On Aug. 1 the industry will be forced to comply with the Consumer Financial Protection Bureau’s Truth In Lending Act and the Real Estate Settlement Procedures Act.

In order to help lenders better sort through the new world of TILA/RESPA, HousingWire hosted a webinar sponsored by Optimal Blue featuring guest speakers Benjamin Olson, partner at BuckleySandler and former Consumer Financial Protection Bureau deputy assistant director, office of regulations.

Other participants included Jerra Ryan, vice president of compliance with Cherry Creek Mortgage Company and Diane Evans, president of American Land Title Association.

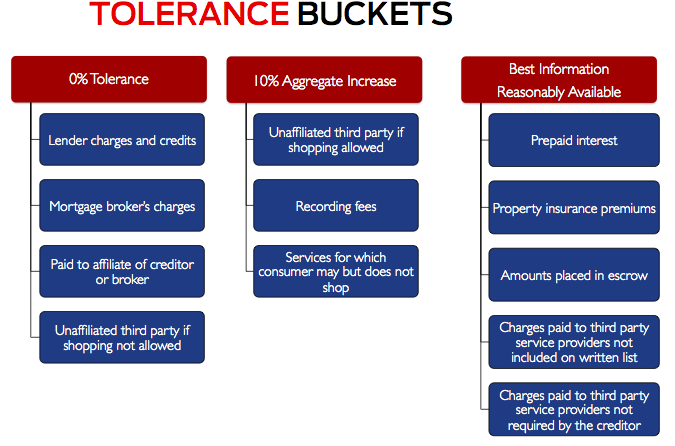

Olson used this chart to show the different tolerance buckets that come with the new rule.

In 2010, the U.S. Housing Department of Urban Development interpreted the “good faith estimate” requirement in RESPA to limit variations between estimated settlement charges on the GFE and actual settlement charges on the HUD-1, referred to as “tolerances.”

However, Olson explained that implementation has been extraordinarily challenging for the industry and involves extensive compliance issues and remediation.

In addition, the CFPB adopted tolerances under TILA’s “good faith estimate” requirement, creating a private right of action and assignee liability.

Rebroadcasts of the webinar are available here.

Click to enlarge

Source: HousingWire and BuckleySandler