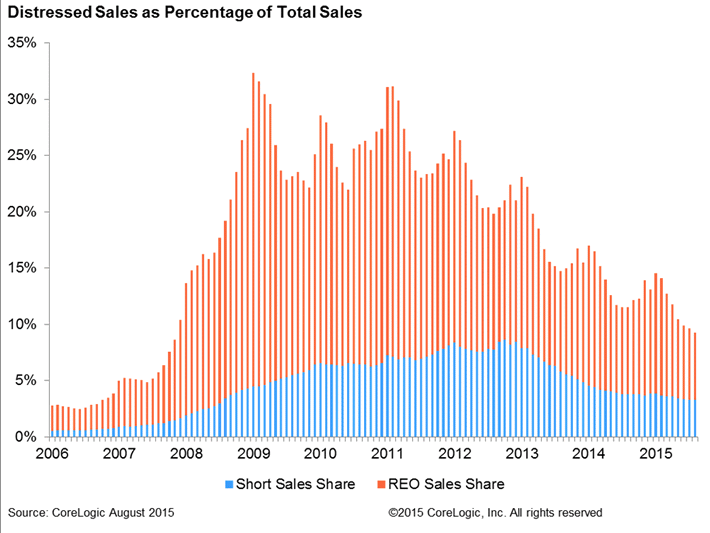

Distressed sales, which include real estate-owned properties and short sales, accounted for 9.3% of total home sales nationally in August 2015, down 2.3 percentage points from August 2014 and down 0.4 percentage points from July 2015, CoreLogic (CLGX).

Click to enlarge

(Source: CoreLogic)

Within the distressed category, REO sales accounted for 6%, which is the lowest since September 2007 when it was 5.2%, while short sales made up 3.3% of total home sales.

The share of short sales has stayed in the 3% to 4% range since it fell below 4% back in mid-2014.

At its peak in January 2009, distressed sales totaled 32.4% of all sales, with REO sales representing 27.9% of that share.

The report did note that there will always be some level of distress in the housing market. The pre-crisis share of distressed sales was traditionally about 2%.

If the current year-over-year decrease in the distressed sales share continues, it would reach that "normal" 2% mark in mid-2018.