Black and Hispanic homeowners have a harder time securing a mortgage compared to white and Asian homeowners, an updated report from Zillow (Z) revealed.

Zillow analyzed housing value and federal mortgage denial data by race, finding persistent housing performance and access-to-credit issues for racial and ethnic minorities across the country.

Zillow analyzed the data for the first time last year and released an updated report based on Census Bureau data. (Click the link for a breakdown of ethnic and racial pluralities.)

In 2013, 27.6% of blacks and 21.9% of Hispanics who applied for a conventional mortgage were denied, while only 10.4% of white applicants were denied.

“While many of the disparities between the experiences of white communities and minority communities during the housing boom and bust can be explained by plain differences in finances and geography, it’s clear that the housing playing field remains strikingly unequal in this country,” said Zillow Chief Economist Stan Humphries.

The study cited several explanations for the disparities:

1. Salary

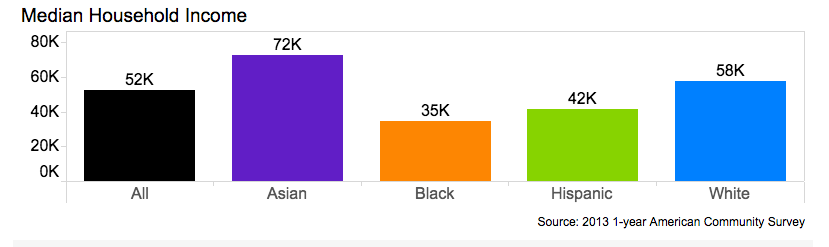

According to mortgage application data, the median household income for black applicants for conventional home loans was roughly $23,000 less per year than white applicants, resulting in a higher denial rate. The median household income for Hispanic households was $16,000 less.

Click to enlarge

Source: Zillow

2. Home values

Black and Hispanic communities tend to be in areas that saw huge run-ups in home values prior to the recession, and even larger drops during the crash.

3. Location

For example, many Asian neighborhoods are on the West coast, in some of the country’s hottest housing markets, which can help explain why home values in Asian communities have risen faster and further than in other neighborhoods.

On the other side, many Hispanic-dominated communities are based in volatile housing markets in the Southwest and Southern California, which can explain their rapid appreciation during the boom and steep fall during the bust.