Although home prices have risen around 20% since mid-2011, many homeowners are highly unaware of the true value of their home.

According to a study by Fannie Mae, this could be creating a roadblock in the housing market since it is stopping people from buying move-up homes.

“If homeowners believe that large down payments are now required to purchase a home, then widespread, large underestimates of their home equity could be deterring them from applying for mortgages, selling their homes, and buying different homes,” the report stated.

This first chart shows how high home prices have increased.

Click to enlarge

(Source: Fannie Mae)

Fannie’s report looked at data from the National Housing Survey, which pulled a national representative sample of U.S. adults in order to calculate the percent of mortgaged households who perceived they had negative home equity.

During NHS telephone interviews, homeowners rely on their perceptions of their homes’ values and their mortgage balances. Unlike respondents to online and mail surveys, NHS respondents have no opportunity to review their personal records or search for data.

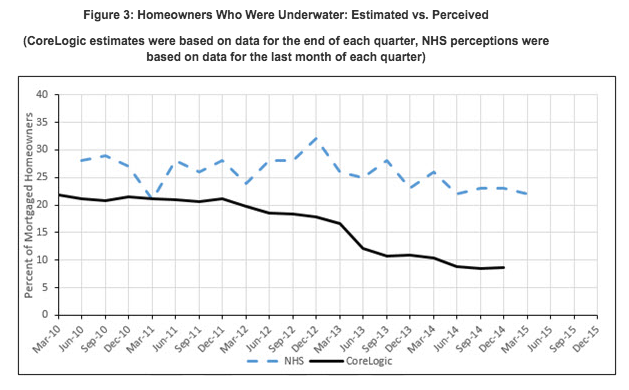

The blue dashed line in the chart below shows the percent of mortgaged homeowners in the NHS who perceived that they were underwater by 5% or more.

Click to enlarge

(Source: Fannie Mae)

Despite a significant rise in home prices, survey respondents still perceived that they had negative equity.

On the other side, borrowers also wrongly assumed how much their home equity had grown.

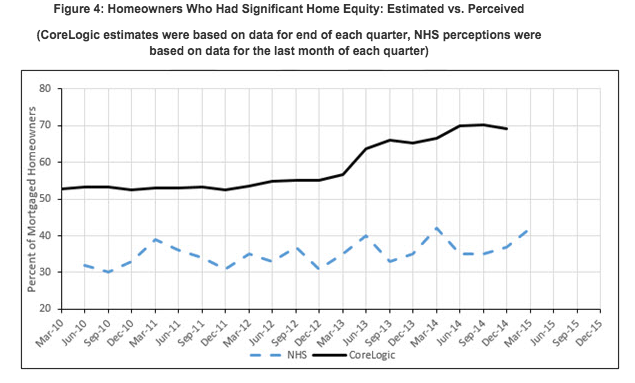

The blue dashed line in the chart below shows the percent of mortgaged homeowners in the NHS who perceived that they had significant equity in their homes.

Click to enlarge

(Source: Fannie Mae)

The report explained that the percent of homeowners estimated by CoreLogic (CLGX) to have significant home equity always was much higher than the percent who perceived themselves as having significant equity.

Fannie attributed the divide to the fact that a substantial group of homeowners may not recognize how much the values of their homes rose after 2011.

“And, even if they recognized that their homes’ values had increased, many homeowners may underestimate how much their homes’ values and home equity increased,” the report stated.

Fannie explained that one side effect of this is that homeowners who underestimate their homes’ values also likely underestimate:

- How large a down payment they could make with their home equity

- Their chances of qualifying for mortgages, and, therefore

- Their opportunities for selling their current homes and for buying different homes.

Unlike other housing changes, Fannie said this issue has a simpler solution since it doesn’t require changes in laws or regulations.

Fannie suggests that the industry should provide homeowners with the information and tools necessary so they can better estimate their home equity, delivering easy, affordable access to better estimates of home values could afford many benefits.