Does this mean a federally backed mortgage insurance boom is in the works?

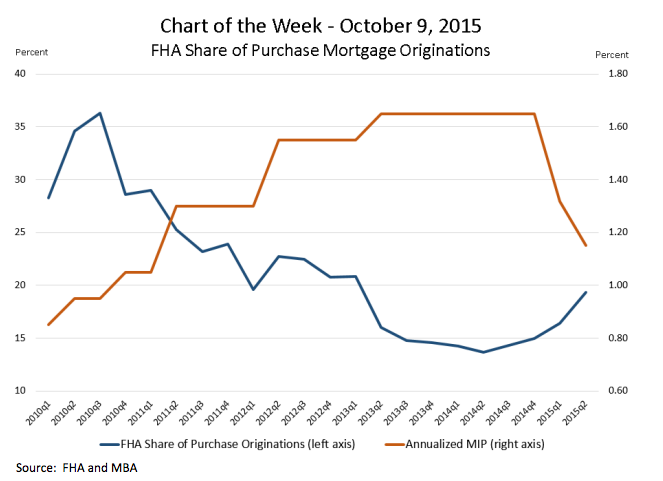

The Federal Housing Administration’s share of purchase mortgage insurance steadily declined since 2010 until 2015, the latest chart in the Mortgage Bankers Association’s chart series showed.

Click to enlarge

(Source: MBA)

So why did the mortgage-insurance course reverse?

Back at the start of the year, the Obama Administration directed, via executive action, that the Federal Housing Administration reduce annual mortgage insurance premiums by 50 basis points, from 1.35% to 0.85%.

The decision was made to make mortgages more affordable and accessible for creditworthy families.

As a result, following the 50 basis point decrease in the annual portion of the MIP in January, the trend reversed direction.

The FHA’s share of purchase mortgage originations grew from just under 15% of total purchase mortgage originations in the fourth quarter of 2014 to more than 19% during the second quarter of 2015.