The housing market continues to recover from the recent financial crisis. For the month of February, a recent report shows that vacancy and “zombie foreclosures” are down 4% from a year ago nationwide, but continue to increase in a minority of markets, mostly those with a protracted foreclosure process or high numbers of blighted properties.

A new report from RealtyTrac, a provider of comprehensive U.S. housing and property data, including nationwide parcel-level records for more than 130 million U.S. properties, shows that out of nearly 85 million residential properties (1 to 4 units) nationwide, more than 1.3 million (1.6%) were vacant at the beginning of February 2016, down 9.3% from the third quarter of 2015.

“With several notable exceptions, the challenge facing most U.S. real estate markets is not too many vacant homes but too few,” said Daren Blomquist, vice president at RealtyTrac.

“The razor-thin vacancy rates in many markets are placing upward pressure on home prices and rents. While that may be good news for sellers and landlords, it is bad news for buyers and renters and could be bad news for all if prices and rents are inflated above tolerable affordability thresholds,” added Blomquist.

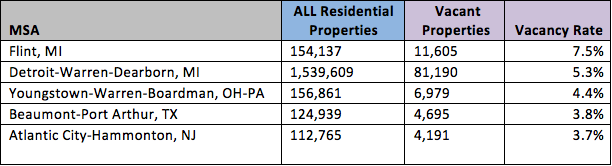

Among the 147 metropolitan statistical areas with at least 100,000 residential properties, major cities as well as metro areas the U.S. have seen vacancy rates rise.

See picture below for the top 5 vacant cities in the U.S.

Click to enlarge

(Source: RealtyTrac)

Major metro areas with vacancy rates above the national average included Indianapolis (3.0%), Tampa (2.9%), Miami (2.8%), Cleveland (2.8%), and St. Louis (2.6%).While shrinking inventory of available housing is still plaguing many markets, these five continue to struggle with too many vacant homes.

“Across the Ohio markets, occupancy demand is fueling a robust seller’s market for residential and commercial real estate,” said Michael Mahon, president at HER Realtors, covering the Ohio markets of Dayton, Columbus and Cincinnati.

“With vacancy rates low, situations such as leasebacks and delayed occupancy are factors of concern in trying to get timing aligned for possession transfer in many communities. Couple this demand with the added necessary timing factors of the new Federal TRID disclosure process for 2016, and there is an even more heightened need for clear and consistent communication between buyers and sellers involving the timing and expectations of possession transfer regarding real estate transactions.”

According to the report, properties in the foreclosure process accounted for 1.5% (19,793) of all vacant properties nationwide, but the number of these “zombie” foreclosures was down 4% from a year ago when there were 20,575 nationwide.

States that were affected in 2015 from zombie foreclosures were Massachusetts (up 167%), Oklahoma (up 89%), Michigan (up 71%), Arizona (up 52%), and New Jersey (up 49%).

Metro areas that were also affected in 2015 were Worcester, Massachusetts (up 163%), Providence, Rhode Island (up 148%), Boston (up 111%), St. Louis (up 108%), and Detroit (up 71%).

RealtyTrac also states that while Investment properties are more likely to be vacant at 4.3%, investment property vacancy rates a rock-bottom 3% in more than one-third of U.S. markets which is good news for landlords but bad news for renters in those markets.

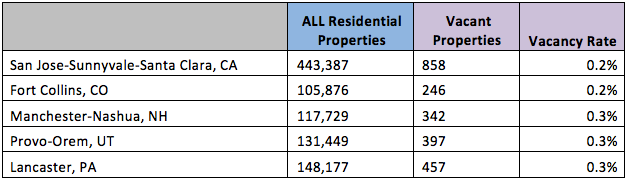

See picture below for the top 5 U.S. cities running out of rooms

Click to enlarge

(Source: RealtyTrac)

Other major metro areas with vacancy rates below the national average included San Francisco (0.3%), Los Angeles (0.4%), Boston (0.5%), Denver (0.5%), and Washington, D.C. (0.5%).