The growth of rental demand as homeownership rates hit historic, near 40-year lows may in part be because of Millennials who want to stay mobile, but it’s also driven by would-be homebuyers who are getting shut out by tight mortgage-lending standards.

"If you can't get into a single-family house and you can't get a mortgage, well, you don't need a mortgage to get an apartment," said Stephanie Karol, an economist at IHS.

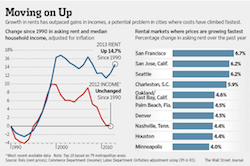

Undeniably, household incomes have been stagnant since the 1970s, and especially since 1990. Median household income was $50,017 in 2012, below 2007's peak level of $55,627, after adjusting for inflation, according to U.S. Census Bureau data.

Click on the graph to enlarge.

As Tyler at ZeroHedge puts it, there is one big beneficiary of all this.

And since the demand for rental properties will only go up as even parent basements are getting full, it means the already record high rent prices will duly follow, taking even bigger chunks out of US disposable income, and thus, that part of the US economy, some 70% of it, which depends on consumer spending. The beneficiary? The personal bank accounts of owners of rental properties… such as BlackStone – America's largest landlord.

Sure enough, as WSJ confirms, "apartment landlords continued to push through hefty rent hikes in the second quarter, squeezing U.S. households that already are struggling financially after four years of steady increases."