Foreclosure inventory tumbled by 25.7%, while completed foreclosures also dropped by 15.5% from March 2014, according to the latest report from CoreLogic (CLGX).

There were 41,000 completed foreclosures nationwide in March 2015, down from 48,000 in March 2014, representing a decrease of 65.2% from the peak of completed foreclosures in September 2010, according to CoreLogic data.

Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 5.6 million completed foreclosures across the country, and since homeownership rates peaked in the second quarter of 2004, there have been approximately 7.7 million homes lost to foreclosure.

“We are seeing additional improvement in housing market conditions due to a decline in the serious delinquency rate to 3.9%, far below the peak of 8.6% in early 2010,” said Frank Nothaft, chief economist for CoreLogic. “Despite the decline in the number of loans that are 90 days or more delinquent or in foreclosure, the percent of homeowners struggling to keep up is still well above the pre-recession average of 1.5%.”

In addition, CoreLogic reports that the number of mortgages in serious delinquency declined by 19.1% from March 2014 to March 2015 with 1.5 million mortgages, or 3.9%, in serious delinquency (defined as 90 days or more past due, including those loans in foreclosure or REO).

This is the lowest delinquency rate since May 2008. On a monthly basis, the number of seriously delinquent mortgages declined by 1.9%.

As of March 2015, the national foreclosure inventory included approximately 542,000 homes, or 1.4%, of all homes with a mortgage compared with 729,000 homes, or 1.9%, in March 2014, representing a year-over-year decline of 25.7%.

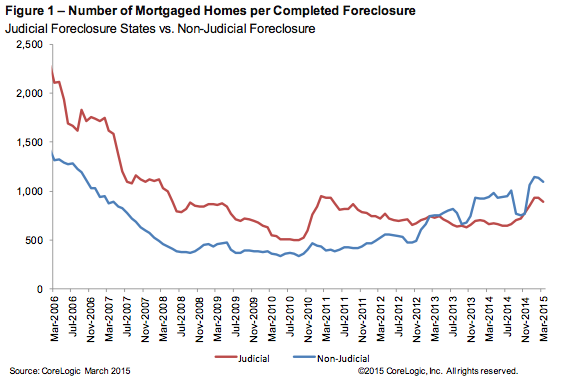

Click to enlarge

Source: CoreLogic

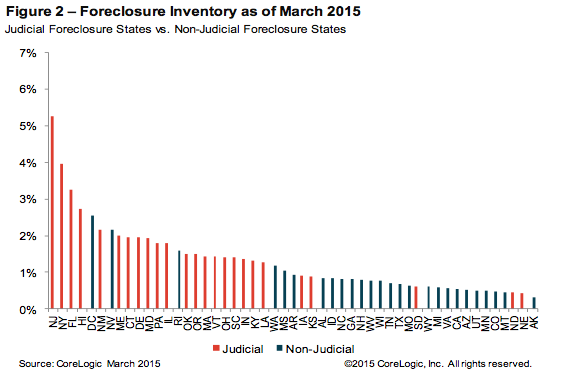

Click to enlarge

Source: CoreLogic

Furthermore, the just-released Federal Reserve Bank of New York Household Debt and Credit Report states aggregate household debt balances were largely flat in the first quarter of 2015.

According to the report, only about 112,000 individuals had a new foreclosure notation added to their credit reports in the first quarter of this year, the lowest total since at least 1999.