HousingWire hosted an educational web seminar to address the changing face of the mortgage industry as it steadily becomes more digitally driven.

David Whitaker, counsel with BuckleySandler, and Michael Laurie, vice president of product strategy with e-Signlive by Silanis, discussed the legal requirements businesses need to know and best practices around satisfying requirements when moving to e-disclosure delivery of mortgage disclosures.

There is an increased push for companies to go digital due to regulatory pressure combined with consumer expectations for convenient and efficient service are driving mortgage companies to go digital.

Earlier this year, Kelly Adkisson, a managing director at Accenture Credit Services, explained that they are seeing a clear change in customer demographics and needs, and lenders must adapt.

"Millennials are expecting different services and capabilities from lenders,” she said. Accenture’s research suggests the emergence of a new high value customer segment – “Generation D”. Generation D spans age groups and encompasses people who are deeply digital, integrating online and social media into the fabric of their lives.

Additionally, in August, the Consumer Financial Protection Bureau finished its study on the benefits of electronic closings that it started back in April 2014.

The CFPB wanted to work with some of the lenders that already offered eClosing solutions in order to explore how they can best facilitate the process. And in the end the CFPB discovered that borrowers can in fact benefit from electronic closings as part of the mortgage loan process.

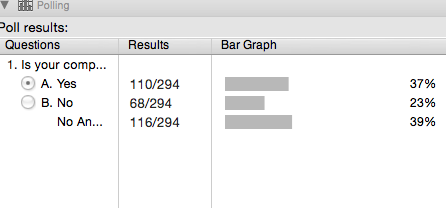

The webinar began by asking the simple, but powerful, question: Is your company ready for the TILA/RESPA Integrated Disclosure Oct. 3 deadline?

Here are the results, which shower fewer companies might be as prepared as you think.

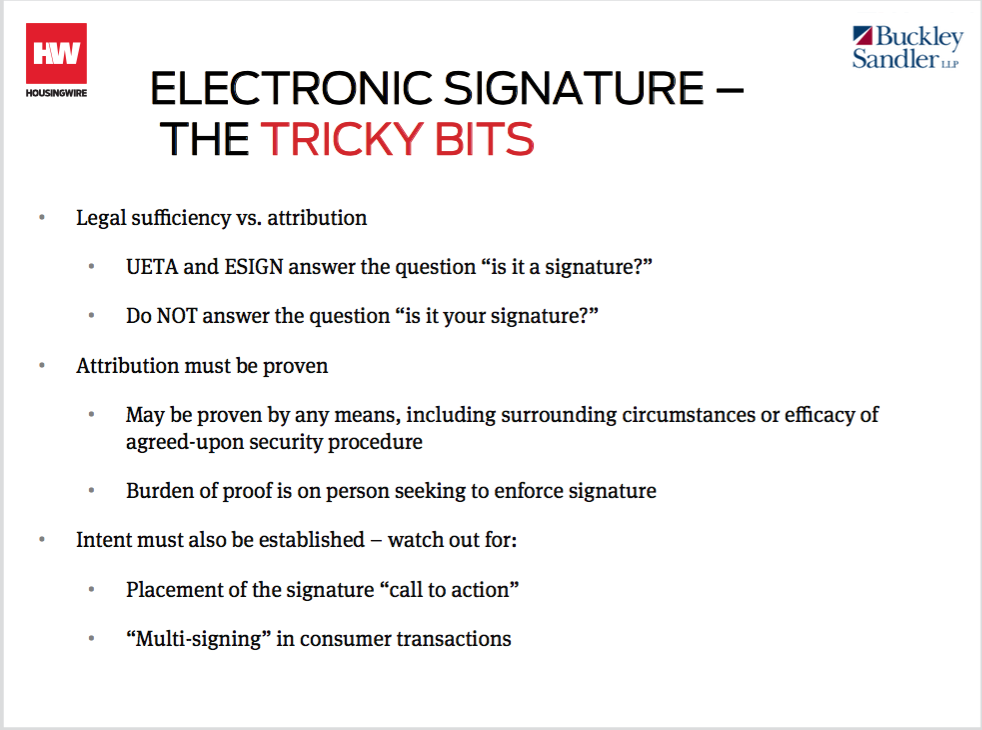

Whitaker dove into what exactly is a electronic signature and what are some of the challenges that come with it.

Whitaker explained that an electronic signature is an “electronic sound, symbol, or process attached to or logically associated with a record and executed or adopted by a person with the intent to sign the record.”

There are two main statutes:

- The state law: the Uniform Electronic Transaction Act (UETA)

- The Federal solution: The Electronic Signatures in Global and National Commerce Act (ESIGN)

The statutes are there to say in essence that electronic mortgages are acceptable:

- A record or signature may not be denied legal effect or enforceability solely because it is in electronic form

- If a law requires a record to be in writing, an electronic record satisfies the law

- If a law requires a signature, an electronic signature satisfies the law

For a full explanation of the challenges, including legal, associated with electronic signatures, check HousingWire’s Knowledge Center for the webinar’s audio and slides.

Here is a quick look at just one of the slides that show the challenges that come with electronic signitures.

Click to enlarge

(Source: HousingWire)

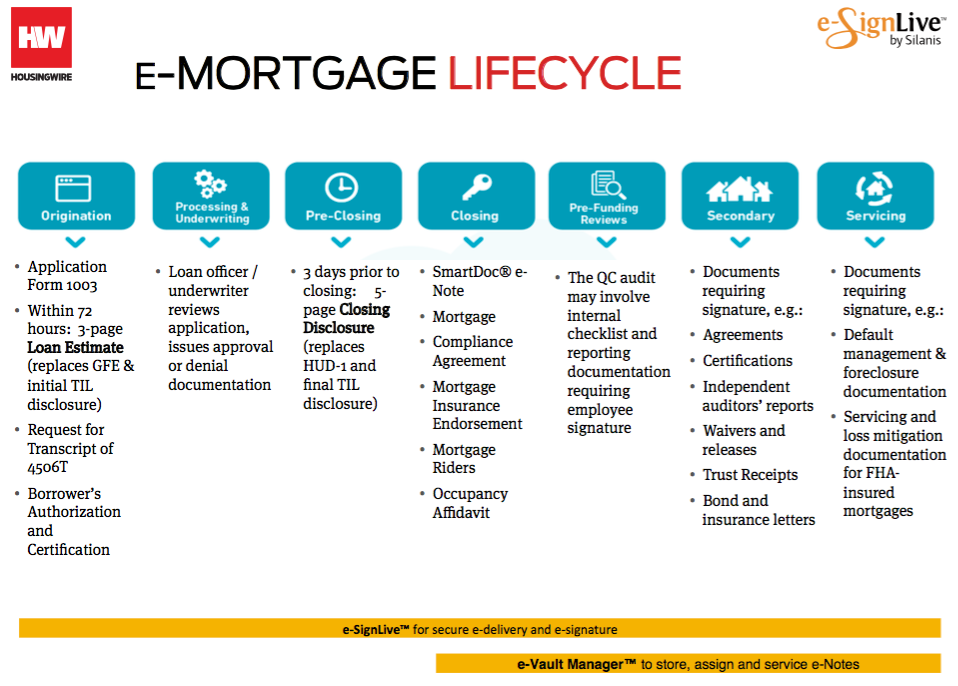

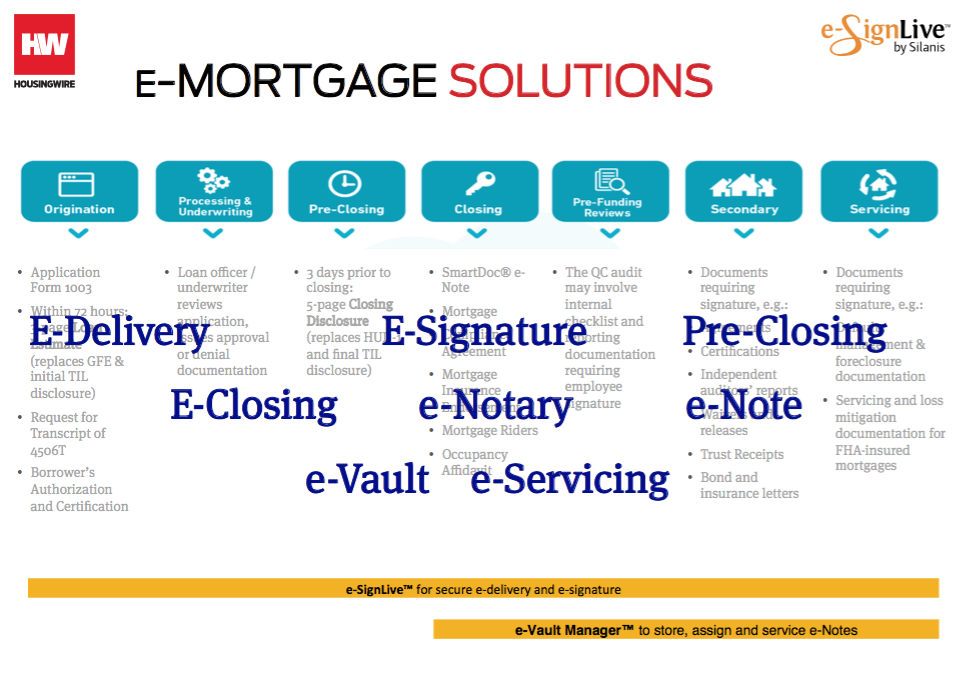

Meanwhile, Laurie explained how the jump into electronic signatures and how the digital world best fits into the mortgage process.

Here is a snapshot of the mortgage lifecycle, along with how it can be transformed digitally, along with the potential solutions offered in the bottom clip.

Click to enlarge

(Source: HousingWire)

Click to enlarge

(Source: HousingWire)