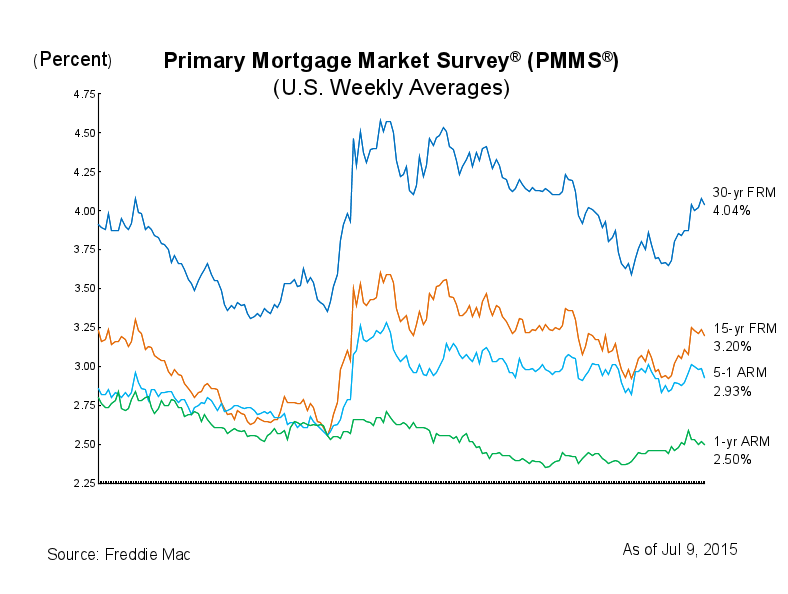

Mortgage rates stopped their upward trend and dropped back down due to global uncertainty, the latest Freddie Mac Primary Mortgage Market Survey said.

The 30-year fixed-rate mortgage averaged 4.04% for the week ended July 9, down from last week’s average of 4.08%. A year ago, the 30-year FRM averaged 4.15%.

The 15-year, FRM also dipped back down, falling to 3.20% from 3.24% last week. In 2014, it averaged 3.25%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage decreased from 2.99% a week ago to 2.93% this week. A year ago, the 5-year ARM averaged 2.99%.

Additionally, the 1-year Treasury-indexed ARM averaged 2.50%, down from 2.52% last week, but up from 2.40% a year ago.

“Yields on Treasury securities declined this week in response to investor concerns about events in Greece and China. Overseas volatility is likely to persist for some time, providing some restraint on potential U.S. rate increases,” said Sean Becketti, chief economist with Freddie Mac.

“In addition, the minutes of the June meeting of the Federal Open Market Committee suggest the Federal Reserve will proceed cautiously—monitoring events both overseas and in the U.S. to ascertain the appropriate moment to begin raising short-term interest rates. As a result, mortgage rates may remain in the neighborhood of 4% for a while,” continued Becketti.

Click to enlarge

Source: Freddie Mac

Bankrate’s results were not too different, with the 30-year, FRM falling to 4.14% from 4.19% last week.

The 15-year, fixed dipped to 3.28%, down from 3.34% last week, while the 5/1 ARM decreased to 3.16%, down from 3.25% a week ago.