Delinquency rates for commercial and multifamily mortgage loans continued to decline in the first quarter of 2015, according to the latest Mortgage Bankers Association Commercial/Multifamily Delinquency Report.

“Commercial and multifamily mortgage performance continues to improve. Increasing property incomes, rising property values and a strong finance market are working together to push delinquency rates lower,” said Jamie Woodwell, MBA’s vice president of commercial real estate research.

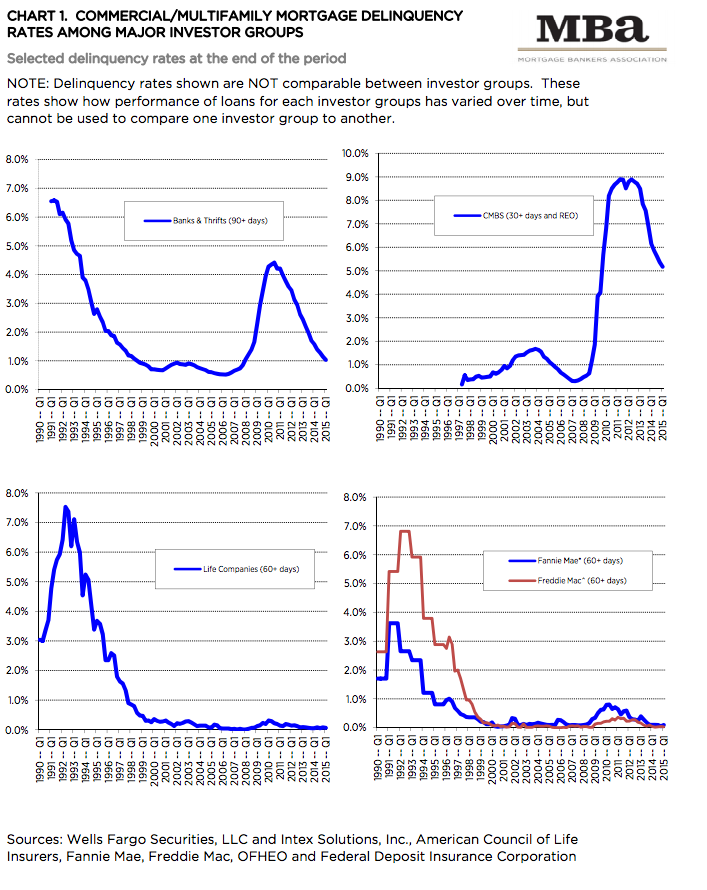

The report collects data from the commercial/multifamily delinquency rates for five of the largest investor-groups: commercial banks and thrifts, commercial mortgage-backed securities, life insurance companies, Fannie Mae and Freddie Mac.

As a whole, these groups hold more than 80% of commercial/multifamily mortgage debt outstanding.

Here are the delinquency rates for each group at the end of the first quarter:

- Life company portfolios (60 or more days delinquent): 0.06%, a decrease of 0.02 percentage points from the fourth quarter of 2014;

- Freddie Mac (60 or more days delinquent): 0.03%, a decrease of 0.01 percentage points from the fourth quarter of 2014;

- Banks and thrifts (90 or more days delinquent or in non-accrual): 1.03%, a decrease of 0.11 percentage points from the fourth quarter of 2014;

- CMBS (30 or more days delinquent or in REO): 5.17%, a decrease of 0.19 percentage points from the fourth quarter of 2014;

- Fannie Mae (60 or more days delinquent): 0.09%, an increase of 0.04 percentage points from the fourth quarter of 2014.

Click to enlarge

Source: MBA