The Federal Reserve is forecasted to raise interest rates during its December meeting, which would mark the first rate rise in nine years. Despite some concerns that this could devastate the housing market, a new report from Capital Economics said that housing looks well placed to withstand a rate hike, and its interest rate forecast is even above consensus.

“There are concerns that, with rates last raised over nine years ago, even a small increase could come as a major shock to homebuyers. Those concerns are understandable. After all, the health of the housing market and the cost of finance are closely linked,” the report stated. “Moreover, falls in real house prices have accompanied, and in many cases preceded, nearly every recession since the mid-1970s, a fact which highlights the potential risks of derailing the housing recovery.”

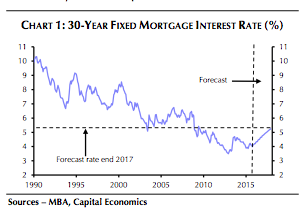

Despite this, the report said that the housing market can handle the increase, adding, “after all, even on our forecast, rates will remain historically low for some time yet. We expect 30- year mortgage rates to rise to 5.25% by the end of 2017, from around 4.0% now.”

This chart shows the 30-year fixed rate mortgage interest rate since 1990, along with a forecast through 2017.

Click to enlarge

(Source: Capital Economics)

The most recent Freddie Mac Primary Mortgage Market Survey showed mortgage rates barely changing, with the average 30-year fixed mortgage rate staying just barely below 4%.

Capital Economics isn’t the only one saying that housing can digest the upcoming impact of rising interest rates. In August, Mark Fleming, chief economist at First American, said, “An expected move by the Federal Reserve this fall to raise rates will have a moderating, but not devastating impact on market capacity for existing-home sales.”

He also noted that rising rates are an indication of stronger labor market conditions, which is beneficial to the housing market.

Instead, the Capital Economics report cited a different issue to watch for.

“The risk that Fed tightening will derail the housing market therefore appears low. Rather, perhaps more of a concern is the risk of another boom. After all, for a really damaging housing bust to occur, you first need prices to spiral way above their fundamental values,” the report stated. “And house price gains are once again accelerating.”

According to CoreLogic’s (CLGX) latest Home Price Index, home prices nationwide, including distressed sales, increased by 6.8% in the month of October when compared with one year ago.

“On the demand side, there is certainly the potential for a surge of buyers to hit the market. After years of subdued activity, a far larger than normal share of young adults are living with their parents. And with credit conditions now loosening, this pent-up demand could quickly be released,” the report said.

However, the report said that this outcome looks unlikely.

“After the financial crisis, banks are understandably nervous about easing credit conditions too quickly. And while the government and GSEs are trying to boost homeownership, tougher regulations are pushing in the opposite direction. On balance, we expect credit conditions to continue to ease only gradually, preventing a repeat of the mid-2000s boom,” it said.

And at the same time, Capital Economics also said it thinks a dangerous house price boom can be avoided.

“Even though they have already risen by over 25% since the start of 2012, house prices are not set to become overvalued. In other words, we expect the market will be in goldilocks territory — not too hot, not too cold — for the next few years.”