The Consumer Financial Protection Bureau released its newest consumer tool “Owning a Home” to help spur homeowner education.

This is a part of the CFPB Know Before you Owe mortgage initiative announced in November 2013.

The campaign’s loan disclosure documents were created in an effort to more efficiently lay out mortgage terms for homebuyers and consist of two new forms: the Loan Estimate and the Closing Disclosure to ensure compliance.

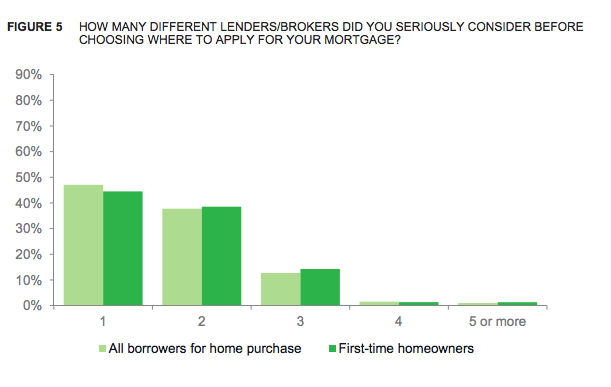

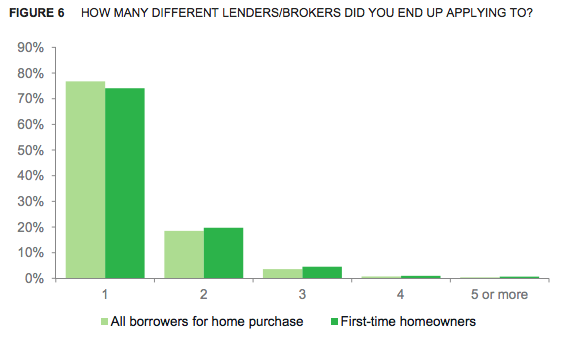

Based on new data in the National Survey of Mortgage Borrowers, a voluntary survey jointly conducted by the CFPB and the Federal Housing Finance Agency, almost half of consumers who take out a mortgage fail to shop prior to filling out an application for a mortgage. Three out of four consumers only apply with one lender or broker, and most consumers only get their information from lenders or brokers, who have a stake in the outcome.

Click to enlarge

Source: CFPB

“Most consumers put substantial effort into considering their differing housing needs,” CFPB Director Richard Cordray said in a speech at The Brookings Institute. “But they do not seem to be as careful or as confident in weighing the economic aspects of the mortgage decision, such as what down payment they can afford or what mortgage terms fit their unique financial needs.”

Owning a Home is a suite of tools to inform and empower consumers shopping for a mortgage, taking the consumer from the very start of the home-buying process, with a guide to loan options, terminology and costs, through to the closing table with a closing checklist.

Included in the suite of tools is the Rate Checker. In its beta release, this tool helps consumers understand what interest rates may be available to them by using the same underwriting variables that lenders use on their internal rate sheets.

“In other words, we are giving consumers direct access to the same type of information that the lenders themselves have,” said Cordray.

“And let me take a second to debunk a popular myth: You can shop around for a mortgage and it will not hurt your credit score. Within a certain window of time – generally between 14 and 45 days – multiple credit checks from mortgage lenders or brokers are treated as a single inquiry,” he added.

This is because other creditors realize that borrowers are only going to buy one home at a time, and in turn, it permits borrowers to shop around and even submit multiple applications to obtain multiple initial estimates.

“For these reasons, it is vital that consumers meet with several lenders early on and ask lots of questions, but wait until they receive official loan offers to make their final selection,” said Cordray.