There were 41,000 completed foreclosures nationally, down from 55,000 in October 2013, according to CoreLogic’s (CLGX) October National Foreclosure Report.

This marks a year-over-year decrease of 26.4% and is down 65% from the peak of completed foreclosures in September 2010.

Month-over-month, completed foreclosures were down by 34.1% from the 62,000 reported in September 2014.

To put it in perspective, before the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month nationwide between 2000 and 2006.

Since the financial crisis began in September 2008, there have been approximately 5.3 million completed foreclosures across the country, and since homeownership rates peaked in the second quarter of 2004, there have been approximately 7 million homes lost to foreclosure.

"While there has been a large improvement in the reduction of foreclosure inventory, completed foreclosures remain high and serve as one of the obstacles to new single-family construction," said Sam Khater, deputy chief economist for CoreLogic. "Until the flow of completed foreclosures declines to normal levels, new-home construction will not pick up because builders have little incentive to compete with foreclosure stock."

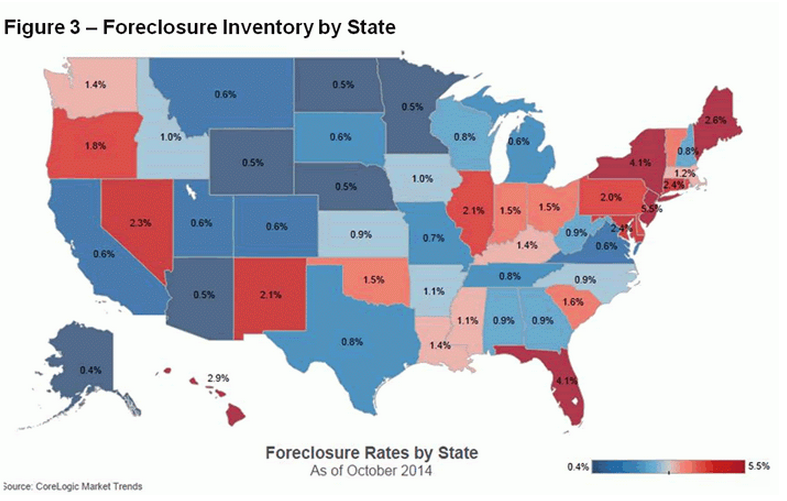

As of October 2014, approximately 605,000 homes nationally were in some stage of foreclosure, known as the foreclosure inventory. This is compared to 875,000 in October 2013, a year-over-year decrease of 30.9% and representing 36 consecutive months of year-over-year declines.

The foreclosure inventory as of October 2014 made up 1.6% of all homes with a mortgage, compared to 2.2% in October 2013.

On a month-over-month basis, the foreclosure inventory was down 2.1% from September 2014. The current foreclosure rate of 1.6% is the lowest inventory level since May 2008.

"The foreclosure inventory is less than 2% and seriously delinquent loans are trending lower right now," said Anand Nallathambi, president and CEO of CoreLogic. "At current rates, we can expect the foreclosure inventory to slip below 500,000 units during 2015."

Click picture to enlarge

(Source: CoreLogic)