Not only is the student debt crisis a threat to housing, but it also shows no sign of easing soon. In fact, it will probably get worse before it gets better.

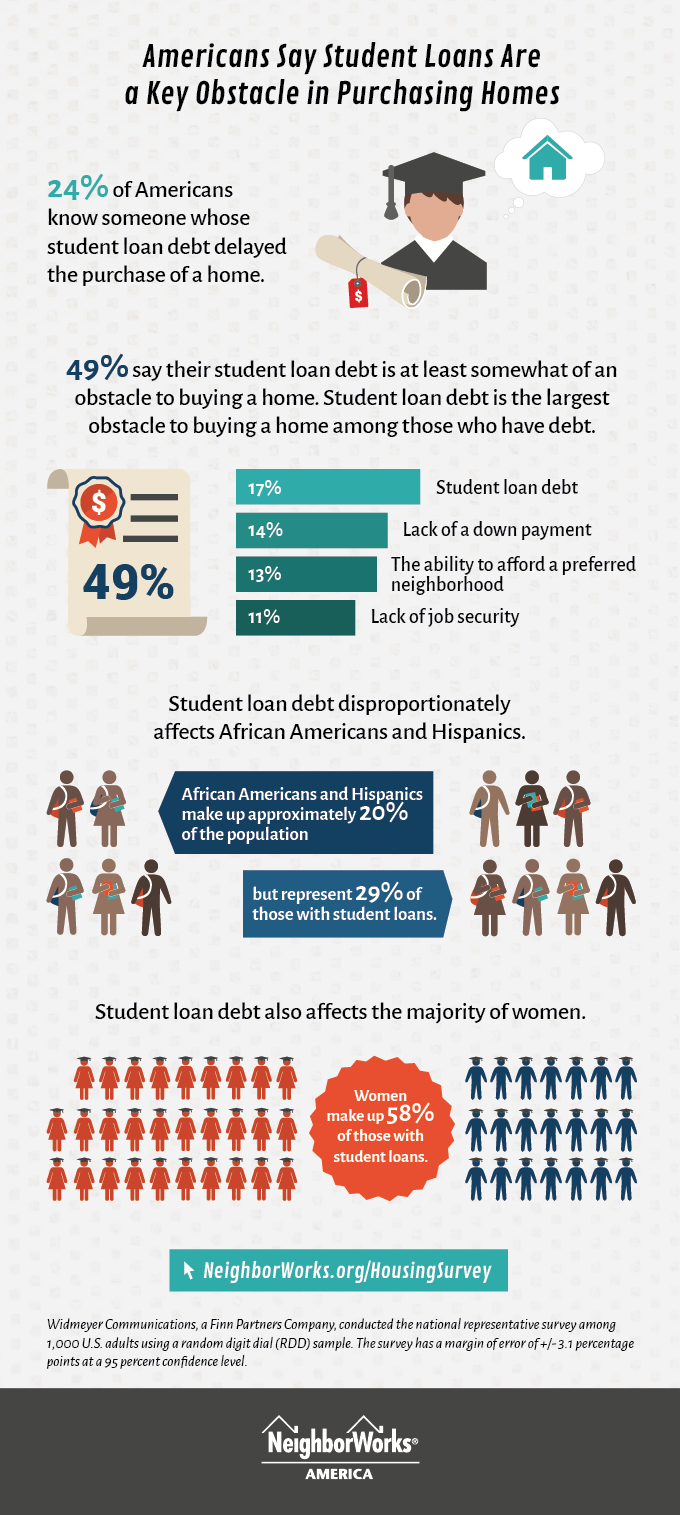

A recent housing survey by NeighborWorks America found that nearly one-out-of-four Americans know someone who has delayed buying a home because of student loan debt.

And the numbers vary even more when race is added into the equation.

At the same time, 60% of adults still believe that owning a home is either the “ most important” or “very important” part of the American dream.

(Source NeighborWorks; click to enlarge)

To put this into numbers, John Burns Real Estate Consulting reported that college debt is increasing by 6% every year and heavy college debt will reduce real estate sales by 8% for this year.

This translates into approximately $83 billion lost in housing sales in 2014.

“Earning a postsecondary degree is increasingly critical in the United States, but student debt is preventing some Americans from purchasing a home and fully fulfilling this ‘American Dream’ aspiration,” said Chuck Wehrwein, acting CEO of NeighborWorks America.

“If we don’t mitigate the effect student loan burden is having and will have for years to come on homeownership, the country will lose a significant amount of economic activity and hundreds of thousands of people will be unable to benefit from the stability and financial value that homeownership has been proven to offer,” he added.