Mortgage originations are expected to exceed Freddie Mac’s original forecasts, thanks to lower mortgage rates and an improving jobs picture, the enterprise’s February U.S. Economic and Housing Market Outlook said.

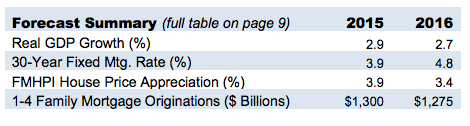

Freddie raised its 2015 originations forecast to $1.3 trillion, up from $1.2 trillion last month. The forecast for the refinance share of originations in 2015 was also revised up from 35% to 40%.

However, the home sales expectation of 5.6 million in 2015 and housing starts expectation of 1.18 million in 2015 are unchanged from last month. Due to continued strong growth in house prices and relatively low inventories, Freddie is expecting house prices to increase 3.9% in 2015 (up from a forecast of 3.5% last month).

For the overall economy, the forecast for economic growth was revised down compared to last month.

“Data for the fourth quarter of 2014 and the first quarter of 2015 indicate that overall economic growth may have slowed from the torrid pace in the third quarter of 2014,” said Leonard Kiefer, deputy chief economist with Freddie Mac. “We’ve lowered our overall projection of first-quarter growth to 2.5% (from 3.0% last month) and lowered 2015 annual growth by 0.1 percentage points to 2.9% for the year. Due to declining interest rates in January, we have lowered the projected path for most interest rates.”

The Federal Reserve is still expected to begin raising the fed funds target and short-term rates will rise accordingly, but long-term interest rates will only rise slowly. The average 30 -year fixed-rate mortgage rate forecast for 2015 was revised down to 3.9% for the year (compared to 4.2 %last month).

According to latest Freddie mortgage report, the 30-year fixed-rate mortgage averaged 3.76% with an average 0.6 point for the week ending February 19, 2015, up from last week when it averaged 3.69%. A year ago at this time, the 30-year FRM averaged 4.33%.

Click to enlarge

Source: Freddie Mac

"Despite the fact the yield curve has flattened, we remain optimistic about the course of the domestic U.S. economy over the next year. We also do not foresee a major turnaround in the global growth picture and therefore recent trends in foreign buying of long-term U.S. securities activity should continue. That means continued downward pressure on long-term interest rates here in the U.S. Even if the Federal Reserve begins raising short-term rates later this year, don't expect to see long-term rates — including mortgage rates — increase much,” said Kiefer.

“This is great news for housing markets, especially headed into the spring homebuying season. Lower rates help to offset some of the recent increases in house prices and keep homebuyer affordability high," he continued.