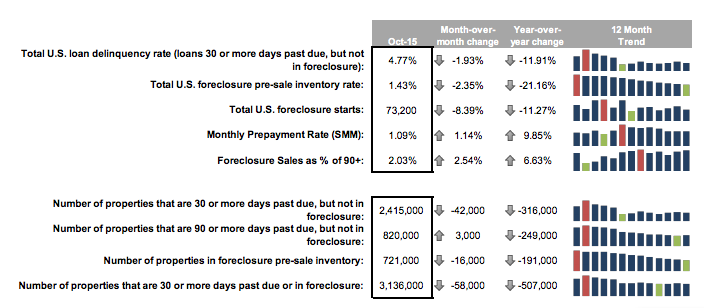

After two consecutive months of increases, the total delinquency rate finally reversed course and declined by nearly 2% from September and nearly 12% from last year, the “first look” report for October 2015 from Black Knight Financial Services showed.

Click to enlarge

(Source: Black Knight)

Foreclosure starts improved for the month and did not hit any sort of multi-year high despite speculation.

Instead, the report found that foreclosure starts declined by 8.4% to 73,000 for the month and were down 11.3% from last year.

As an added note, the report said both first-time and repeat foreclosure starts were down in October, falling 7% and 11% month-over-month, respectively, with first-time starts remaining near post-crisis lows.

Other positives in the report include the inventory of loans in foreclosure falling to its lowest point since the end of 2007.

However, the number of seriously delinquent loans — 90 or more days past due, but not yet in foreclosure — did tick up slightly in October (3,000), but it's still down by almost 250,000 from last year.

The report also added that prepayment speeds (historically a good indicator of refinance activity) were up slightly for the month, with a single month mortality (SMM) rate of 1.09%.