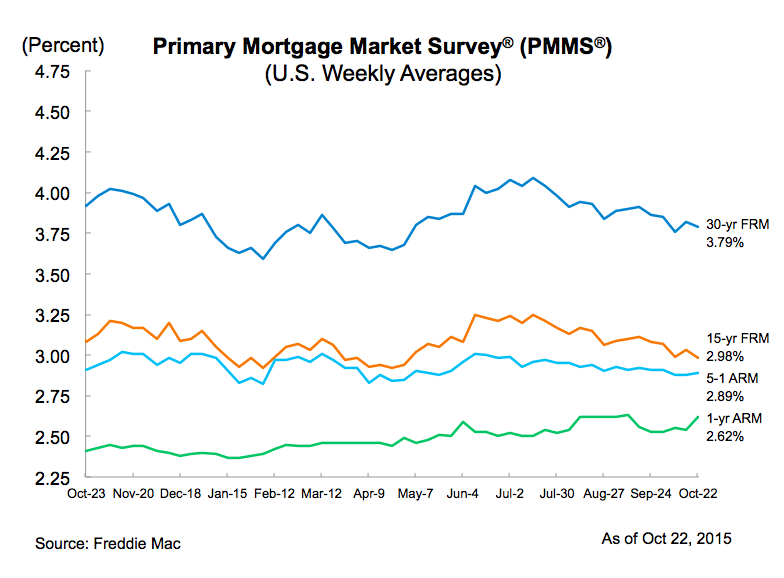

Mortgage rates continued to trend lower, following declining Treasury yields, the latest Primary Mortgage Market Survey from Freddie Mac said.

The 30-year fixed-rate mortgage averaged 3.79% for the week ending Oct. 22, down from last week when it averaged 3.82%. In 2014, the 30-year FRM averaged 3.92%.

In addition, the 15-year FRM averaged 2.98%, down from last week when it averaged 3.03%. A year ago at this time, the 15-year FRM averaged 3.08%.

The, 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.89%, up from last week when it averaged 2.88%. A year ago, the 5-year ARM averaged 2.91%.

The 1-year Treasury-indexed ARM averaged 2.62% this week, up from 2.54% last week. At this time last year, the 1-year ARM averaged 2.41%.

Click to enlarge

(Source: Freddie Mac)

“Following Federal Reserve Governor Daniel Tarullo’s remarks last week Treasury yields dipped. In response, 30-year mortgage rates fell 3 basis points this week to 3.79%," said Sean Becketti, chief economist with Freddie Mac.

"The housing market continues to benefit from low mortgage rates, with housing starts for September beating expectations and the NAHB’s Housing Market index registering a ten year high in October," he continued.