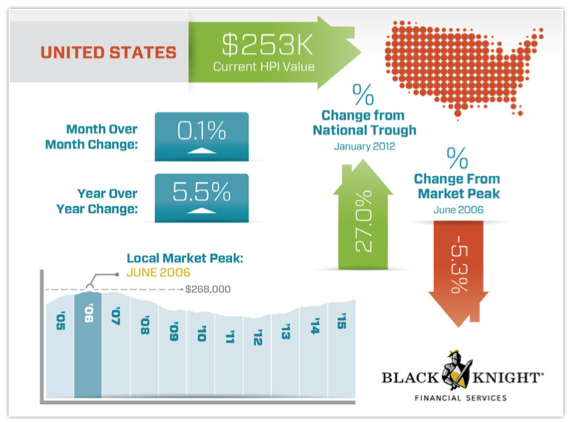

Home prices remained basically flat as last year came to a close, the December Black Knight home price report said.

From November, U.S. home prices increased a marginal 0.1%, putting them up 5.5% for the year.

For added perspective, as of the end of 2015, national home prices were 27% above where they were at the bottom of the market in January 2012.

Compared to November, the chart below is almost identical.

Click to enlarge

(Source: Black Knight)

The Black Knight HPI utilizes repeat sales data from the nation’s largest public records data set, as well as its “market-leading, loan-level mortgage performance data, to produce one of the most complete and accurate measures of home prices available for both disclosure and non-disclosure states.”

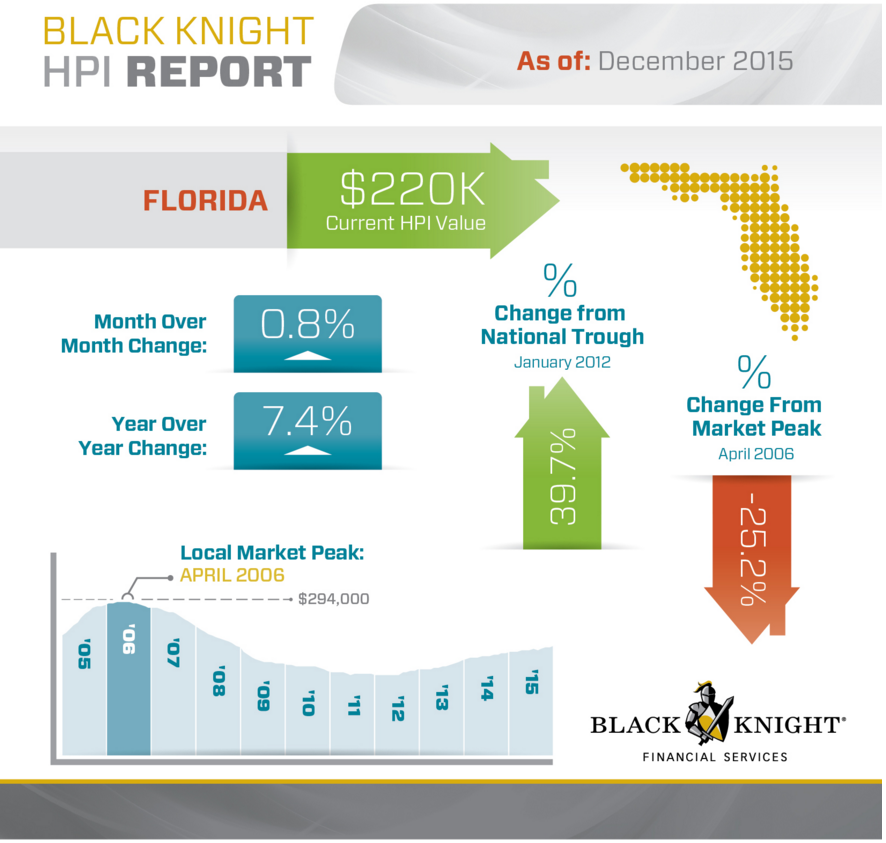

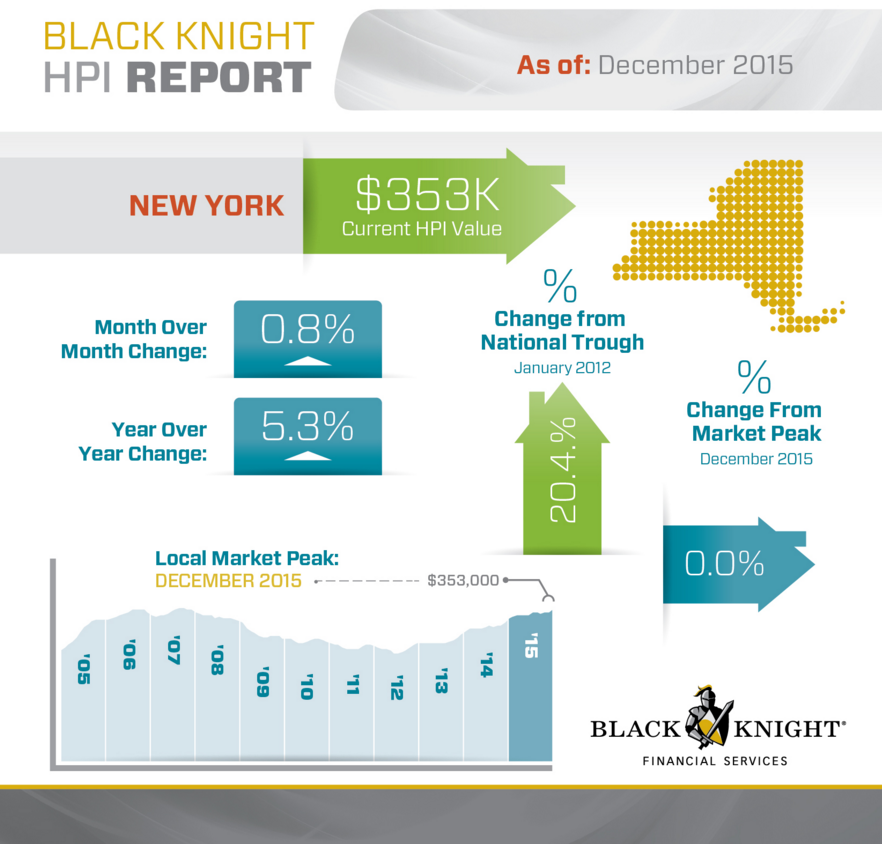

While New York once again led gains among the states, Florida also led the way this month, with each state seeing 0.8% month-over-month appreciation.

Black Knight noted that Florida accounted for every one of the top 10 best performing metro areas in December, with Sarasota leading the way at 1.4%.

Here’s a break down of the Florida and New York housing market:

Click to enlarge

(Source: Black Knight)

Click to enlarge

(Source: Black Knight)

Additionally, among the nation's 20 largest states, 2 hit new peaks in December:

- New York ($353K)

- Texas ($216K)

And of the nation’s 40 largest metros, 8 hit new peaks:

- Austin, Texas ($288K)

- Dallas, Texas ($222K)

- Denver, Colorado ($331K)

- Houston, Texas ($221K)

- Nashville, Tennessee ($222K)

- Portland, Oregon ($325K)

- San Antonio, Texas ($196K)

- San Francisco, California ($727K)