Mortgage customer satisfaction is better thanks to heightened focus from lenders on developing functional digital channels and improving operation efficiency.

And the lenders that does this best: Quicken Loans.

J.D. Power published the results of its latest U.S. Primary Mortgage Origination Satisfaction Study, which is based on responses from 4,666 customers who originated a new mortgage or refinanced within the past 12 months.

The study measures customer satisfaction with the mortgage origination experience in six factors: application/approval process, interaction, loan closing, loan offerings, onboarding and problem resolution.

The study was fielded in two waves: February – March and July – August 2015.

Starting with the overall picture, customer satisfaction with mortgage origination increased 7 points from 2014 to an average of 793 in 2015.

The rise primarily driven by a 22-point gain in the application and approval process factor, influenced by improved perceptions of the speed of the loan process.

According to the results, when loans close earlier than promised, satisfaction is significantly higher (866), compared to when loans close as expected (821) and when it takes longer than expected (658).

Plus, the study found that overall satisfaction with several mortgage application-related activities, such as completing an application (799), submitting documents (804) and receiving status updates (811) was markedly higher among customers who used digital communication channels versus those who communicated via mail and fax (753, 766, and 770, respectively).

“While a lot of effort has been placed on ensuring compliance with new regulations, it is imperative that lenders improve their education and communication about the impact of these changes or risk losing customers,” said Craig Martin, director of the mortgage practice at J.D. Power.

“Effective communication remains one of the most important aspects of a satisfying mortgage experience, especially if the process is taking longer than it has historically. As the number of Millennial homebuyers continues to rise, lenders must be ready to meet their expectations. This generation is highly digitally connected, so ongoing communication and transparency via the channels they prefer, particularly mobile, are vital.”

HousingWire recently held a webinar on how to reach the Millennial first-time homebuyer, emphasizing that they want a digital mortgage.

In addition to this, even the government is pushing the mortgage market to go more online. The Consumer Financial Protection Bureau’s new TILA/RESPA Integrated Disclosure rule is just one example of this.

However, the survey said that one side effect of the new TRID rule is that mortgage lenders are under increased pressure from new loan disclosure regulations that could increase the time it takes to get a home loan while also facing increased competition from non-traditional lenders.

“This law has the potential to increase the mortgage timeline which poses a significant challenge for lenders when serving home buyers across all generations, but could be particularly challenging when dealing with Millennials who are technically savvy, always connected to the Internet and noted as being capricious consumers,” the survey stated.

And longer timelines equal lower satisfaction, with satisfaction falling to 686 when the loan process takes more than two months. But when an accurate time frame estimate and proactive updates are provided in that same scenario, satisfaction is 859, showing the importance of commination throughout the loan process.

However, loans are closing sooner, with the percentage of applications and approvals that close earlier than promised increasing to 35% in 2015 from 31% in 2014.

Additionally, nearly 4 in 10 (37%) millennial customers indicated that the origination process was not completely explained to them, and 58% indicated that their options, terms and fees were not completely explained.

The survey found that effective loan representatives are vital, citing that those loan reps who engage customers, build trust and ensure that borrowers understand each step of the process can mitigate the negative impact on satisfaction due to missing closing dates (764 missed date/effective representative vs. 511 missed date/ineffective representative).

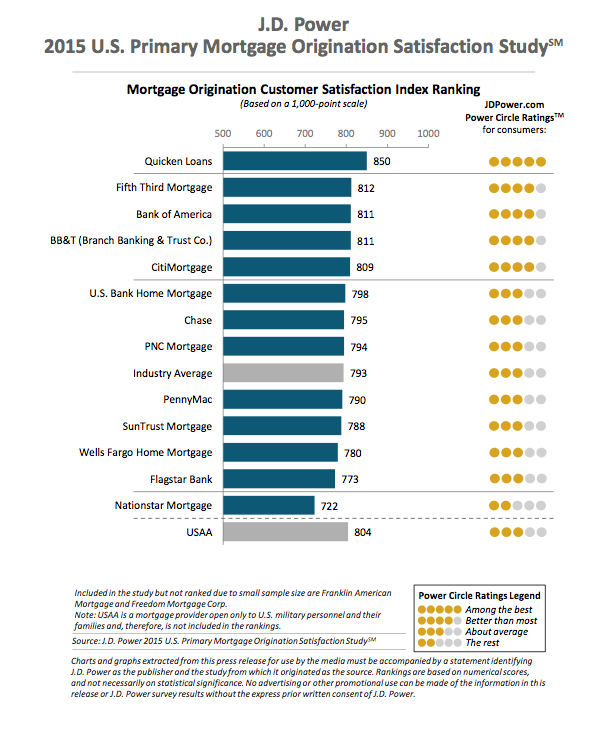

As far as which lender does this properly, Quicken Loans once again ranked highest in primary mortgage origination satisfaction for the sixth consecutive year, with a score of 850, an increase of 15 points from 2014. Quicken Loans performs particularly well in all six factors.

J.D. Power also announced back in July that for the second year in a row, Quicken Loans had the most satisfied customers of any mortgage servicer.

Here’s chart of the overall rankings.

Click to enlarge

(Source: J.D. Power)