The number of homes in foreclosure fell 37% year-over year, declining to 720,000 in March 2014 from 1.1 million in March 2013, an analytics firm reported.

The CoreLogic [CLGX] latest National Foreclosure Report revealed that there were 48,000 completed foreclosures nationally in March, down from 53,000 last year, a year-over-year decrease of 10%.

However, month-over-month completed foreclosures were up 5.9% from 45,000 in February 2014 (February numbers revised), and 48,000 in January.

Before the housing crisis in 2007, completed foreclosures averaged 21,000 per month nationwide between 2000 ad 2006.

“The inventory of homes in foreclosure and serious delinquency status are back to 2008 levels, yet remain elevated from a historical perspective,” said Mark Fleming, chief economist for CoreLogic.

Despite the housing market improving, Fleming explained that it still has a long way to go from being fully recovered.

“By way of comparison, distressed stock inventories are more than three times higher than the levels of the early 2000s, before the most-recent housing boom and subsequent financial crisis,” he continued.

For the 29th month year-over-year, the foreclosure inventory dropped and fell from 2.8% in March 2013 to 1.8% of all homes in March 2014.

“The pathway to a full recovery in housing is proving to be a very long one, but lower distressed stock levels are one clear indicator that we continue to make slow-but-steady progress,” said Anand Nallathambi, president and CEO of CoreLogic.

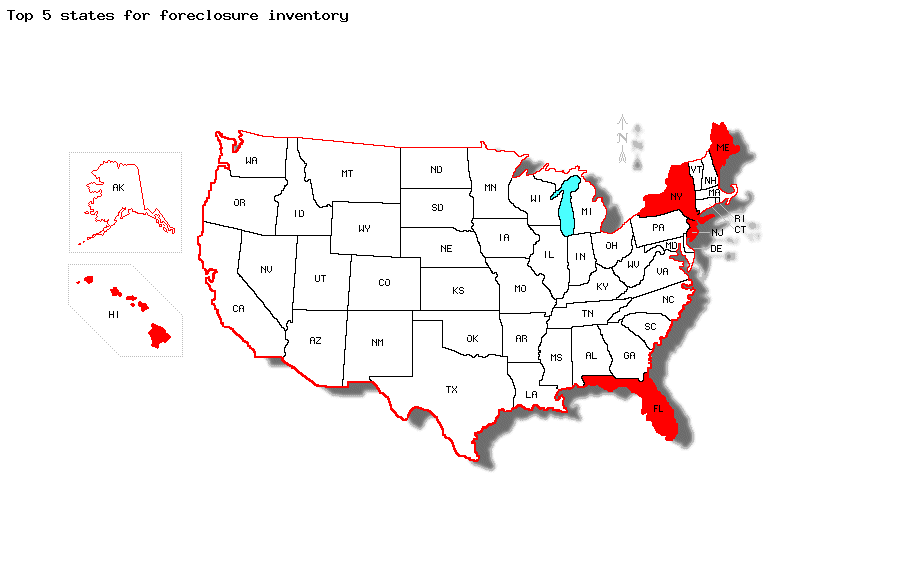

“Most states have made good progress clearing their foreclosure inventories but states that have a longer judicial foreclosure process such as Florida, New Jersey and New York, continue to struggle with elevated distressed stock inventories,” Nallathambi said.

See the next page for the highest foreclsore inventory states.

Five states with the highest foreclosure inventory as a percentage of all mortgaged homes were:

New Jersey (6%)

Florida (5.8%)

New York (4.6%)

Maine (3.2%)

Hawaii (3.1%).