Rent appreciation is finally projected to cool down in 2016, giving renters a much-needed break from what seemed to be never-ending price increases.

But, the good news stops there.

The new rent appreciation report from online real estate listing service, Zillow, does caution that although prices will level off over the next 12 months, rents will remain unaffordable in many of the major markets across the U.S., especially on the West Coast.

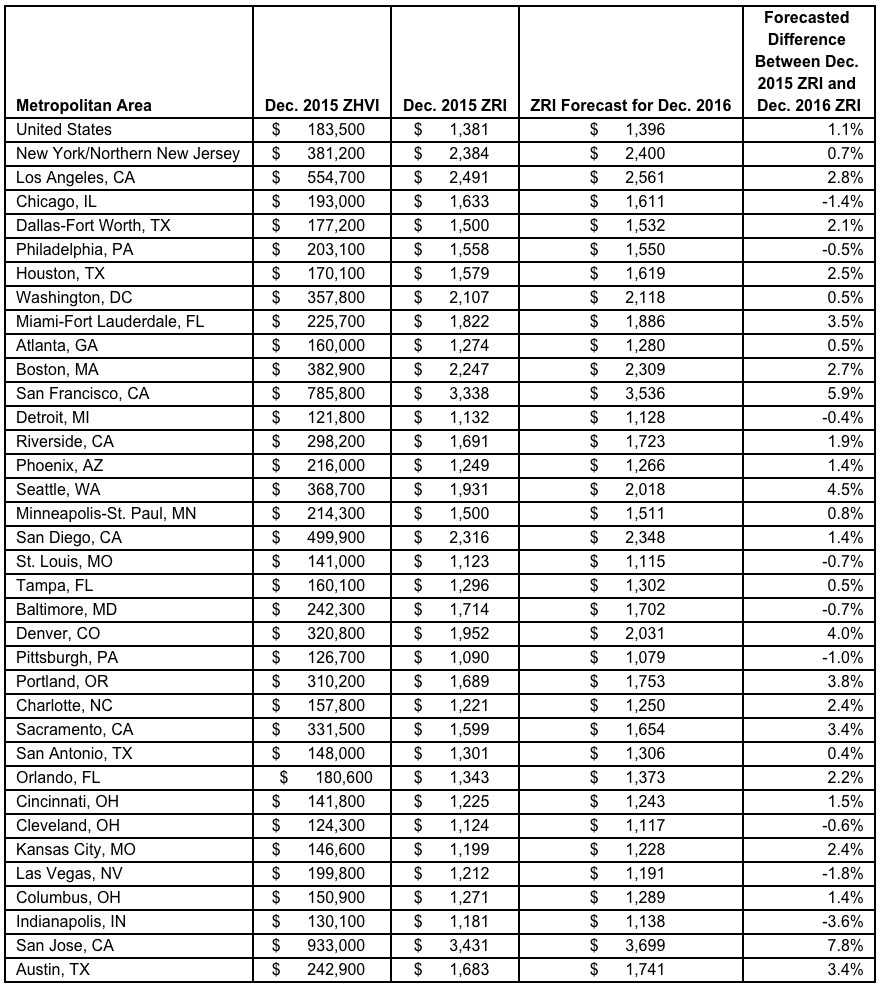

According to Zillow, rent appreciation will slow to an annual rate of 1.1% by December 2016, with the national Zillow rent index at the end of 2016 projected to be $1,396, compared to $1,381 in December 2015.

However, a price slowdown isn’t enough to turnaround some of the outrageous costs of rent on the West Coast. Renters in San Francisco and Los Angeles can still expect to spend 40% of their income on a rental payment, Zillow said.

"Hot markets are still going to be hot in 2016, but rents won't rise as quickly as they have been," said Zillow Chief Economist Svenja Gudell.

"The slowdown in rental appreciation will provide some relief for renters who've been seeing their rents rise dramatically every single year for the past few years. However, the situation remains tough on the ground: rents are still rising and renters are struggling to keep up,” continued Gudell.

Outside of the West Coast, places like Washington D.C. and Atlanta are only projected to increase 0.5%.

Here is full list for exactly what to expect in various markets.

Click to enlarge

(Source: Zillow)