Despite the percentage of flipped homes shrinking to 3.7% of the total homes sold, the profits from flipping a house are up to 30%. The share of flipped house sales was down from 4.1% in the fourth quarter of 2013 and down from 6.5% in the first quarter of 2013.

While the share of flipped homes is shrinking, the average sales price of single-family homes flipped in the first quarter was $55,574 higher than the average original purchase price. That’s up from a year ago when the average gross profit per flip was $51,805, according to the Q1 2014 U.S. Home Flipping Report from RealtyTrac.

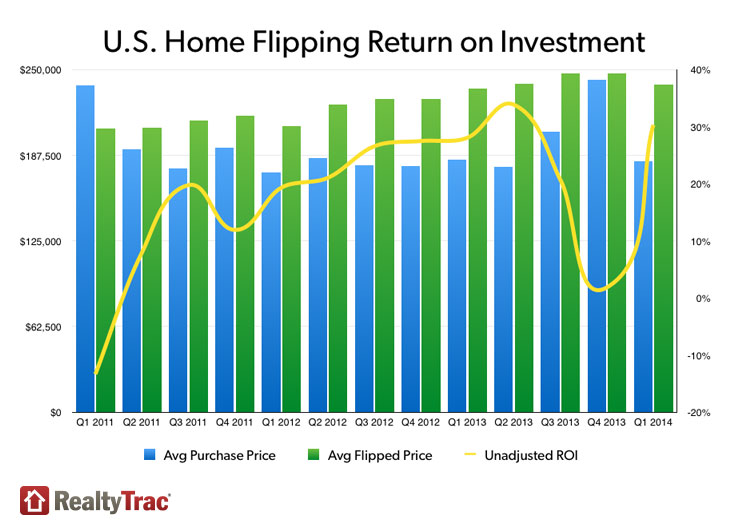

That gross profit provided flippers with an unadjusted ROI of 30% of the average original purchase price. The average gross profit per flip a year ago was an unadjusted ROI of 28%.

The graph below illustrates that investors are back to buying lower priced properties and flipping them for healthy profit, even if the sales are at a lower share of the total sales than in years past.

“Slowing home price appreciation early this year in many of the most popular flipping markets put some investors in danger of flying too close to the sun,” said Daren Blomquist, vice president at RealtyTrac.

“But investors appear to have recalibrated their flipping strategy, accounting for the slower home price appreciation even if that means fewer flips. This is another good sign that this housing recovery is behaving much more rationally than the last housing boom, which was built largely on unfounded speculation rather than fact-based calculations.”

The average time to complete a flip rose to 101 days, up fro an average of 92 days in the previous quarter and up from an average of 79 days for flips completed in the first quarter of 2013.

The major cities that had the highest share of flips in the first quarter were New York (10.2%), Jacksonville, Fla., (10.0%), San Diego (7.1%), Las Vegas (6.7%) and Miami (5.9%).

The cities that provided the highest average gross ROI percentage were Pittsburgh (89%), Philadelphia (56%), Memphis (51%), Detroit (48%), and Seattle (48%).

Conversely, the cities that had the largest decreases in flips from a year ago were New Orleans (down 83%), Baltimore (down 81%), Minneapolis (down 80%), Richmond, Va. (down 80%), Detroit (down 76%), and Washington, D.C. (down 73%).

Other major metros with year-over-year decreases in flipping as a share of all sales included New York (down 37%), Phoenix (down 39%), Riverside-San Bernardino (down 22%), Atlanta (down 57%), Chicago (down 29%) and Las Vegas (down 9%).

The cities that recorded the most total flips in the first quarter were New York (1,791), Phoenix (894), Los Angeles (828), Miami (749), and Riverside-San Bernardino (627).