In today’s housing environment, more parents are helping their kids buy a home, but there is one catch for the parents: They probably won’t see that money ever again.

loanDepot interviewed 1,000 parents of Millennial-aged children and 1,000 adults ages 18-38 to see what the financial relationship is like between the two.

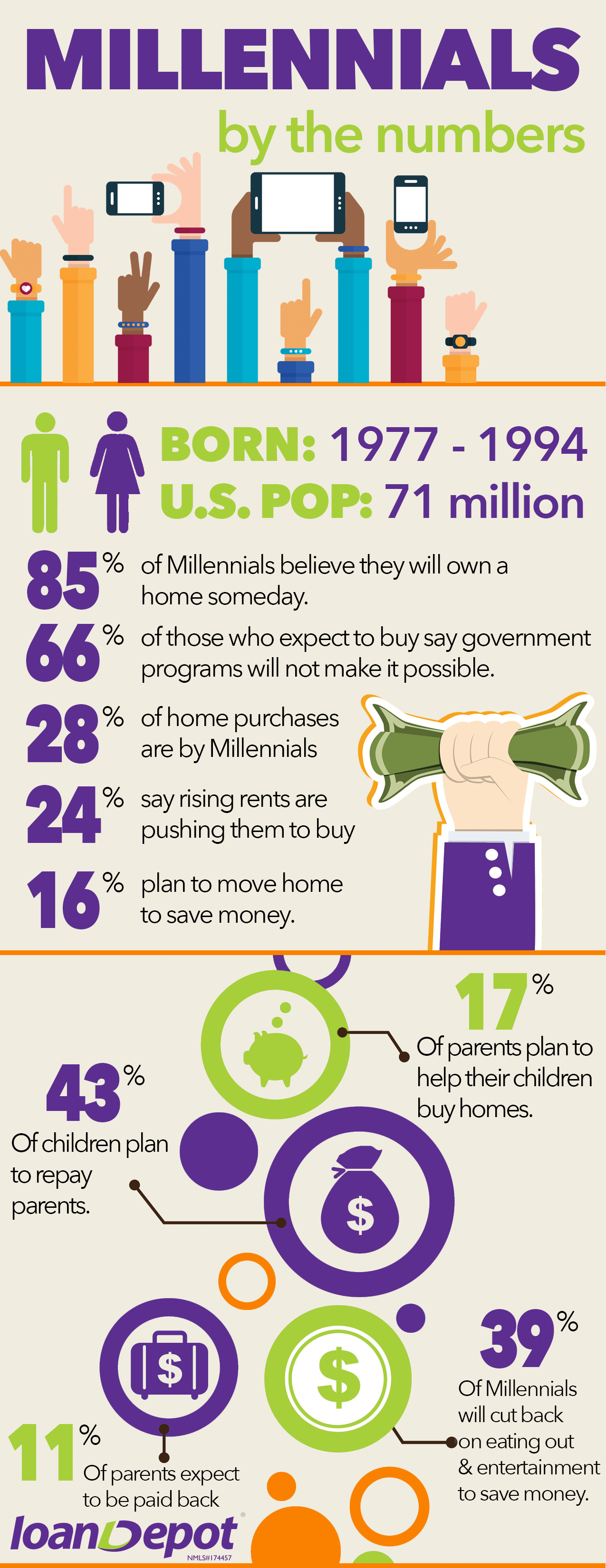

The study found that 85% of Millennials plan to own a home someday; however, how they will afford it is a different story.

Seventeen percent of parents said they plan to help their children buy homes, while only 11% expect to be paid back (check out the bottom, left of the graph below).

Oddly enough, the percent of parents expecting to be paid back is significantly lower than the 43% of Millennials who plan on repaying their parents.

Click to enlarge

(Source: loanDepot)

Right now, Millennials are struggling to save enough money for a home since prices are rising faster than their pay, an article in The Washington Post said.

To put this in perspective, the article references a Zillow (Z) report that found in the 1970s, new homebuyers found homes that cost about 1.7 times their annual pay.

Today, the typical first-time homebuyer purchases a home that costs 2.6 times his or her annual income.

The bank of mom and dad might be the best option for Millennials, especially if they don’t need to pay them back. As it stands, Millennials are barely able to save for retirement, with most unable to retire before they are 73.