One of the ten largest shareholders of Home Loan Servicing Solutions (HLSS) is accusing the company’s board of “dereliction of duty” and demanding that HLSS terminate its business relationship with Ocwen Financial (OCN), which subservices all of the mortgage loans that HLSS holds servicing rights for.

In a letter sent to HLSS’ board of directors, Mangrove Partners, which disclosed that it owns more than 1.6 million of HLSS’ 71 million outstanding shares, states that it believes it is “imperative” for HLSS to terminate its servicing relationship with Ocwen “without delay.”

Mangrove cites Ocwen’s numerous recent regulatory troubles and the subsequent responses from ratings agencies and other entities as reasons that HLSS should end its relationship with its former parent company.

“We believe that continuing to expose HLSS to Ocwen-related risks by leaving the Ocwen relationship intact constitutes a dereliction of your duty to the company and a grave risk to all shareholders,” Mangrove’s president and portfolio manager, Nathaniel August, said in the letter to HLSS’ board.

Mangrove said that it previously sent a letter to HLSS’ board last week with a similar request but was unpleased with HLSS’ response. “Your response was inadequate,” Mangrove said. “Your response's vague reassurances and legal boilerplate did nothing to ease Mangrove Partners' increasing and justified concerns about the direction of the company.”

Mangrove added that as a result of HLSS’ inadequate response, the hedge fund plans to nominate replacement board members, because “time is not the company's friend and you as the board are showing no signs of taking concrete action to protect shareholders in this serious situation.”

According to Mangrove, multiple “termination events” have taken place recently that give HLSS the right and authority to terminate agreements with Ocwen.

Chief among those was when Fitch Ratings recently downgraded Ocwen’s servicer ratings, citing “weaknesses in Ocwen's corporate governance and operational control framework.” Fitch downgraded Ocwen's servicer ratings in a number of categories from a level 3 to a level 4. Fitch rates servicers on a 1-5 scale, with 1 being the highest rating, so the drop from 3 to 4 places Ocwen’s servicer ratings just one rung above Fitch’s lowest possible rating.

Ocwen responded to the claims laid out by Fitch in a letter to its shareholders, stating that no ratings agency has identified any actual servicing performance deficiencies among Ocwen-serviced loans in residential mortgage-backed securities.

In the letter from Ocwen CEO Ron Faris, he notes that Fitch stated that despite the downgrade, Ocwen “continues to perform servicing functions at a proficient level.”

Faris added that “objective data” on private-label security performance “continues to show that Ocwen excels in managing loss mitigation timelines, bringing borrowers current on their payments and keeping them current.”

But Faris did disclose that due to the servicer ratings downgrades, Ocwen no longer meets the minimum servicer ratings requirements in nearly 70% of the private-label securities it services.

According to Mangrove, these downgrades make it HLSS' board's duty to terminate the relationship with Ocwen.

“We believe that there are compelling reasons why HLSS should immediately begin the process of exercising its rights to direct Ocwen to transfer the servicing rights to one or more different servicers,” Mangrove stated in its letter. “Most importantly, servicing transfers will isolate HLSS from the risks of an ongoing relationship with Ocwen.”

Mangrove adds that Ocwen’s recent series of legal and regulatory troubles are highly concerning. In December, Ocwen settled with the NYDFS over its servicing practices to the tune of $150 million. Then Ocwen settled with the state of California over Ocwen’s reluctance to provide documentation proving that it was allowed operate in the state.

“It is our belief that HLSS's continued affiliation with Ocwen is an unacceptable risk and contrary to the best interests of the company and its shareholders,” Mangrove said.

“We believe that restructuring HLSS's servicing counterparty relationships would be a significant positive development for the company in the current operating environment and would be viewed positively by all of the company's lending relationships,” Mangrove continued. “Transferring servicing would give HLSS the opportunity to engage with servicers that have greater servicing stability, better management oversight, stronger relationships with regulators, and higher ratings.”

Mangrove also states that a separation from Ocwen carries more benefits for HLSS than simply distancing itself from the trouble nonbank.

“In addition to shielding HLSS shareholders from Ocwen-related risks, we believe that a transfer of the servicing rights will create significant value for HLSS and its shareholders,” Mangrove states.

“While our valuation work shows a range of potential values, we believe that a reasonable estimate of the value created by transferring the servicing rights would be between $8 and $13 per share of incremental value to HLSS,” Mangrove continues. “Based on the company's book value on September 30, 2014, this represents an increase in book value of between 44% and 72%.”

Mangrove states that if HLSS ends its association with Ocwen, it sees “no reason” that the HLSS’ stock would not return to its “historic” value. “In a reasonable scenario, this would give shareholders a value of between $31 and $40 per share,” Mangrove said.

As of 12:30 p.m. Eastern on Tuesday, HLSS’ stock was trading at $15.42.

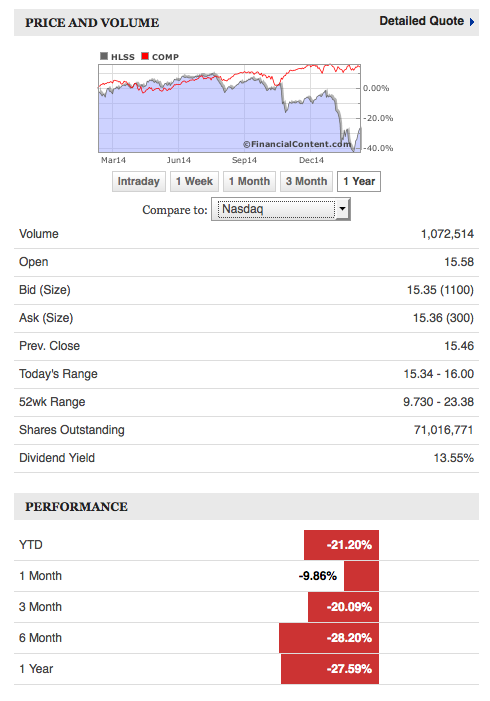

Over the last 12 months, HLSS' stock is down 27.59%, performing signficantly worse than the NASDAQ average. Click the image below, compiled using HousingWire's HW30 tool, to see HLSS perfomance in the last year. The red line, by way of comparison, is the NASDAQ's average performance over the last year.

Mangrove said that it recognizes that the HLSS board may be concerned with the potential for further instability at Ocwen if HLSS terminates its relationship, but notes that after the proposed servicing transfers are consummated, HLSS’ exposure to Ocwen would be “de minimis.”

Mangrove concludes its letter by again urging the HLSS board to fulfill its fiduciary duty to act in the best interest of the company.

“To be clear, we are not looking for you to make selective disclosure to us—we are looking for you to take prudent action to protect the company and shareholder interests,” Mangrove concluded.

“Accordingly, until such time as the company announces it has entered into definitive agreements to transfer the servicing rights away from Ocwen pursuant to competitive processes conducted by top-tier advisors, it is our intention to bring new leadership to the board by nominating a highly qualified slate of directors this week.”