Wind. “The amount of investment it takes, it’ll be a hurdle to get over and may prove to be too challenging for some. But for the bigger players in the market, we feel like we are well down the path of being compliant.”

Still, regulation is regulation. The future for correspondent lending is not some arena of gladiator pillow-fighting. It’s a business struggling to make ends meet like any other existing in the current macroeconomic fundamentals of the United States. Not everyone can survive.

“For the next four months there will be some fallout from guys who aren’t seeing the level of profitability they expected,” said FGMC’s Peters. “Retaining servicing is not an easy prospect, especially with new regulations. Some of the entrants will slide back into their comfort zone, which is retail.”

So, in correspondent lending, to the victor the spoils. But to be clear, with the refi markets drying up and the purchase market still a long way off, the spoils will remain slim pickings.