While the market reacted to the Federal Open Market Committee’s announcement yesterday, the news came too late to impact this week’s mortgage rates.

According Thursday’s Primary Mortgage Market Survey from Freddie Mac, average fixed mortgage rates slightly increased but are still well below 4% for now.

“Treasury yields marched higher this week. As a result, the 30-year mortgage rate jumped 7 basis points to 3.66%. The Federal Reserve’s decision to leave the Federal funds rate unchanged triggered a 9 basis point drop in the 10-year Treasury yield on Wednesday, however the drop occurred too late to impact this week’s survey,” said Sean Becketti, chief economist with Freddie Mac.

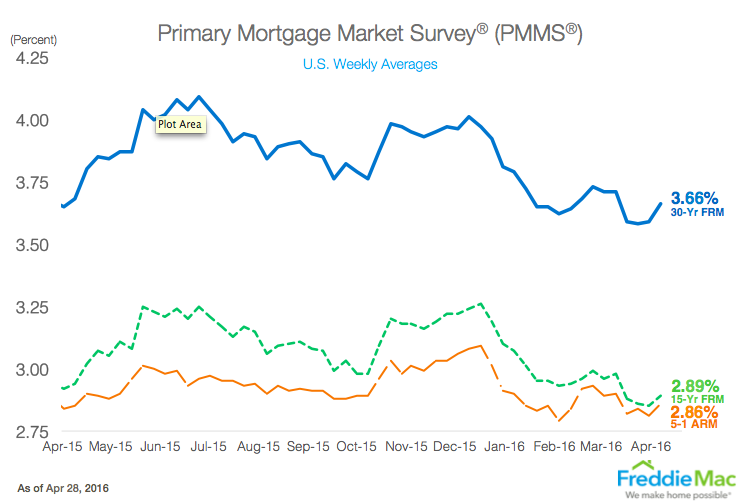

This chart to shows mortgage rates over the past year.

Click chart to enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage increased to 3.66% for the week ending April 28, up from last week when it averaged 3.59%. A year ago at this time, the 30-year FRM averaged 3.68%.

Similarly, the 15-year FRM this week came in at 2.89 %, up from last week when it averaged 2.85%. This time in 2015, the 15-year FRM averaged 2.94%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.86% this week, growing from last week’s 2.81%. A year ago, the 5-year ARM averaged 2.85%.