The precipitous growth of nonbank mortgage servicers in recent years presents a threat to the performance of private-label residential mortgage-backed securitizations, Fitch Ratings said in a new report.

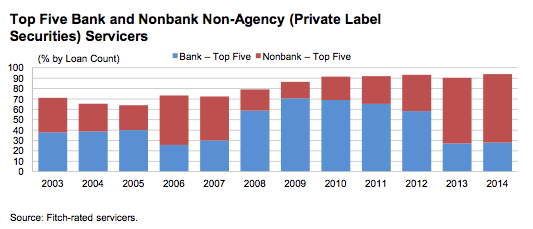

According to Fitch’s report, nonbanks now service approximately 74% of all private-label securities by loan count, up from 48% in 2004. And nearly all of that 74% is being serviced by the top five nonbank servicers.

According to Fitch’s data, Ocwen Loan Servicing (OCN), Nationstar (NSM), Select Portfolio Servicing, Green Tree Servicing, and PHH Mortgage Corp. (PHH) currently account for 64% of all non-agency servicing. That concentration is a concern, Fitch said.

“Nonbank servicers have grown significantly through the sale and transfer of difficult-to-service loans from large banking institutions," said Fitch Managing Director Roelof Slump. “However, while nonbank servicers typically offer specialization which is important for this critical function, they are generally not as well-capitalized as the banks and this could increase servicer disruption/continuity risk among lower-rated companies with unique business strategies.”

The mortgage servicing rights market share held by nonbank servicers has exploded in the last several years. For example, in 2009 the top five commercial bank servicers of private-label product, Bank of America (BAC), JPMorgan Chase (JPM), GMAC, IndyMac and Wells Fargo (WFC), accounted for 72% of the total of private-label servicing.

Today, the top five commercial banks, Bank of America, JPMorgan Chase, Wells Fargo, Citibank (C), and PNC, make up only 26% of the non-agency servicing.

Conversely, among the Fitch-rated servicers, the top five nonbanks, Ocwen, Green Tree, American Home Mortgage Servicing, Aurora Loan Services and Litton Loan Servicing, accounted for only 16% of the non-agency servicing in 2009.

“While nonbank servicers’ market share grew steadily from 2009–2012, their growth exploded in 2013,” Fitch said. “A number of large mortgage servicing rights acquisitions saw the nonbank segment market share increase for the top five servicers to 63%.”

Click the image below to see a graph from Fitch’s report that shows the rapid growth of nonbank servicers.

Fitch identifies several factors that have driven the rise of nonbank servicers, including: more onerous capital requirements affecting bank servicers; a desire to focus on core bank customers and new mortgage production; the specialization of nonbank servicers in managing challenged loans; and cost advantages of the larger nonbank servicers, especially those with offshore staffing.

“Unlike bank servicers, nonbank servicers typically have little or limited private-label mortgage origination activity,” Fitch said. “Much of the nonbank growth has occurred through the sale and transfer of difficult-to-service loans from large banking institutions.”

According to Fitch’s report, the biggest beneficiaries of the MSR transfer boom have been Ocwen, Nationstar and Green Tree. “For example, since the beginning of 2013, both Ocwen and Nationstar have more than doubled their non-agency servicing portfolio,” Fitch said.

The graph below shows just how quickly Ocwen, Nationstar and Green Tree have increased their market share.

But the rise of the nonbanks presents heightened risks to investors, Fitch said. “In contrast to large commercial bank servicers, most nonbank servicers, including most of the current top five, have a weaker financial profile and are currently rated non-investment grade or are not publicly rated by Fitch,” the company said.

“As such, the significant growth of nonbank servicers has also increased the counterparty default risk for PLS transactions.”

Fitch said the biggest risk to a private-label security investor from a servicer default is a disruption in servicing continuity, which could lead to pool delinquencies and trust cash flow disruption.

“Fitch has also observed that servicing transfers to several nonbank servicers have affected PLS cash flows due to differences in practices and policies,” Fitch said.

“For example, nonbank servicers have generally been more restrictive in servicer advance policies, which in some cases have temporarily reduced or cut off cash flows to PLS transactions. In select PLS transactions, these policies and their influence on transaction cash flows have negatively affected ratings.”

But Fitch expects the rapid growth rate of nonbanks to slow in the relative future, especially among the largest players, due to the growing regulatory and legal inquiries.

Ocwen, for example, has been the subject of recent probes by the Securities and Exchange Commission over the convoluted relationship between Ocwen and its affiliated companies, Altisource Residential (RESI), Altisource Asset Management Corp (AAMC), Altisource Portfolio (ASPS), and Home Loan Servicing Solutions (HLSS).

And the SEC isn’t the only one looking into Ocwen’s business dealings. The New York Department of Financial Services has been looking into Ocwen’s business since February, when it sent a letter to Ocwen’s general counsel about the company’s dealings with its affiliates.

Green Tree has also had its share of problems recently. In May, a report from Joseph Smith, the monitor of the National Mortgage Settlement, reported that Green Tree failed eight of the settlement’s 29 metrics for mortgage servicing.

“The pace of nonbank servicer growth is expected to be moderate over the short term as large nonbank servicers integrate recent acquisitions and work to comply with new regulations,” Fitch said.

“However, Fitch believes that market incentives continue to support specialization in PLS servicing and that nonbank servicers will continue to grow over the intermediate term. Longer term, consolidation among nonbank servicers might be expected as costs and the economics of the business model become a greater focus.”