Good news for failed borrowers who were negatively impacted during the financial crisis — Fannie Mae updated the policy related to the minimum waiting periods following a preforeclosure sale or deed-in-lieu of foreclosure, making it easier for distressed borrowers to jump back into the market sooner, according to a new fact sheet released by Fannie.

In order to be eligible for a mortgage loan, Fannie requires borrowers to demonstrate that they have reestablished credit following a significant derogatory credit event, such as a foreclosure, bankruptcy, preforeclosure sale or deed-in-lieu.

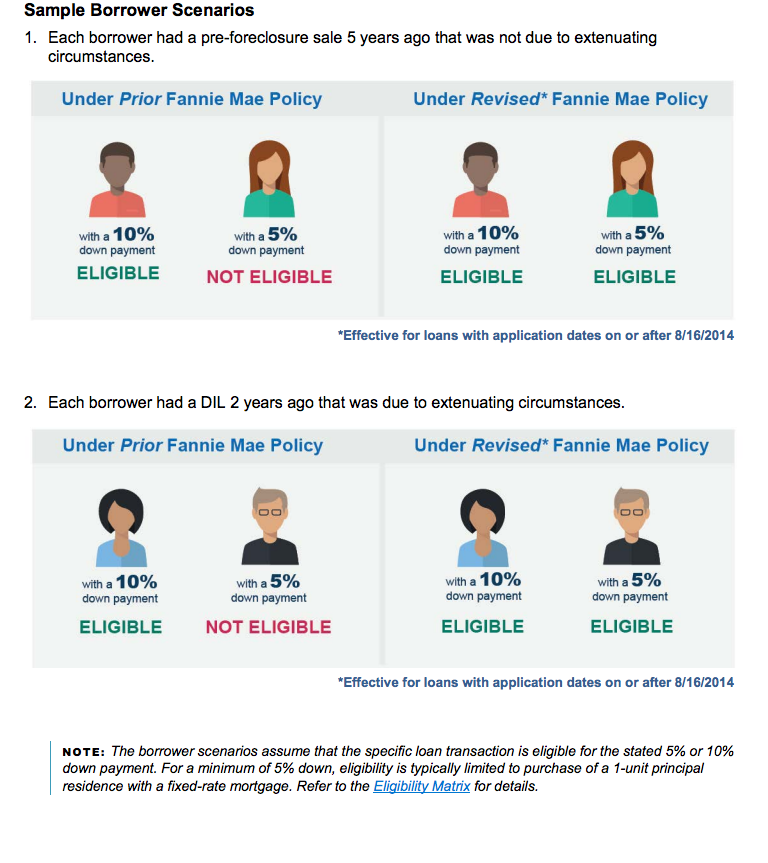

Previously, the standard wait period was two years with a maximum 80% LTV and four years with a maximum 90% LTV, with standard eligibility after seven years. In extenuating circumstances, borrowers could wait only two years with a maximum 90% LTV.

Now, for all loans with applications dates on or after Aug. 16, the standard waiting period was four years, and only two years with extenuating circumstances.

While the new revisions get rid of the earlier options and LTV requirements, it is sooner than the previous standard wait of seven years.

According to Fannie Mae, extenuating circumstances are nonrecurring events that are beyond the borrower’s control that result in a sudden, significant and prolonged reduction in income or a catastrophic increase in financial obligations.

(Source: Fannie Mae, click for larger image)

This new rule comes during a time that demand for housing is down due to various reasons. “A ding on the credit score, a lost down payment, there are multiple reasons we think demand is down,” Director of the Federal Housing Finance Agency Mel Watt said in an exclusive interview with HousingWire. “It’s a lack of confidence that housing has the same place in the pecking order of the American dream.”