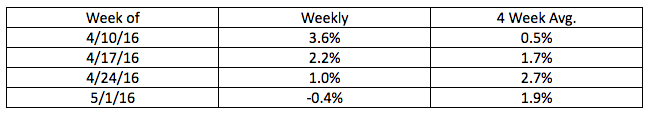

Appraisal volume continues to struggle to lift-off this spring. With more than half the season already over, volume fell -0.4% for the week of May 1, according to the latest appraisal volume numbers from a la mode, an appraisal forms software company that provides its findings exclusively to HousingWire.

This is down from the 1% rise in last week’s report despite it being peak home-buying season.

Click chart to enlarge

(Source: a la mode)

“This year the Index has a very modest upward trend. This week’s negative growth rate is one of the few we’ve seen this year and the first since the end of March,” said Kevin Golden, director of analytics with a la mode.

“Overall this spring buying season has been tepid at best. Tight credit, stalled wages and rising prices have countered the good employment data and low rates,” he continued.

Appraisal volume is an indicator of market strength and has some advantages over mortgage applications. Fallout is less for appraisals since they are ordered later in the mortgage process after credit worthiness is determined and there are few multiple-orders.

a la mode captures 50% of the appraiser market – more than 6 million appraisals per year.

The Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending April 29 posted similar news, reiterating the difficulties of this spring-buying season. Mortgage applications dropped, falling 3.4% from one week earlier. This came after previous week’s decline of 4.1%.

[Update 1: Headline modified to better reflect appraisal volumes in total]