After a drought that saw once-prolific Redwood Trust (RWT) issue only one residential mortgage-backed securitization in the first half of 2014, the real estate investment trust is set to bring its second jumbo RMBS to market soon.

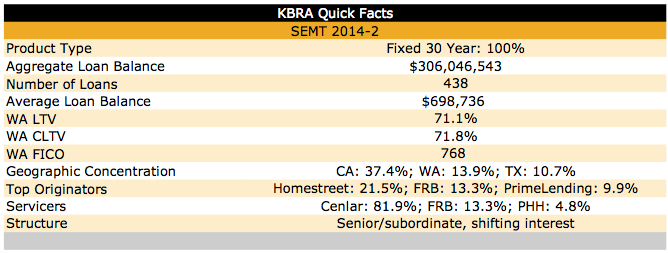

Redwood’s Sequoia Mortgage Trust 2014-2 is backed by 438 loans with an average loan balance of $698,736.

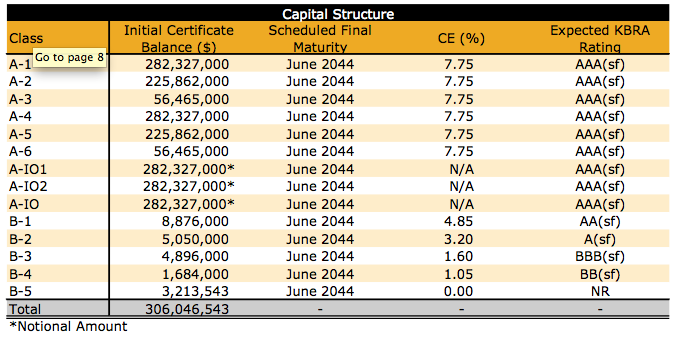

Kroll Bond Ratings Agency has issued its presale ratings for SEMT 2014-2 and has awarded AAA ratings to the vast majority of the $306 million deal.

Click the image below to see a breakdown of Kroll's expected ratings.

The loans in the pool are all fixed 30-year notes and the loans have a weighted average loan-to-value of 71.1%, according to Kroll’s report.

The weighted average of the borrowers’ FICO scores is 768. In its presale report, Kroll notes the “strong” borrower credit quality as a positive of the deal.

Distributions of principal and interest and loss allocations are based on a traditional senior subordinate shifting interest structure.

In its presale report, Kroll states that Redwood’s experience as an aggregator of mortgage loans and as an issuer of RMBSs as a positive for the deal. According to Kroll’s report, this will be the 23rd SEMT transaction Redwood has offered since 2010.

In March, Redwood brought its first jumbo RMBS of the year to market after issuing roughly one RMBS per month in 2013.

Kroll also cites the collateral quality of the pool as a positive. “SEMT 2014-2 consists of high quality, prime mortgage loans that exhibit significant borrower equity,” Kroll’s report states. “The collateral pool’s 71.1% weighted average loan-to-value ratio and 71.8% WA combined LTV ratio provide a substantial margin of safety against potential home price declines.”

Independent third-party reviews were conducted on 88.9% of the loans. “In general, the loans either exhibited no material exceptions to underwriting guidelines or included adequate mitigating and compensating factors for the exceptions that were found,” Kroll’s report states.

Cenlar will conduct servicing on 81.9% of the loans, with the remaining loans being serviced by First Republic Bank and PHH Mortgage. Kroll notes the experience of the servicers as a positive for the deal as well.

CitiMortgage will act as the master servicer for the loans.

Click the image below to see a snapshot of the deal's details.

The amount of loan sellers in the transaction is a concern for Kroll. According to Kroll’s report, the loans in SEMT 2014-2 come from 74 different originators. HomeStreet Bank originated 21.5% of the loans, FRB originated 13.3% and PrimeLending originated 9.9%. Those are the only three lenders that contributed more than 5% to the offering.

"While seller diversity helps reduce geographic concentration, it also increases exposure to the underwriting standards and processes of sellers with limited jumbo mortgage loan performance history,” Kroll’s report states. “In addition, some of the sellers may lack sufficient financial resources to fulfill their repurchase obligations should a breach of a loan representation and warranty occur.”

As with other similar transactions, the geographic concentration of the loans is listed as a potential negative. "Non-conforming prime mortgages are most frequently originated in those regions of the country where home prices are highest,” Kroll said. “As a result, the geographic concentration of pools of jumbo loans tends to be high, with significant exposure to assets located in California as well as a number of other major metropolitan areas.”

According to Kroll’s report, 37.4% of the loans in the pool are located in California. Washington makes up 13.9% and Texas makes up 10.7%.