This low housing inventory environment is not projected to go away any time soon, according to the latest report from Capital Economics.

“A lack of housing inventory continues to drive developments in the market. As demand has slowly recovered, low inventory levels have weighed on home sales and put upwards pressure on house price,” the report said.

“Those tight conditions are only set to ease gradually over the coming months, in spite of a steady recovery in housing starts,” it continued.

The most recent pending home sales report from the National Association of Realtors said that sales have plateaued this fall as buyers struggle to overcome a scant number of available homes for sale and prices that are rising too fast in some markets.

And existing-sales don’t have a much better future. While existing-home sales are projected to expand next year, ongoing inventory shortages and affordability pressures from rising prices and mortgage rates will likely temper sales growth.

Additionally, Frank Nothaft, chief economist for CoreLogic, said in the latest Home Price Index report, “Many markets have experienced a low inventory of homes for sale along with strong buyer demand, which is sustaining upward pressure on home prices. These conditions are likely to persist as we enter 2016."

Although there is definitely pent up demand, as evidenced by the high proportion of 18-34 year olds living with their parents – there is limited prospect of a strong recovery in total home sales in the near term, Capital Economics said.

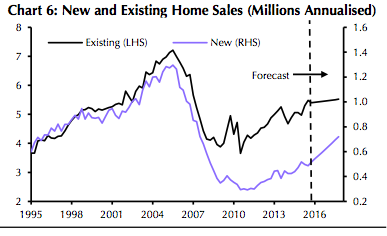

As a result, Capital Economics trimmed back its forecasts for existing home sales, expecting sales to increase very gradually to 5.52 million by the end of 2017.

On the other hand, housing starts are set for solid growth, giving a more positive outlook for new home.

Capital Economics said, “We expect a robust rise to 720,000 by the end of 2017, a rise of around 50% compared to current levels. That means total home sales are set for average annual growth of just under 3% over the next two years.”

Click to enlarge

(Source: Capital Economics)