Long-term successis a rarity in any industry, but the roller coaster of change that companies in housing finance have to navigate makes it even more challenging. What does it take to innovate and adapt to the boom and bust cycles of our economy over many decades? How have some companies managed to excel for so long?

We decided to explore the secret to longevity by interviewing executives at Forsythe Appraisals, MGIC, United Guaranty and TD Service, which have all been in business for 50 years or more. We did not include banks in our analysis because banks by their very nature are long-lived institutions (for the good of us all). In fact, two out of three banks have been in business for 50 years and almost half have been in business for more than a century, according to the American Bankers Association. That’s enviable, but not necessarily instructive for the rest of us.

Talking to these venerable companies revealed certain trends. The executives we talked to are (still) passionate about what their companies do, they rank customer service as a high priority and they treat their employees like their greatest resource. Instead of super-strict hierarchical structures, there are employee-led gatherings and annual get-togethers that actually sound like fun. There are long-time employees keeping the culture intact, and new employees adding fresh ideas. Most of all, there’s a sense of optimism about the future of the industry and their company’s place in it.

Intrigued? Read on.

FORSYTHE APPRAISALS: 75 years

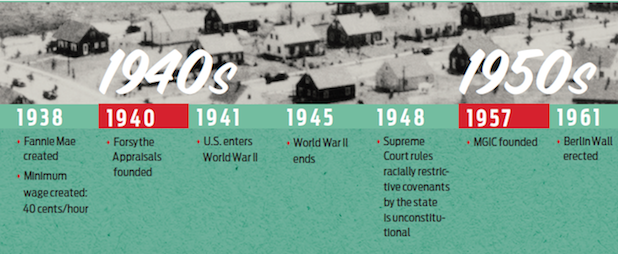

Today, the company covers more than 50 metro markets and is the largest independent residential real estate appraisal company in the country. But the core values that Al Forsythe established at the beginning are still guiding the company 75 years later.hen Al Forsythe started his business in Minneapolis, Minnesota, in 1940, the country was working its way out of the Depression, with a wary eye on the war escalating in Europe. The average yearly wage was $1,524 and the median home value in the U.S. was $2,938.

John Forsythe, Al’s grandson and the current president and CEO, summarized the company’s core values:

- Work really hard, but keep a balance between work and the rest of your life.

- Stay absolutely true to ethical behavior.

- Always focus on business development opportunities.

“We want to treat each other and our customers like a family member or valued friend, so that our clients wouldn’t consider going anywhere else for their appraisal needs,” John said.

His brother Tim Forsythe, CEO from 1993 to 2011 and current senior director of customer development, echoed the sentiment. “Our senior management works harder on maintaining our core values than anything else we do. We make it clear from the day we hire someone what those values are, and look to see if a person is a good fit.”

Tim and John said they were part of a “big Irish family” of eight kids, and the core values lived out in their branch offices are the same ones they learned at the kitchen table from their parents.

“At Forsythe we really are good to one another. We empower people and we trust them, and then we get out of the way,” Tim said.

Recruiting and keeping the right employees is obviously something the company has figured out. So what’s the most important attribute they look for? Attitude.

“We are in the service business, and some people understand right away that there’s a dignity to being of service to others,” Tim said. “I have watched John take someone with the right work ethic and attitude and we can teach them the rest. We look for people who don’t check brains at the door — we are hiring them to be creative and enthusiastic problem solvers.”

Of course, Forsythe found a lot of talent early on in family members. After founding the company, Al Forsythe was joined by his sons Jerry and Bob, and then grandsons Tim and John in the 1970s and '80s.

“Family members or not, nobody could join the company if they didn’t earn the SRA designation — the highest designation for real estate appraisers,” Tim said.

In fact, at one time, seven members of the Forsythe family had the SRA designation: Jerry and his wife Charlotte, Tim, John, their sister Eileen, brother Richard and Tim’s wife, Mary.

These days, people come to Forsythe from many different avenues, and the company welcomes the fresh perspective of new talent.

“A one-way ticket to stagnation is to look only within the industry for hiring and promoting,” John said.

INNOVATION = TAKING RISKS

As a crucial part of the innovation that the company is relentlessly pursuing, Forsythe seeks to be a safe place for people to take chances and even make mistakes.

“We’re human and we make mistakes — that’s a given. When we do, we never get defensive or run from a problem, we just try to correct it and learn from it,” Tim said.

“On the other hand, when someone has made a hard decision that might have cost us a client but reflects our core values — we celebrate that. In the appraisal business it’s important to know where the boundaries are.”

One of the important elements of Forsythe’s success is the company’s ability to ride the ups and downs of the industry. The company predates HUD, and the ink was barely dry on Fannie Mae’s charter when Forsythe started up. But all of the market fluctuations and crises since then — and all of the regulatory fixes and changes —taught the company’s leaders how to thrive in the midst of change.

“As appraisers we’ve got cycles that are tied into interest rates and the economy. It took a while for us to understand that the down cycles are inevitable, but also integral for the company to grow and prosper,” John said. “It’s during the tough times that you come up with the best ideas. We learned in those hard times to quit wishing it was easier, and wish that we were better.

“It’s during those down cycles that a good company gains market share.”

Forsythe’s long history and positive attitude about down cycles means something else, too — the company doesn’t rattle easily.

“This isn’t a company that overreacts,” John said. “We don’t go on spending sprees when things are good and when things are tough we don’t lay off our invaluable staff. We understand very well that cycles are relatively short-lived on both sides and we stay even keeled.”

That even course is easier to keep if a company sticks with its core competencies, John said.

“We stick to what we know and what we’re good at. And we keep a close eye on our fixed costs,” John said. “We’re not afraid to invest in technology that’s going to keep us very efficient, but we are not necessarily on the front end of adoption — it seems like the phase-two adopters get a system with the bugs already worked out. We’ve seen people bury their company in IT expenses.”

CRYSTAL BALL

What does Forsythe think the future of the industry will look like?

“We are very, very optimistic about the future,” John said. “The one certainty is that things will change, but what excites about the future is that I see the appraisal industry evolving into a true profession of highly trained and educated valuation experts.

“As things have come into play like licensing and requiring four-year degrees, as well as the explosion of data availability, our profession is going to continue to evolve and grow. I think the end result will be a better trained, more highly educated appraiser,” he said.

“We are very excited about the future and looking for ways to embrace it, not fight it. Those that do will survive and prosper. Those that are not willing to adapt are going to be challenged.”

Tim agreed. “If big data and things like Collateral Underwriter scare you, those appraisers are going to have a hard time. The future is data-oriented. If you understand that and stay on the front end of it, you can prove your value to the industry and you are going to see your business progress.

“A lot of people are wringing their hands in dismay about the future of the appraisal industry, but it’s going to be a more interesting, more rewarding profession in the future."

MGIC: 58 years

The country was undergoing a residential construction boom in 1957. In 1945, at the end of World War II, about 40% of Americans owned homes. By 1960 that number had grown to 60% — and everyone wanted a piece of the American dream.

But saving for a down payment on a house in the median range — about $10,000 in 1957 — was as difficult then as it is now.

To remedy that problem, Max Karl, a real estate attorney in Milwaukee, Wisconsin, looked at the problem in a new way.

“Mr. Karl was frustrated with the process of closing loans with 100% government guarantees, which he believed was rife with red tape and bureaucracy. Why not create a private company that insured only the top portion of a mortgage, rather than 100% of the mortgage? This could be a less costly and easier way to provide low-down-payment financing to borrowers with less than a 20% down payment,” said Margaret Crowley, vice president of marketing at MGIC.

Karl took his idea to a group of investors, many of whom were savings and loan executives, and this group, along with his family and friends (even his barber!) contributed $250,000 in capital, which he used to start Mortgage Guaranty Insurance Corp.

“Helping families achieve the dream of homeownership in an affordable, sustainable way remains our driving principle,” said Sal Miosi, senior vice president of business strategies and operations. “With that as our foundation, we look for innovative ways we can serve the market.”

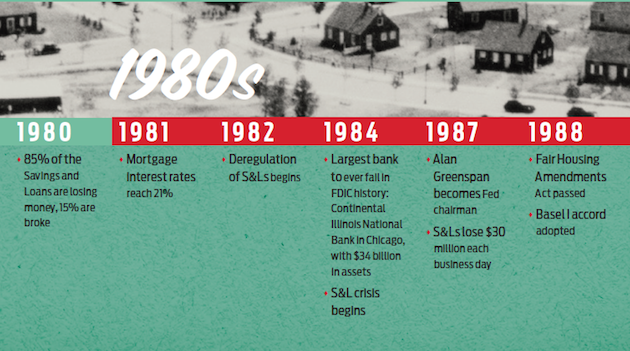

During the company’s 58 years in business, MGIC has seen it all, from boom cycles to regional downturns, and, most recently, the coast-to-coast effect the Great Recession had on housing. Two things stand out to Patrick Sinks, president and CEO, as the top lessons the company learned during the downturns:

“First, best-in-class customer service needs to remain at the forefront of our operations at all times. Our customers are our partners and we are committed to helping them succeed at their lending goals in every cycle. Sometimes that means offering innovative mortgage insurance solutions that match changing market conditions.

"Other times that means focusing on loss mitigation efforts and ramping up our claims operations. In both good times and hard ones, nothing trumps great customer service.

“Second, is that we have a core competency in assessing and managing residential credit risk and we need to stay true to that even as we look for new ways to serve our customers. The depth of our industry knowledge is unmatched and gives us insights we can draw upon to guide our decision-making when exploring new opportunities,” Sinks said.

One thing the company wished it had learned earlier was brought home during the recent Great Recession: rescission protection.

“The financial crisis led everyone involved in the loan origination process to focus on rescissions,” Sinks said. “We cannot live through this process again of having fights with customers over coverage. As a result, all of the private mortgage insurance companies created a new master policy to avoid this fight and offer greater rescission protection for our customers.”

Learning valuable lessons through the last downturn makes the company stronger going forward, Sinks said.

“The credit quality of MGIC’s current book of business is outstanding. The last few years represent some of the best business the company has ever underwritten,” Sinks said. “With the uncertainty regarding the financial health of the industry behind us, and continued clarity coming on the regulatory front, mortgage insurance is well positioned to expand its role in the market place.

United Guaranty: 52 years

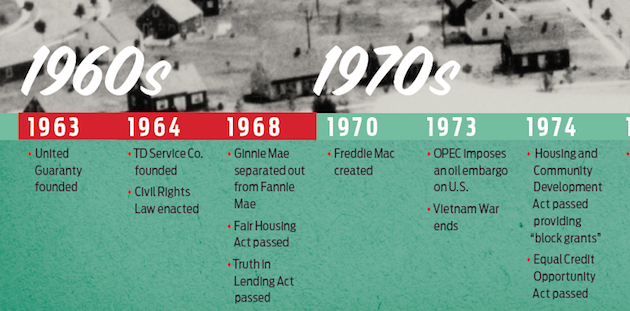

In some ways, 1963 was the beginning of a new era in American history. It was the year Martin Luther King Jr. gave his “I Have a Dream” speech, and the year President John F. Kennedy was assassinated. A new house averaged $18,000 that year and wages averaged $6,200, a record according to the Census Bureau.

It was also the year First Mortgage Insurance Co. (FMIC) was organized in Greensboro, North Carolina, with three employees working in a small office space downtown. Marvin Legare served as CEO, with Bill Hemphill as president of the new company.

United Guaranty Residential Insurance of North Carolina was one of several subsidiaries established in 1973. In December of that year, FMIC merged with Iowa-based Excel, and the name of the new company became United Guaranty Corp. in 1974. Today, the company employs more than 900 professionals and support staff throughout the country, and is headed by CEO Donna DeMaio.

“United Guaranty’s management team includes employees tenured as many as 25 years, experienced executives from AIG, people from outside of the organization, and individuals from inside and outside the financial sector,” DeMaio said.

United Guaranty has weathered everything from the inflationary 1970s to the most recent financial crisis by adapting to fit the needs of its clients. At the height of the financial crisis, United Guaranty transformed itself into a company designed to succeed in all parts of the economic cycle — including down periods — by changing the company in four fundamental ways:

- Introducing Performance Premium, a comprehensive risk-based pricing system.

- Putting increased emphasis on full-file underwriting to limit risk.

- Dedicating the company to providing the best service to its customers, with 24-hour turnaround on full-file submissions.

- Achieving the highest level of financial strength in the industry. Standard & Poor’s recently upgraded United Guaranty to an A.

“After establishing and continuing to develop those core strengths, United Guaranty became the No. 1 mortgage insurer in terms of traditional New Insurance Written (NIW) in 2011 and has continued to lead the industry for four consecutive years, from 2011 to 2014,” DeMaio said.

The company is constantly looking to innovate, and develops solutions that are directly related to its customers’ needs.

“It may sound simple, but one of the best tools we have when it comes to innovation is listening to our customers,” she said. “Sometimes they have specific ideas or requests. Other times, just sitting down and listening to some of their challenges brings to light opportunities that both parties may not have recognized on their own.”

It was through this kind of attention to its customers that led United Guaranty to create its Performance Premium solutions, as well as introduce SecureCert — an accelerated rescission relief product — more than two years before any other mortgage insurance company.

The company also credits its long success to its strategy for recruit top talent.

“We look for people with high integrity who want to work as part of a customer-focused team that is passionate about helping people achieve the dream of home ownership,” DeMaio said. “We seek out individuals who combine that specialized knowledge with a customer-focused perspective and a desire to excel.”

Looking ahead, United Guaranty is confident that its innovative stance and commitment to customers means even more opportunity.

“We’re optimistic about the future of the housing industry. From a mortgage insurance standpoint, we’ve seen the arrival of a number of new competitors and strong regulations that will help serve as a vote of confidence in the mortgage insurance industry — ideally ending with the transfer of more risk from the public market to private capital,” DeMaio said.

“We also look forward to the industry looking to responsibly extend credit to more homeowners. We recognize there’s a growing pool of highly qualified borrowers who may need the help of mortgage insurance to achieve their goal of owning a home.”

TD Service Co.: 51 years

Dale Dykema founded TD Service Co. in 1964 with a total capital investment of $8,000. Dykema had been working for a title insurance company and felt he could do a better job while being his own boss. Today, TD Service provides a wide array of mortgage related services, including foreclosures, lien releases, audits, imaging, assignments, document retrieval and research and post-closing services.

“Initially it was just me and one secretary,” Dykema says. “My attitude from the beginning was to provide a better service than anyone else could perform. That’s still my attitude today. At the time I had no idea of the level of success we would reach.”

When TD Service was founded, about 70% of lending was done by savings and loan associations, which were limited to originating loans within a certain geographical region. As these S&Ls were allowed to expand statewide and open up branches, TD Service expanded, too. As mortgage companies — many with a national presence —became the predominant originators of residential mortgages, TD Service continued to adapt its services and reach.

But the company’s best example of innovation might be the change it went through as the worst of the recent financial crisis started to wind down, and with it, a huge volume of foreclosure activity. TD Service processed a record number of foreclosures in 2009, but recognized that level would drop off. Foreseeing the future, TD Service made a strategic pivot to focus on providing IT services for the mortgage industry to make up for that volume.

“We’re always trying to look ahead to anticipate what’s going to happen. My vision is that three to four years from now, 80% of our revenue would be coming from the IT business,” Dykema said.

That kind of vision is critical to succeeding over a long period of time, he said. “The major thing is recognizing that the good times may not always be there, so you have to prepare for to make sure you have enough operating capital in case there’s a downturn. You have to have something to fall back on as far as taking care of expenses.”

When it comes to the future, Dykema sees an industry on the mend.

“I am optimistic from a longer-range standpoint,” he said. “Always in the past when we’ve been in a recession, housing has led us out of the recession. This time that hasn’t happened, but housing will have its resurgence. It just won’t be this year.”

SHORT TAKE: FORSYTHE APPRAISALS SHARES THE SECRET SAUCE

HousingWire: What’s one of the most important things you do as a company?

Forsythe: We have a brainstorming meeting every week that goes back 30 years. We ask ourselves: What could we do this week that we’ve never done before? It’s become our favorite part of the job — we are looking for ways to try new ideas in small doses. We can know quick if it wasn’t working, so we can tweak it or throw it out altogether.

HW: What’s one of the best ideas that came out of that meeting?

Forsythe: When the foreclosure crisis hit we went through a cycle so busy our appraisers were slammed with work. We decided to hire drivers for every appraiser that worked for us, to drive them from morning to night so that the appraisers could use the car as an office.

What happened was that the appraisers were much more efficient, but the drivers also became really effective teammates and would help on measuring the house, etc. After a while those drivers really picked up on some of the nuances of appraising and also the culture of our company. Many of those drivers became the next wave of appraisers to go through our Forsythe University. We no longer hire drivers, but we are always looking for ways to invest in the right areas to help our employees.

HW: How have you helped your employees lately?

Forsythe: One of our key initiatives in 2014 was to improve the quality of life for the appraisers that work for us. When you break that down it equals making more money, but not working more than a reasonable amount. When we looked hard at that, combined with the increased regulations, we saw that a lot of those solutions are going to come out of technology. So one things we did last year was invest in iPads for all of our appraiser staff to save them time. Our goal is to make our company the first choice if someone wants to make a career as an appraiser.

HW: How do you keep things fresh after so long?

HW: How do you keep things fresh after so long?

Forsythe: We hold our annual meeting in January every year, and yes, many times in Minnesota! We bring in all the branch managers from around the country and they get to spend two or three days in brainstorming sessions, sharing best practices and also having some fun. Having that face-to-face time with everybody has been important to continue to grow but not lose sight of who we are. Our dad always felt that if there wasn’t plenty of laughter and fun, we were missing the boat. You have to have the right perspective — it’s just business!

We encourage people to be generous with one another and create a network that they can rely on year after year. There is almost nothing they can’t solve as a group.

HW: What’s one thing you are most proud of accomplishing as a company?

Forsythe (John): Tim and I laid out a vision decades ago that has evolved. We first set our target on being the largest appraisal firm in Minneapolis, and then we would continue to move the bar. I’m very proud of that execution and seeing it come to reality. A big part of our growth has been our partnership with Hillcrest Capital. We approached them 11 or 12 years ago because we wanted to more rapidly expand our branch footprint. They’ve been our partner ever since and helped us get from eight branches to 50 locations across the country.

SHORT TAKE: ADAPTING AND INNOVATING ARE PAR FOR THE COURSE

HousingWire: How do successful companies innovate over the long haul?

MGIC: “The nature of our business is such that if we didn’t listen to lenders’ and investors’ wants and needs we would not have been able to stay in business as long as we have. So what we do is listen very carefully to our customers’ requests and then try and develop a solution that meets that need.”

TD Service: “We stay involved with the trade organizations that our customers belong to: the American Bankers Association, the California Bankers Association, the Mortgage Bankers Association, and others. We stay involved with them so we know what is happening in the industry and what’s likely to be happening in the industry in the future.”

United Guaranty: “We have an expectation that great ideas can originate from individuals at all levels. In fact, it’s often the people who work most closely with our customers who provide the kinds of insights that can potentially lead to breakthrough solutions. We have an ongoing program to recognize employees who are vocal in suggesting solutions, as well as those who go the extra mile to get a customer the answer or solution they need.

Highlighting those examples encourages others to speak up, and it enables us to share best practices in customer service throughout our company.”

HW: How have you kept the core values of your company over the years?

TD Service: “We’ve always had high standards in terms of hiring employees and motivating employees and rewarding employees, and trying to inculcate this idea of being the best company from a service standpoint. We give them the responsibility and the authority to do their job. We haven’t been a company that puts tight ropes on employees, instead we hire good employees we can trust and they take responsibility for making sure they’re performing according to the company’s values.”

HW: What’s something you are proud of accomplishing as a company?

MGIC: “There is no denying that the Great Recession presented a number of challenges for our company. Three of our competitors ceased writing business during the downturn, and we had to make some difficult decisions as a company to ensure our own survival. The hard work put in by our co-workers has put us in an excellent position for the future. Over a few short quarters we have grown our market share from a low of 16.5% to 20.6% at the end of 2014. That speaks volumes about the dedication our co-workers have to serving our customers.”

MGIC: “There is no denying that the Great Recession presented a number of challenges for our company. Three of our competitors ceased writing business during the downturn, and we had to make some difficult decisions as a company to ensure our own survival. The hard work put in by our co-workers has put us in an excellent position for the future. Over a few short quarters we have grown our market share from a low of 16.5% to 20.6% at the end of 2014. That speaks volumes about the dedication our co-workers have to serving our customers.”

United Guaranty:“Changing the way we price and evaluate risk after the most recent financial crisis in a way that enabled United Guaranty to emerge as the industry leader. We developed the only comprehensive risk-based pricing system in our industry, Performance Premium, and dedicated ourselves to building out the deepest, most-experienced underwriting team in the industry — one that delivered 24-hour turnaround on more than 98% of full-file submissions during 2014.”