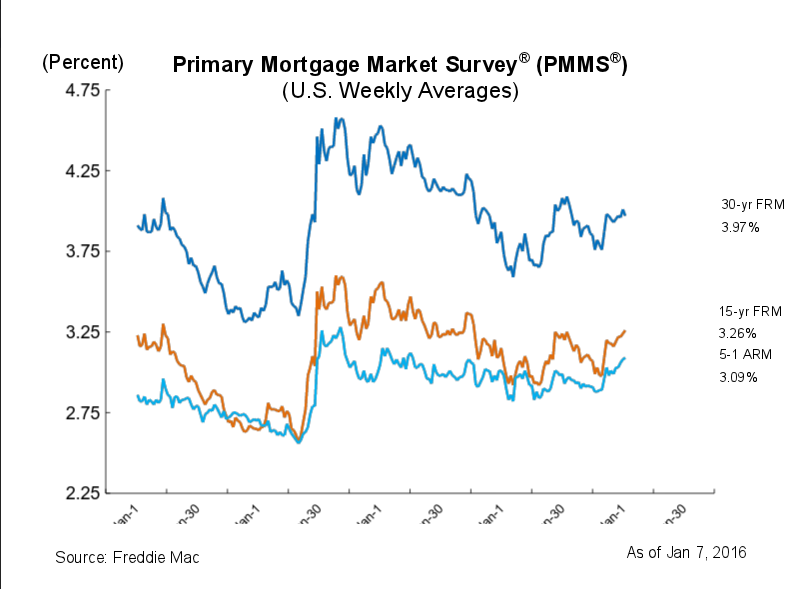

The 30-year mortgage interest rate didn’t linger above 4% for long and dropped back down for the start of 2016, the latest Freddie Mac Primary Mortgage Market Survey said.

The 30-year fixed-rate mortgage dipped to 3.97%, down from 4.01% last week. One year ago at this time, the 30-year FRM averaged 3.73%.

Last week marked the first time in five months that the 30-year mortgage rose above 4%. The increase was attributed to Treasury yields reacting in part to strong consumer confidence in December.

For this week, Sean Becketti, chief economist with Freddie Mac, said, “Concerns about overseas economic developments have dominated financial markets to start the year. U.S. Treasury bond yields fell amidst a global equity selloff and flight to safety. In response, the 30-year mortgage rate dipped 4 basis points to 3.97%.”

Meanwhile, the 15-year FRM this week slightly increased to 3.26% with an average 0.5 point, up from 3.24 percent last week. A year ago, the 15-year FRM averaged 3.05%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage barely moved higher to 3.09% this week, up from last week when it averaged 3.08%. A year ago, the 5-year ARM came in at 2.98%.

Click to enlarge

(Source: Freddie Mac)