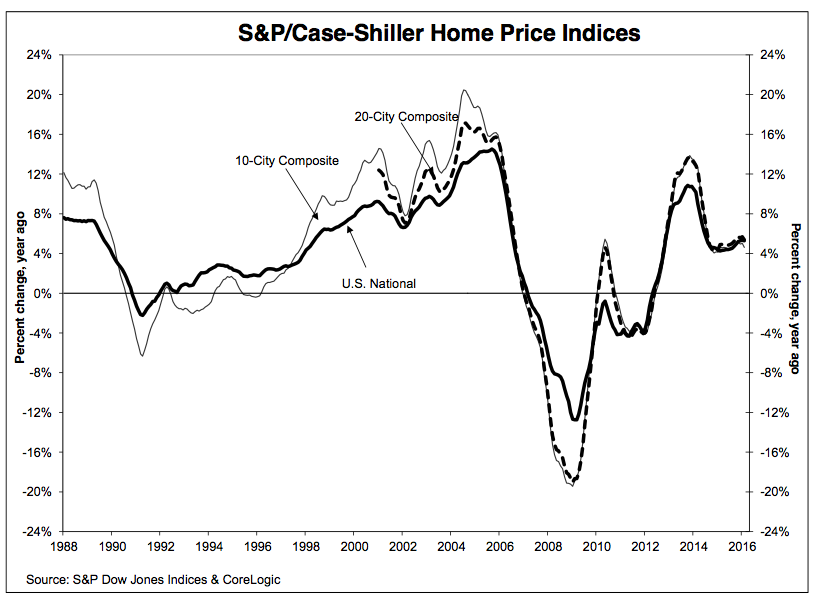

The National Home Price Index, covering all nine U.S. census divisions, increased 5.3% annually in February, unchanged from the previous month, breaking a 10-month streak where the year-over-year figure increased over the previous month, the latest S&P/Case-Shiller report found.

Click to enlarge

(Source: S&P/Case-Shiller)

“While one month does not make a trend, this is a sign that the US housing market may be stabilizing in the wake of strong price appreciation between 2012 and 2014,” said Ralph McLaughlin, chief economist for Trulia.

McLaughlin cautioned that although the S&P/Case-Shiller National Home Price Index is an important metric to watch, it’s worth noting that the measure is more reflective of price movements in premium homes rather than middle or lower tier homes.

According to the new report, the 10-City Composite increased 4.6% in the year to February, compared to 5.0% previously, as the 20-City Composite’s year-over-year gain was 5.4%, down from 5.7% the prior month.

On a monthly basis, after seasonal adjustment, the National Index recorded a 0.4% increase. The 10-City Composite posted a 0.6% increase and the 20-City Composite reported a 0.7% month-over-month increase after seasonal adjustment.

Only 10 cities increased for the month after seasonal adjustment.

“Home prices continue to rise, although more slowly, at a largely sustainable clip. But a deeper look at recent housing trends reveals a few troubling issues set to impact first-time and move-up buyers in the critical months ahead,” said Zillow Chief Economist Svenja Gudell.

Gudell explained that homebuyers will face very different types of housing markets depending on how much they are willing to spend on a home.

“Inventory of entry-level and middle-tier homes is down sharply, and home prices in those segments are rising more quickly as demand stays strong and the economy keeps chugging along. At the same time, inventory at the top of the market is more available, and prices are growing far more slowly,” Gudell said.

“Heading into spring, buyers looking for the most expensive homes will find somewhat softening prices, a larger selection of homes to choose from and more limited competition. Entry-level and mid-market buyers – typically the housing market’s bread and butter – are likely to face stiff competition, rapidly rising prices and very limited inventory. The patience of many buyers will be tested in coming months,” Gudell added.

Portland, Seattle, and Denver reported the highest year-over-year gains among the 20 cities with another month of annual price increases, with Denver replacing San Francisco in the top three.

“Higher prices in these markets should help increase inventory headed this Spring, but at the same time push some homes out of reach for buyers,” said McLaughlin. Portland led the way with an 11.9% year-over-year price increase, followed by Seattle with 11.0%, and Denver with a 9.7% increase.