The Office of the Comptroller of the Currency on Wednesday finally lifted its mortgage servicing restrictions on Wells Fargo now that the bank is in compliance with the requirements of the Independent Foreclosure Review.

But Wells Fargo didn’t come out of this unscathed and must pay a $70 million civil money penalty for previous violations of the order, according to the OCC.

“We are pleased that the OCC has validated the effectiveness of the significant changes we have made to our mortgage servicing operations and confirmed our release from the Consent Order. Our team worked very hard to complete the requirements of the original Consent Order and the amendments, and continues to provide the best possible service to our customers,” Tom Goyda, a spokesperson for Wells Fargo said.

While the OCC said it originally issued orders in April 2011 and amended the orders in February 2013, it amended the orders again in June 2015.

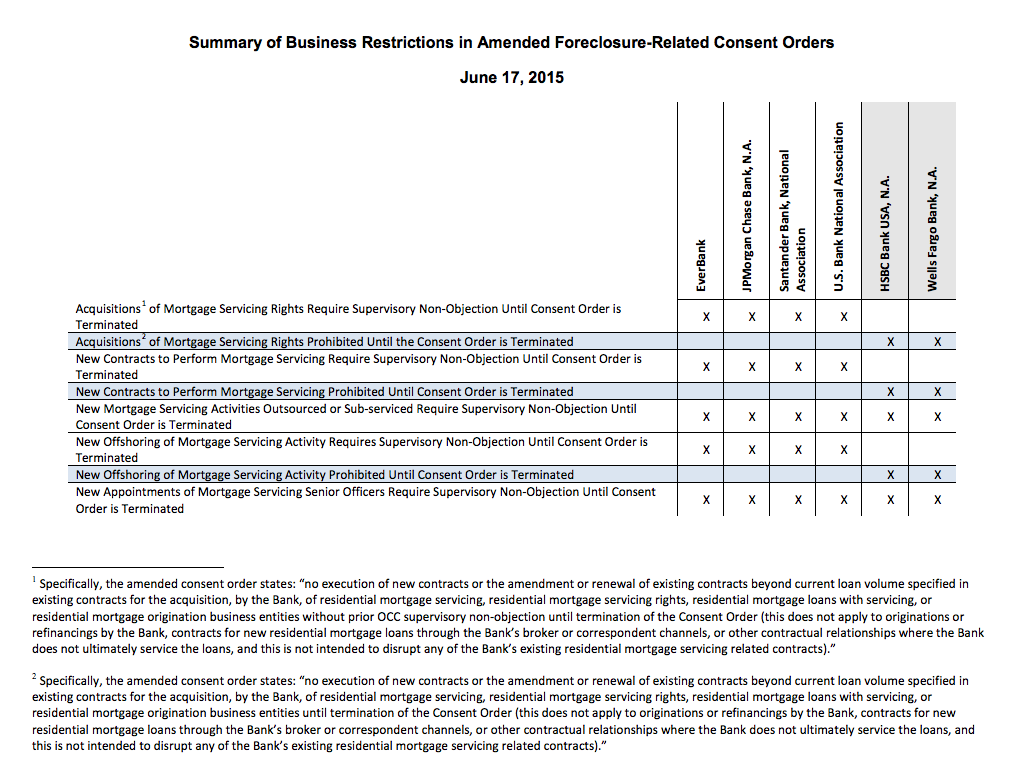

The OCC revised Wells Fargo’s restrictions, along with JPMorgan Chase’s and four other banks that also had restrictions placed on them due to their failure to comply with requirements of the Independent Foreclosure Review.

At the time, Wells Fargo and HSBC were dealt the hardest blow by the OCC and were prohibited from:

- Acquiring of mortgage servicing rights until the consent order is terminated

- New contracts to perform mortgage servicing prohibited until the consent order is terminated

- New offshoring of mortgage servicing activity until the consent order is terminated

Click this chart for a more in-depth outline of the restrictions placed on each bank.

The $70 million civil money penalty against Wells Fargo, which will be paid to the U.S. Treasury, was due to the following issues:

- The OCC found that Wells Fargo failed to correct deficiencies identified in the 2011 consent orders in a timely fashion. As a result, the OCC determined that Wells Fargo violated the 2011 consent order from Oct. 1, 2014, through Aug. 31, 2015.

- The OCC found that, between Dec. 1, 2011, and March 31, 2015, Wells Fargo filed payment change notices in bankruptcy courts that did not comply with bankruptcy rules and safe and sound banking practices.

- The OCC found that, between March 2013 and Oct. 2014, Wells Fargo made escrow calculation errors that in some cases led to incorrect loan modification denials and constituted unsafe or unsound banking practices.

The OCC also terminated mortgage servicing-related consent orders against JPMorgan Chase and EverBank back in Jan after the OCC determined both of the institutions complied with the orders. The OCC dealt JPMorgan a $48 million civil money penalty and EverBank a $1 million civil money penalty.

And in February, the OCC terminated the mortgage servicing-related consent orders against U.S. Bank National Association and Santander Bank. U.S. Bank was assed a $10 million civil money penalty, while Santander was assessed a $3.4 million civil money penalty.