The Federal Housing Finance Agency announced in June that it was seeking industry opinion on Fannie Mae and Freddie Mac guarantee fees, and while the results of this have not been revealed, a new survey of mortgage bankers gives a preview into what lenders expect to happen with increases.

From 2009 to 2013, g-fees continue to gradually increase. In 2013 alone, guarantee fees increased to an average of 51 basis points in 2013 compared to an average of 36 in 2012 and 22 in 2009, according to the annual report from the FHFA.

Genworth U.S. Mortgage Insurance, a unit of Genworth Financial (GNW) released results from a study of industry executives conducted at this year’s Mortgage Bankers Association annual conference in Las Vegas, Nevada. The survey of 302 mortgage professionals was administered in person at the MBA conference in Las Vegas from October 20-21.

“The survey’s findings were in line with expectations and highlight the need for continued dialogue on regulatory reform and credit access,” said Rohit Gupta, president and CEO of Genworth U.S. Mortgage Insurance.

“It’s important the industry and regulators strike a balance between enhancing credit risk protection while ensuring affordable access to mortgage credit for first-time homebuyers, low- to moderate-income borrowers and members of underserved communities. It is also important that mortgage technology platforms are updated to facilitate these processes,” Gupta added.

Here's what the survey found:

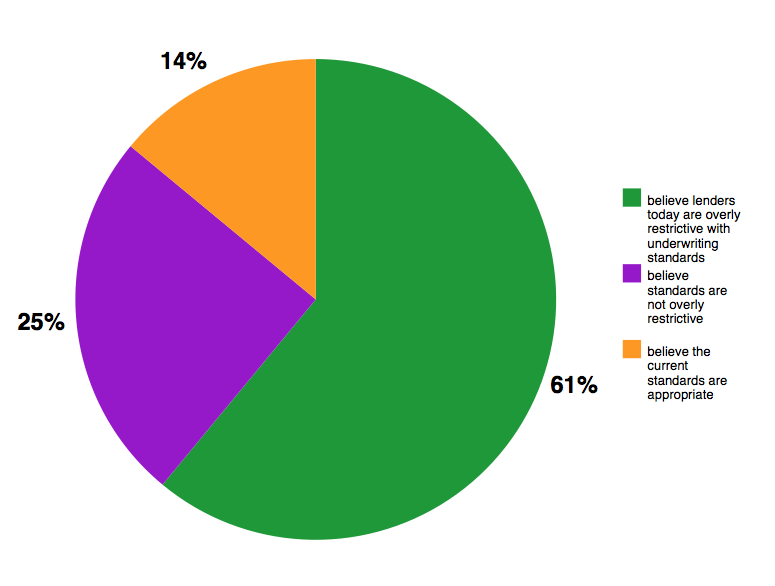

Executives believe: (Source Genworth; Click to enlarge)

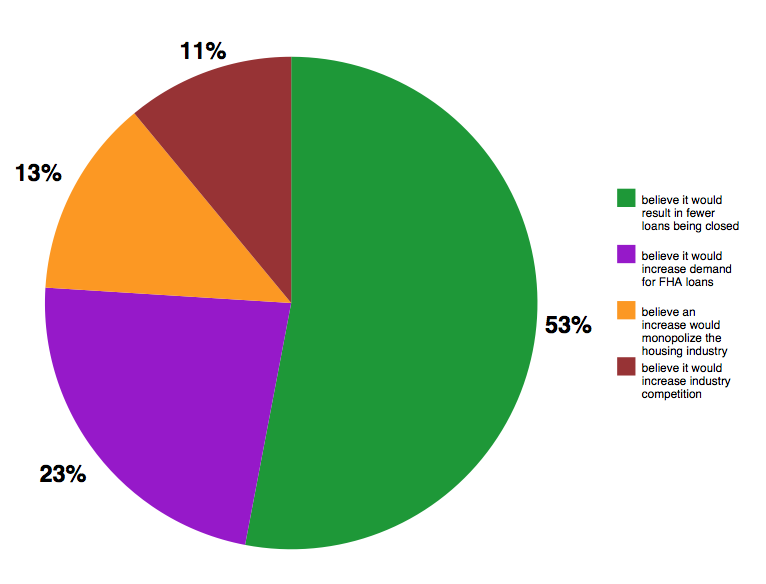

Regarding the proposed increase in Guaranty Fees: (Source Genworth; Click to enlarge)

Other quick statistics include:

- Roughly two-thirds of respondents (64%) believe that low-income borrowers with strong credit do not have appropriate access to credit markets when buying a home.

- Regarding financing, piggyback has not yet surfaced on the radar of many industry executives, however, more than one-third of respondents (38%) are labeling the potential return of this financing type as a threat to the stability of the housing industry.

- Only 10% considered the housing industry, as it pertains to the loan processing process, to be advanced, while 38% of the industry believes current industry platforms meet technological standards. Another 40% of respondents classify it as below technological standards. And, 12% have labeled the industry as technologically outdated.

- Lenders were more optimistic than the broader industry, with 14% considering their platforms technologically advanced, 46% saying they meet technological standards, 31% suggesting they are below technological standards, and 9% labeling them as technologically outdated.