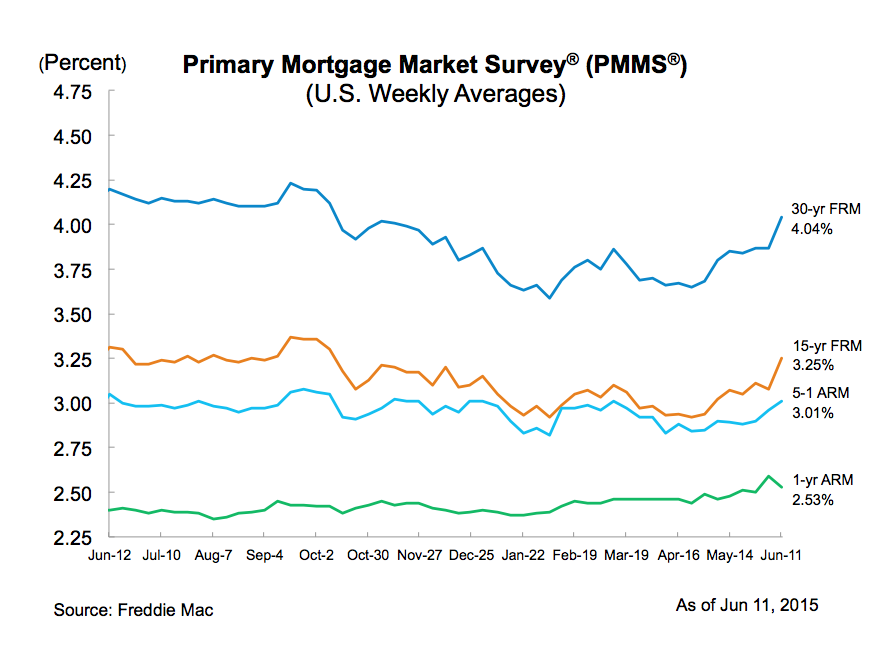

Mortgage rates are officially back above 4% for the first time in over seven months, Freddie Mac’s Primary Mortgage Market Survey found.

While finally above the 4% threshold, mortgage rates have steadily increased for the past week weeks.

Click to enlarge

Source: Freddie Mac

The 30-year fixed-rate mortgage averaged 4.04% with an average 0.6 point for the week ending June 11, up from last week when it averaged 3.87%. A year ago at this time, the 30-year FRM averaged 4.20 percent.

The last time the 30-year FRM was above 4% was in November 6, 2014 when it averaged 4.02%.

The 15-year FRM jumped to 3.25%, up from last week’s 3.08%. In 2014, the 15-year FRM averaged 3.31%.

In addition, 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.01%, up from last week when it averaged 2.96%. A year ago, the 5-year ARM averaged 3.05%.

The 1-year Treasury-indexed ARM averaged 2.53% this week, down from last week when it averaged 2.59%. At this time last year, the 1-year ARM averaged 2.40%

“Mortgage rates rose above 4% for the first time since November 2014 as Treasury yields surged. Markets are responding to strong employment data,” said Len Kiefer, deputy chief economist with Freddie Mac.

“In May, the U.S. economy added 280,000 jobs. Moreover, job openings surged to 5.4 million in April, up over 20% from a year ago,” Kiefer added.

Bankrate posted similar results, with its benchmark 30-year fixed mortgage rate climbing to 4.15%, up from 4.03% last week.

The 15-year, FRM increased to 3.39%, up from 3.26% last week, while the 5/1 ARM escalated to 3.24%, up from 3.18% last week.

“Mortgage rates rocketed higher following a stronger than expected monthly employment report. The good news on the job front further solidifies the notion that the Federal Reserve will likely begin raising interest rates soon, perhaps in the third quarter of this year,” analysts with Bankrate said about the report.

“The job market is one area the Fed has specifically pointed to as needing to show further improvement before they'd be comfortable raising short-term interest rates, and further improvement is what we have seen,” continued Bankrate.