There is one distinct moment in recent memory when everything was going to be just fine. On an early morning, back in April 2013, the smallest of miracles happened on the economic front. This singular event would lead to calls that the developed world’s ability to do business, with all of its multitudinous complexities, was on the road to a recovery, maybe this time, finally, forever.

Somewhere between April and May, the 10-year Treasury yield, for more than a year scrapping between 1.4% and 2%, began to rise. As the bond markets reached closer to the end of September, the yield flirted with 3%. Global investors, it seemed, were growing their appetite for risk.

They sought the higher yielding playgrounds of the emerging markets, proof the other nations’ economies were strong. They eschewed the so-called Treasury safety net, and hunted their money elsewhere. And as demand dwindled for the 10-year Treasury, yield increased. This confidence continued for nearly a year.

Unfortunately, by October 2014, the yield nosedived well below 2% as investors flooded the market. In less than a month, a year of gains was erased.

Global economies

Meanwhile, Christine Lagarde, the head of the International Monetary Fund, warned that Europe faced another recession. And she made the warning in the worst kind of way — by comparing the continent’s economy to Japan.

UK chancellor George Osborne later chimed that the Eurozone negatively impacted Britain’s economy, stoking succession fears. True, Scotland voted down the opportunity to leave the Kingdom, but Britain leave the EU?

This didn’t help economic confidence. And this wasn’t the only thing.

Pro-democracy protests in the financial heart and soul of Asia, Hong Kong, turned violent. Air strikes against Islamic State holdings in the Middle East proved ineffective. The volatility rocked oil prices to the good of the American worker, it must be said, but pretty much to no one else.

“Not to sound Cassandra-ish, but when bond yields are collapsing like this, it is often a signal that something is very wrong in the plumbing of the financial system. Bonds simply don’t behave like this on a weak inflation number or a downgrade of Germany’s economic growth by 50 basis points,” opined Brent Nyitray on world events at the time. Nyitray is director of capital markets at iServe Residential Lending, and its funding parent, DellaCamera Capital Management.

“I’ll conclude with this observation: Bond yields are at these levels without much in the way of QE any more. We could have gotten these yields without the Fed buying 3.5 trillion worth of assets.”

The curious case of Nyitray’s observations, where he mentions the Federal Reserve’s position on quantitative easing, the buying of mortgage-backed securities and Treasurys, is distinct in that his question is very open-ended.

Does Nyitray suggest the Fed return to Quantitative Easing? Is it time for a QE4? Fair Cassandra, in Greek methodology, was given the power of prophecy by Apollo and then cursed with others’ disbelief after she refused the god’s advances. She could speak the truth about the invasion of Troy, but the city still fell. Indeed, as legend has it, the Trojans burned the city from the inside out. Logically, the last thing to burn at Troy would have been its fortifications.

Have we learned enough economically to write our own future? Or are we doomed to repeat the economic mistakes of the past? The 10-year Treasury could be merely cyclical, and on the down, but the hardened bond trader in Nyitray clearly believes otherwise. Could the answer be more Fed pumping again? Or are these economic fortifications, like in the city of Troy, merely a mirage?

Maybe we should leave behind the lessons of ancient mythology as we look at what the future holds for the nation’s economy in 2015. After all, no one seeks their lessons from Greece anymore. Or do they?

One bright spot to Lagarde’s announcement is that, as of press time, Greece is finally exiting its Eurozone bailout. The lesson learned is that countries need to do more to protect against default. This could take the form of reserve funding (not likely) or credit lines (more likely) but will most likely follow the strategies of the Federal Reserve.

In Europe the outlook is arguably to the cyclical nature of the markets.

“Investment grade is safety with yield and the longer it takes to get out of this ‘Japanisation’ of the European markets, the longer appetite for credit will remain strong. In the meantime, total returns are on the rise with IG at over 7% year to date,” wrote Juan Valencia and Guy Stear, of Societe Generale in an October email to clients from the bank’s Paris offices. “Equity analysts for HY has had its issues with the sell-off in the U.S., but we expect appetite for the asset class to return as default rates remain very low and yields are extremely attractive.”

It’s well known that the actions of the federal government in the years after the beginning of the Great Recession prevented the total meltdown of developed economies, in the United States in particular. The Basel Committee, the governing body for international banking regulation, authored several white papers proclaiming this internally, though without promoting it publicly.

Despite giving credit where credit is due (pun intended), the important thing to note is the way global economies are synergizing in methodology. In short, what Europe needs today is also what the United States needs, and the Middle East and Asia. And that is jobs, jobs and more jobs.

Employment conundrum

Domestically, jobs are the elephant in the room. Spinmeisters from the bull and bear sides, and from the two political parties, can find what they want to support their arguments or to show the country is headed in the wrong or right direction, but it all comes down to this.

Employers have added an average of 227,000 jobs a month in 2014, up from an average of 194,000 last year. Over the past 12 months, employers have added 2.64 million jobs, the best showing since April 2006. The unemployment rate has fallen to 5.8%, a six-year low, as of October 2014, the latest month for which data as available.

Which sounds great, and if that’s all it took to make a recovery, we’d be there. But it’s not.

The problems lie in the kinds of jobs, the wages paid, and the number of people either marginally attached to the workforce, or who have dropped out altogether.

In some months, while the topline numbers show job growth topping 200,000, a closer look shows that there’s actually a net loss of full-time jobs, with the losses covered and the gains comprised of part-time jobs.

Many analysts have discussed how much labor force participation fell during the downturn. Millions of Americans no longer count as unemployed because they have become so discouraged, they’ve stopped looking for work.

Analysts have paid much less attention to another problem—anemic wage growth.

Much of the growth in the number of jobs has been in retail, service and other trades that fall below national wage averages. Some 60% of the jobs created so far this year pay above the average hourly wage, compared to less than 50% in 2013.

Hourly wages have grown at a steady 2% annual rate over the past four years, but that’s not enough to kick the economy into overdrive. After factoring out inflation, average hourly earnings have increased just 33 cents over more than five years. If people are earning more, it’s because they are working longer hours, not because they are getting big pay raises.

And economists predict wages will grow only 0.2% in October, keeping the 12-month increase within the 1.9% to 2.2% range that’s prevailed in the past two years.

So wage gains are meager, and the recovery suffers. Case closed? Not really. It’s not a question of what is happening — we can see that in the numbers. The question is: Why is this happening?

One theory on why wages remain low is that there are lots of potential workers ready to pile back into the labor market. It was so weak for so long that there are 6 million people, according to the Bureau of Labor Statistics, who say they want jobs but stopped looking. To these must be added the 9.3 million officially unemployed and another 7 million part-time workers who say they’d like full-time work. All these potential workers keep the balance of supply and demand in employers’ favor, the argument goes.

This seems plausible, though as yet evidence of a slew of workers returning to the job hunt isn’t obvious. If this theory holds maybe the reason is this: Workers are so insecure that they’re afraid to abandon their present jobs for something better; therefore, companies don’t have to pay higher wages to retain them.

Polls taken before the November mid-term elections that resulted in a shellacking for the Democrats found economic concerns topping voters’ anxieties. A sizable majority told Gallup pollsters they consider the economy to be “getting worse.”

Even Federal Reserve Chair Janet Yellen admits the employment situation is a bit of a Potemkin Village — a nice veneer hiding a real problem.

“Finally, changes in labor compensation may also help shed light on the degree of labor market slack, although here, too, there are significant challenges in distinguishing between cyclical and structural influences. Over the past several years, wage inflation, as measured by several different indexes, has averaged about 2%, and there has been little evidence of any broad-based acceleration in either wages or compensation. Indeed, in real terms, wages have been about flat, growing less than labor productivity,” Yellen said back in September 2014.

“This pattern of subdued real wage gains suggests that nominal compensation could rise more quickly without exerting any meaningful upward pressure on inflation. And, since wage movements have historically been sensitive to tightness in the labor market, the recent behavior of both nominal and real wages point to weaker labor market conditions than would be indicated by the current unemployment rate.”

The Federal Reserve spigot

Speaking of the Fed, new research sheds light on another key economic issue of the day: Why doesn’t the Fed’s policy of low interest rates and “quantitative easing,” which shovels hundreds of billions of dollars into the economy, create net new jobs?

One part of the answer is clear: the money is only accessible to established firms, which haven’t been creating net new jobs. It’s simply not accessible to the young firms that are the genuine job creators.

The Kauffman Foundation and the Institute for Competitiveness & Prosperity did a comprehensive study to figure out where new jobs actually do come from. The surprising truth is that over the last 25 years, almost all of the private sector jobs have been created by businesses less than five years old.

“In fact, between 1988 and 2011,” write Jason Wiens and Chris Jackson of the Kauffman Foundation, “companies more than five years old destroyed more jobs than they created in all but eight of those years.”

“They find that, keeping company size and industry constant, private U.S. companies invest nearly twice as much as those listed on the stock market: 6.8% of total assets versus just 3.7%.”

Large publicly owned firms are simply not investing enough to grow the economy.

So if the Fed’s money doesn’t go into job creation or investment, where does it all go? One part of the answer is that the firms are just sitting on the money, not seeing opportunities for investment.

Another part of the answer is provided by William Lazonick in HBR and the New York Times — an astonishing amount goes to share buybacks.

“From 2004 to 2013, 454 companies in the S&P 500 Index expended 51% of their profits, or $3.4 trillion, on repurchases, on top of 35% of profits on dividends… More than three-quarters of compensation for the 500 highest-paid executives came from stock options and stock awards,” Lazonick wrote.

“So who gains from open-market repurchases? Their sole purpose is to give a company’s stock price a manipulative boost, and prime beneficiaries are the corporate executives who decide to do them… For corporate executives, stock-based pay is a ticket to membership in the 0.1% top-income club. So why do we let executives manipulate the stock market?”

As The Economist has written, the Blue Chips’ use of share buybacks is the equivalent of becoming addicted to snorting “corporate cocaine.”

Obstacles for first-time buyers

Without higher wages and good jobs, first-timers won’t be buying houses.

Going back to the 1980s, four out of 10 purchases are from first-time homebuyers. In this year’s homebuyer’s survey from the National Association of Realtors, the share of first-time buyers dropped 5 percentage points from a year ago to 33%, representing the lowest share since 1987 (30%).

Lawrence Yun, NAR chief economist, says there are many obstacles young adults are enduring on their path to homeownership.

“Rising rents and repaying student loan debt makes saving for a down payment more difficult, especially for young adults who’ve experienced limited job prospects and flat wage growth since entering the workforce,” he said. “Adding more bumps in the road is that those finally in a position to buy have had to overcome low inventory levels in their price range, competition from investors, tight credit conditions and high mortgage insurance premiums.”

Yun said that he sees some problems being alleviated going forward, but the problem with that is everything we’ve pointed out with job creation and wage stagnation. The cure is out there, but it’s not out there.

“Stronger job growth should eventually support higher wages, but nearly half (47%) of first-time buyers in this year’s survey (43% in 2013) said the mortgage application and approval process was much more or somewhat more difficult than expected. Less-stringent credit standards and mortgage insurance premiums commensurate with current buyer risk profiles are needed to boost first-time buyer participation, especially with interest rates likely rising in upcoming years.”

Jonathan Smoke, chief economist at Realtor.com, believes we are firmly in recovery mode, but he admits wage and job growth is what will make or break things. Until there is a change in the jobs situation – it’s going to be a go-along, get-along housing economy.

“All of our data points suggest a better second half of every year. Home-price appreciation is much healthier. Life is going to be changing from a demographics perspective. We put a major pause on all of our lives during the Great Recession. We have these waves of baby boomers, the wealthiest generation, even if they elect to stay in place we should see a substantial increase in home improvement.”

Mike Fratantoni, economist for the Mortgage Bankers Association, pointed to macroeconomic conditions improving across the board. “I think we are on the edge where we’ll see meaningful wage growth for families,” he said.

“There is a concern the housing market may pull the economy back under. I see the housing market being pulled behind the locomotive of economy. People are spending, but not on housing. We’re running 10% behind. The weak demand is very disturbing. Disturbing at the entry-level of the market — the share of homes going to first time homebuyers is as low as it’s ever been,” Fratantoni said.

Beth Ann Bovino, chief economist of Standard & Poor’s, is more optimistic.

She said certain negative economic conditions are now turning around, as proof that housing can be sustained.

“Real wages were negative, we’re starting to see that turn around. We’re wondering where the consumers were and it seems they’ve gone back to the mall. We’ll be looking to see housing starts finally reaching and holding 1.5 million in two years,” Bovino added.

Wage growth ties to home price growth. Unless there is some very specific micro economic event happening in any given MSA, median income growth or decline, complemented by anemic growth in wages per worker, strongly suggests that the era of housing price appreciation may be short lived. Outside of certain micro economies — such as metropolitan New York, Washington, D.C., Northern California, and South Florida, the general economic outlook is weak.

The median household income in 2007 was $55,000; as of 2014, it is $51,017, an 8% drop. What is not revealed by this set of statistics is that small drops in median household income often are coupled with big drops in discretionary household income. This decline in median income suggests very low year-over-year changes in wages per worker.

Ultimately, wage and income growth drives housing prices, and this growth is not really happening. Hence, the housing price revival may stall and with it so will home sales and purchase money mortgages, which are showing signs of retreat.

Juxtaposed to the anemic growth in wages is a robust growth in housing prices. Appreciation is slowing, but a collapse is not imminent. Don’t pay too much attention to the recent spike in price-to-income ratio used to measure housing prices across the United States.

While some experts argue that this is a sign of a bubble in the making, this statistic is skewed as a result of an influx of cash buyers. In recent months, 40% of all sales have been paid in cash. The remaining 60% of the sales were made using loans. This 60% distribution represents a skewed, biased distribution, one that has eliminated the high-income, high-net-worth folk who would normalize the price-to-income ratio and reduce it down to its more normal levels.

A recent in-depth analysis from the strategic planners at Fannie Mae unveiled an interesting find. While the rate of home sales being financed in the debt markets is at a traditional low, it is not due to lack of investor interest, or cash. “Private capital participation in the mortgage system has declined, but private capital continues to play a substantial role in the marketplace,” explained Gerry Flood, Patrick Fischetti and David Swift in their research report, The Return of Private Capital.

According to Fannie Mae, private investors hold more than $8 trillion in mortgage debt outstanding, with $4.7 trillion of that in the first-loss position.

The lack of communal demand for building and establishing new families is a continual drag on homebuilders as well. Analysts at Moody’s Investors Service recently dropped a bombshell on the industry.

“Given the homebuilding’s propensity to experience boom cycles followed by bust cycles, and especially given the depth and duration of the prior downturn, we do not regard the industry as investment grade,” wrote Moody’s analysts in a recent Credit Outlook report, adding that damages to the business are too expansive to clear in the coming year.

“The industry experienced peak-to-trough revenue declines of about 80%, five consecutive years of aggregate industry losses and massive impairment charges,” they said, in justification of the above opinion.

Home-price appreciation

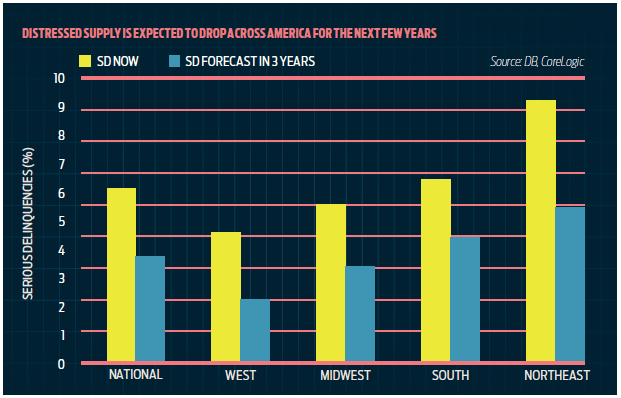

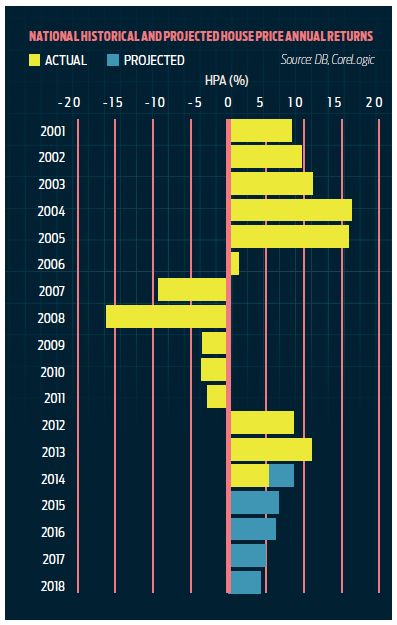

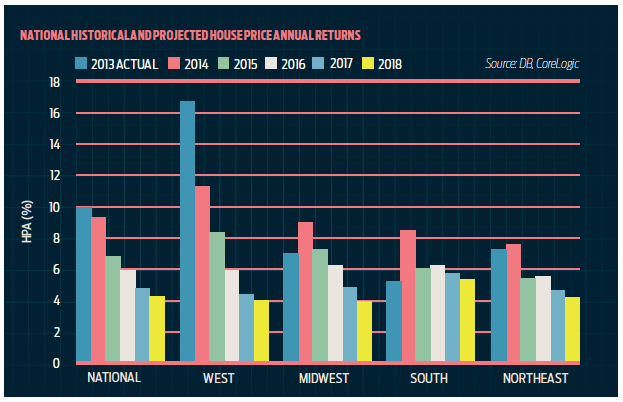

The good news is that the failures in mortgage originations, jobs numbers and even the lack of homebuilding will not prevent home prices from rising nationally. Deutsche Bank is predicting national home prices to rise up to 7% in 2015, and another 6% in 2016, then between 4% and 5% for both 2017 and 2018.

America doesn’t buy it though. According to a Zillow survey, plenty of Americans believe housing won’t normalize for at least three years. While a small percentage of people said they believe the housing market either already has returned to normal, or will in the next 12 months, 40% said it would take three to five years, which would be close to the 10-year anniversary of the financial crisis.

“We’ve reached a point in the recovery where the only real cure-all is time,” said Zillow Chief Economist Stan Humphries. “The market remains very challenging for younger, first-time homebuyers who face an uphill battle saving for a down payment, qualifying for a mortgage and finding an affordable home to buy.”

Time is the one thing the housing economy learned to deal with during the slow recovery, or what Simon Potter, executive vice president of the Federal Reserve Bank of New York, referred to as “normalization” of Federal Policy. And what did he mean by that statement, delivered at a conference held by the Securities Industry and Financial Markets Association trade group? Potter spoke to the ability of the federal government to a) quantitatively ease the nation’s economy through bond and Treasury purchases — which it did, three times — and b) lend to large financial institutions at a Zero Interest Rate Policy, which is the current rate since forever.

What Potter meant was that interest rates will need to rise at some point, and that will also raise the cost of lending to homebuyers. But, on the other hand, should the economy begin to tank, the Fed could reverse course and re-implement one or the other, or both, if necessary. Though whether or not this would be equally as effective remains a point of argument, considering the rise of nonbanks, which are not privy ZIRP lending policies.

“Given the range of available tools, I am confident in our ability to raise short-term interest rates from the zero lower bound when the time to do so arrives,” he said.

NAR’s Yun is quoted in press reports as claiming mortgage rates will rise to 5% next year and to 6% in two years. It’s a bold prediction, as rates again dipped below 4% in late November.

Nonetheless, Yun indicated he believes this will not mean that mortgage rates will put the brakes on home sales, just as long as lenders loosen their standards.

But really, as Humphries said, only time will tell. And Patton said that that time is coming, one day for sure. So the real lingering question to all of this is: What would Cassandra think of all these predictions?