Thanks to improvements made by lenders to their loan production process and updates to the government-sponsored enterprises’ representation and warranty policies, single-family loan repurchase requests are down 95% from their peak in 2010, Freddie Mac said recently.

Chris Mock, Freddie Mac’s vice president of single-family quality control, noted the stat in a recent blog about loan repurchases and their decreasing frequency.

Repurchases, or buybacks, occur when a loan buyer (Freddie Mac in this case) asks a lender to buy a loan back due to various deficiencies in the underwriting process.

But Mock said that those requests are happening far less often these days.

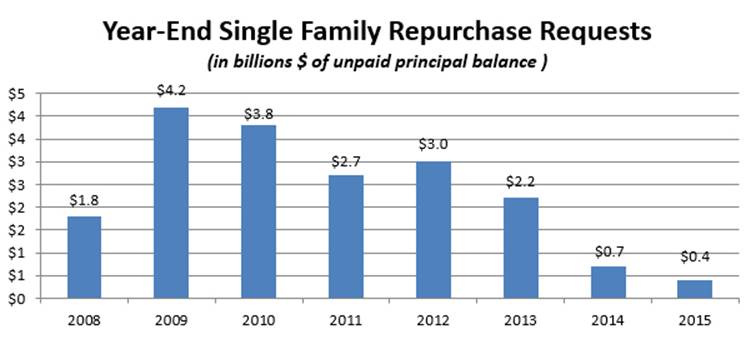

According to Mock, completed repurchases have dropped from a peak of $4.2 billion in 2010 to about $400 million in 2015, which is a decrease of 95%.

The news is entirely as shiny as it appears, as Mock notes a “caveat” about the falling number of repurchase requests.

“Many repurchases in a given year relate to loans originated in earlier years and repurchases of large groups of legacy loans were avoided as a result of some post-crisis settlement agreements,” Mock writes. “That said, the trend is clearly positive and there are several reasons that explain the chart's direction.”

The chart Mock references can be seen below and shows the trend of repurchase requests made by Freddie Mac from 2008 through 2015. Click to enlarge.

(Image courtesy of Freddie Mac)

Mock writes that the downward trend is a positive indication for lenders, servicers, taxpayers, borrowers and Freddie Mac.

“When seller/servicers sell Freddie Mac loans with greater certainty, they are more likely to make loans that take advantage of the full extent of our credit box,” Mock writes.

Mock also suggests that the loan repurchase requests will continue falling as the GSE implements its Loan Advisor Suite, a flexible, end-to-end loan delivery solution that executives with the GSE say can increase lender efficiency and provide earlier insight into representation and warranty relief.

In interviews with HousingWire, other executives with Freddie Mac spoke about the expected impact of the Loan Advisor Suite.

“We think it’s going to a game-changer for the industry,” Chris Boyle, senior vice president and head of single-family sales & relationship management at Freddie Mac, told HousingWire in an interview. “I think it’s our journey to automation and we’re happy to lead the way.”

According to Boyle, the tools will help usher in a new era for Freddie Mac.

“I believe this with my heart and soul,” Boyle told HousingWire. “I’m a veteran of this company and this is a better Freddie Mac and a better housing finance system.”

According to Andy Higginbotham, Freddie Mac’ senior vice president and head of single-family strategic delivery, the new tools are mutually beneficial for lenders and Freddie Mac alike.

Higginbotham said that when lenders start using the new program, they will be able to cure any loan issues during the origination process rather than post-closing, which will help lenders’ bottom lines and help ensure “clean” loans are delivered to Freddie Mac.

With clean loans, comes fewer repurchases. And according to Freddie Mac, that’s a win-win.