Mortgage rates increased for the third week in a row, creating a new upward trend away from the historical lows witnessed this year, Freddie Mac’s Primary Mortgage Market Survey found.

But regardless of the slow and steady rise, average fixed mortgage rates are still near three-year lows.

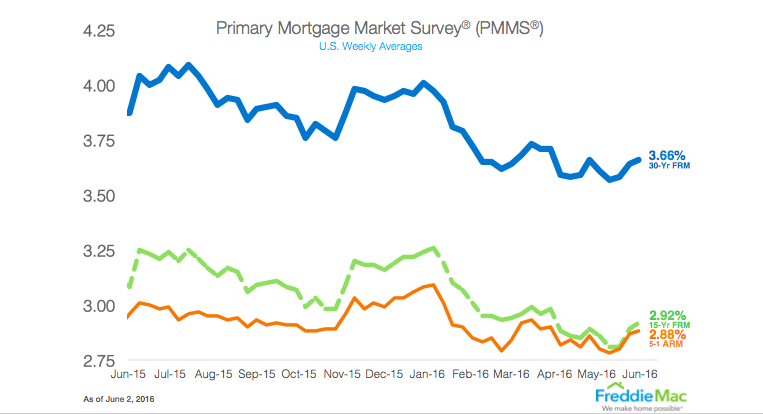

The 30-year fixed-rate mortgage averaged 3.66% for the week ending June 2, 2016, up from last week when it averaged 3.64%. A year ago at this time, the 30-year FRM averaged 3.87%.

Similarly, the 15-year FRM this week averaged 2.92%, increasing from last week when it averaged 2.89%. In 2015, the 15-year FRM averaged 3.08%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.88% this week, growing slightly from last week’s average of 2.87%. A year ago, the 5-year ARM averaged 2.96%.

Click to enlarge

(Source: Freddie Mac)

“Since jumping 11 basis points on May 18th, the 10-year Treasury yield has leveled-off around 1.85%. Mortgage rates continue to adjust to this new level with the 30-year fixed rate inching up another 2 basis points this week to 3.66%,” said Sean Becketti, chief economist with Freddie Mac.

“Recent statements by the Fed appear to have persuaded the market that a rate hike may come sooner than later,” Becketti said. “However, the market is fickle, and Friday’s employment report has the potential to swing opinion 180 degrees in the other direction.”