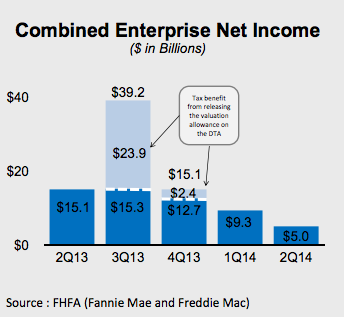

Government-sponsored enterprises Fannie Mae and Freddie Mac brought in a combined second-quarter net income of $5 billion, nearly half of the $9.3 billion the two made in the first quarter of 2014, the Federal Housing Finance Agency’s Quarterly Performance Report of the Housing GSEs stated.

This significant decline is attributed mainly to lower income from private-label mortgage-related securities settlements.

But on the other hand, both enterprises reported that continued improvement in national home prices contributed to releases of loan loss reserves at both enterprises, with combined loan loss reserves decreased $4.5 billion during the quarter.

Since Dec. 31, 2013, combined loan loss reserves at the GSEs declined 10%, or $7.1 billion to $64.9 billion.

To put it in perspective, for the first half 2014, the enterprise reported combined net income of $14.3 billion, driven by proceeds from legal settlements in the first quarter, as GSE and FHFA continued to reach agreements with a number of financial institutions to cover claims in connection with the purchases of PLSs.

For example, Bank of America (BAC) reached a huge settlement with the FHFA in March, resolving claims associated with non-agency mortgage-related securities from 2005 to 2007.