San Francisco-based SoFi continues to make waves in the industry and has officially surpassed $4 billion in funded loans across mortgages, personal loans and student loan refinancing.

Nearly a year ago, the lender announced it was expanding past its standard student loan refinancing products and moving into the next important stage for financial borrowers, purchasing a home.

At that time, the peer-to-peer lender just surpassed $1 billion in crowdfunded loans, making it the fastest marketplace lender to reach this milestone.

At that time, the peer-to-peer lender just surpassed $1 billion in crowdfunded loans, making it the fastest marketplace lender to reach this milestone.

Now a year later, the bank is one of the country’s 30 largest banks, raising $1 billion in a recent round of funding, giving the lender a market cap of approximately $4 billion.

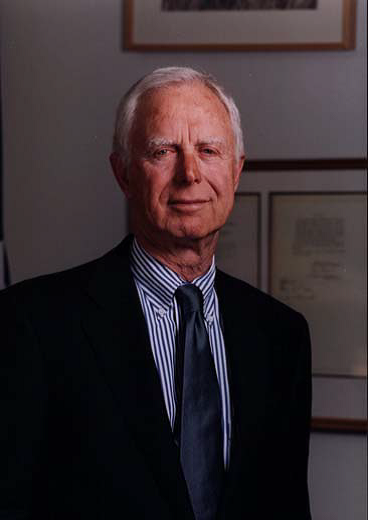

In addition, SoFi announced Arthur Levitt, the longest-serving chairman of the Securities and Exchange Commission, will become a SoFi advisor.

“As a long-time supporter of new technologies, innovation and challenging the status quo, I was naturally drawn to SoFi,” said Levitt. “SoFi is creating a unique financial services model, providing significant value to members and investors alike.”

“As we reach $4 billion in funded loans — an important milestone – I’m humbled and honored that Arthur is joining us in an advisory role. We’re confident that his experience will benefit SoFi and the marketplace lending industry overall as we navigate an increasingly complex regulatory environment,” said Mike Cagney, SoFi CEO and co-founder.