Thanks in large part to loosening government standards, it keeps getting easier to get a mortgage, the Mortgage Bankers Association said in a new report.

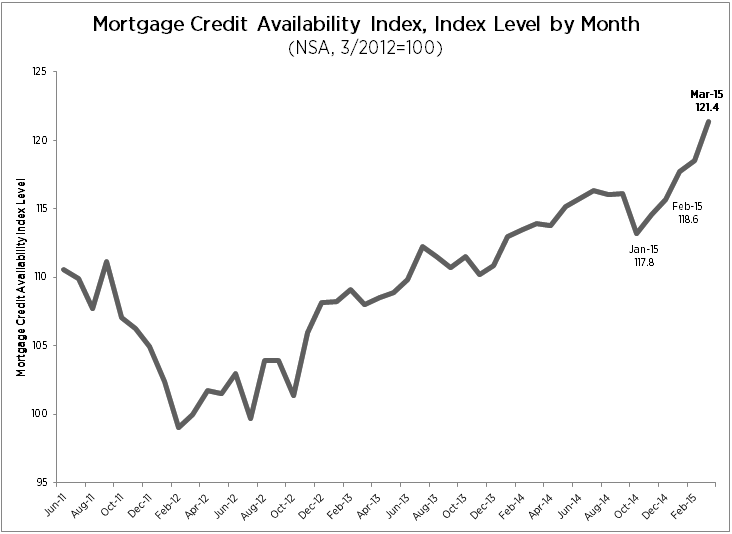

According to the MBA’s newly released Mortgage Credit Availability Index, mortgage credit availability rose in April by 0.5% to 122.0. The index also rose in March, climbing 2.3% to 121.4.

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of a loosening of credit. The index was benchmarked to 100 in March 2012.

According the MBA’s data (as seen below), the mortgage credit availability index has risen consistently over the last several months, indicating the loosening of credit in the wake of several announcements from the federal government designed to open the credit box.

(Source: MBA)

In March, MBA Chief Economist Mike Fratantoni said that Fannie Mae and Freddie Mac’s introduction of 97% loan-to-value loan programs, along with the continued expansion of the Federal Housing Administration streamline refinance, helped to ease credit in March.

For April, Fratantoni said that mortgage credit became more available due to other new government offerings.

“Mortgage credit availability increased on net in April,” Fratantoni said. “The increase was driven by new offerings of FHA’s 203K home improvement program, new VA offerings, and new jumbo products. The increase was partially offset by some investors tightening underwriting criteria on conventional cash out offerings.”

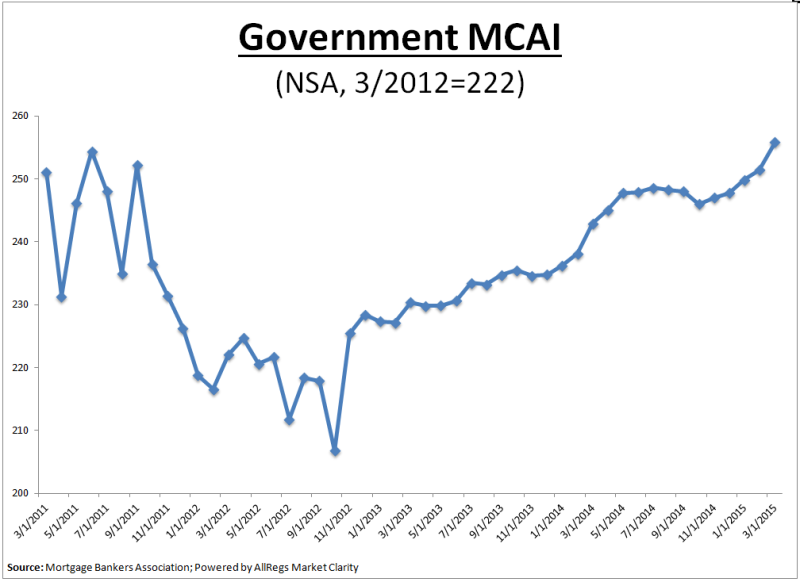

Broken down by segments, the MBA’s report showed that the government MCAI, which measures FHA, VA and USDA loan programs rose 1.1% in April, driving much of the overall increase.

(Source: MBA)

The jumbo MCAI also rose in April, climbing by 0.8%. The conforming MCAI, which measures loan programs that fall under conforming loan limits, rose slightly in April, easing up by 0.2%.

On the other hand, the conventional MCAI, which examines non-government loan programs, fell in April by 0.6%.

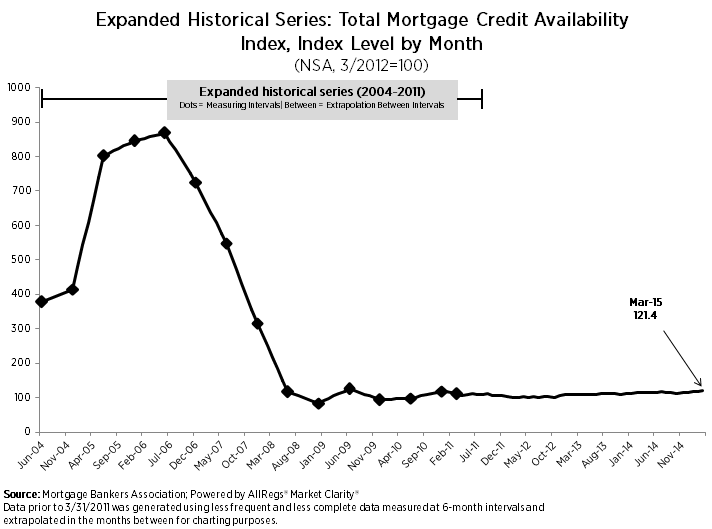

While the mortgage credit availability index rose again in April, credit is still far less available than it was in the run-up to the financial crisis, as shown in the graph below.

(Source: MBA)

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via Ellie Mae’s AllRegs Market Clarity product and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time, the MBA said.