After loosening for most of last year, credit standards started to tighten in the last quarter of 2014. The news may be temporary as the government is pushing new iniatives to open the credit box for first-time borrowers.

According to the quarterly Zillow (Z) Mortgage Access Index, overall, it was still easier for homebuyers to access credit in 2014 compared with the prior year.

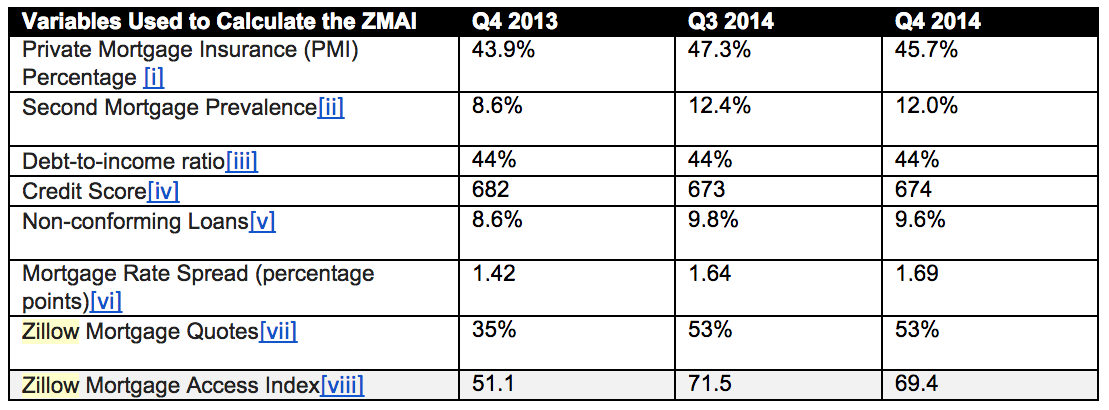

But in the fourth quarter the index dropped to 69.4, compared to 71.5 the previous quarter. It is still up more than 18 points from the fourth quarter of 2013 when it sat at 51.1.

An Index reading of 100 would indicate that credit has returned to pre-housing bubble levels.

Click to enlarge

Source: Zillow

Meanwhile, it was in October of Last year that Federal Housing Finance Agency director Mel Watt announced a number of policy steps aimed at increasing mortgage credibility at the Mortgage Bankers Association Convention & Expo.

Watt didn’t provide a great deal of specifics, but said that the FHFA will be taking steps to further clarify lender liability in representations & warranties. He also said that he supports the return of the 97% loan-to-value product at the GSEs, Fannie Mae and Freddie Mac.

“We know that access to credit remains tight for many borrowers, and we are also working to address this issue in a responsible and thoughtful manner. Additionally, FHFA continues to evaluate ways to refine and improve the loss mitigation and foreclosure prevention policies at the Enterprises, because we understand that many individuals and families are still facing the possibility of foreclosure and are looking for alternatives to stay in their homes. I want to assure you that we are hard at work and making good progress on all these issues, several of which I will highlight in my remarks today,” Watt said at the convention on access to credit. Shortly after the convention, both government-sponsored enterprises officially announced their individual 97% loan-to-value products.

And it didn’t take long for lenders to jump on board and start offering 3% down payments options.

One broker in California, Brad Yzermans posted about his easier credit mortgage offerings on this HousingWire blog yesterday.

"Right now I'm offering Fannie Mae's a 3% down program with minimum credit score of 620 and it has reduced PMI premiums, Freddie Mac's 3% Down Home Possible Advantage program, and FHA offers 3.5% down with 580 credit score," Yzermans wrote. "Plus, state housing agencies and non-profits are tripping over themselves trying to give money away in the form of tax credits, 5% grants and down payment assistance that can work with the 3% down programs."

"Basically all you need is a heart beat to qualify……," he added, "and most first time home buyers don't even need $1 for a down payment!!"

So why did credit tighten in the fourth quarter?

Zillow’s Chief Economist Stan Humphries, said, “After several years of rapidly increasing access to home loans, lenders are taking a pause. With the mini-boomlet in refinance activity late last year, perhaps there was less business imperative for banks to attract new customers with looser lending.”

The good news: Don’t expect this trend to continue though. “Instead, credit access should continue its slow normalization, although it’s doubtful it will ever return fully to where it was pre-bubble. The new normal likely lies somewhere between current conditions and those of the early 2000s,” Humphries said.