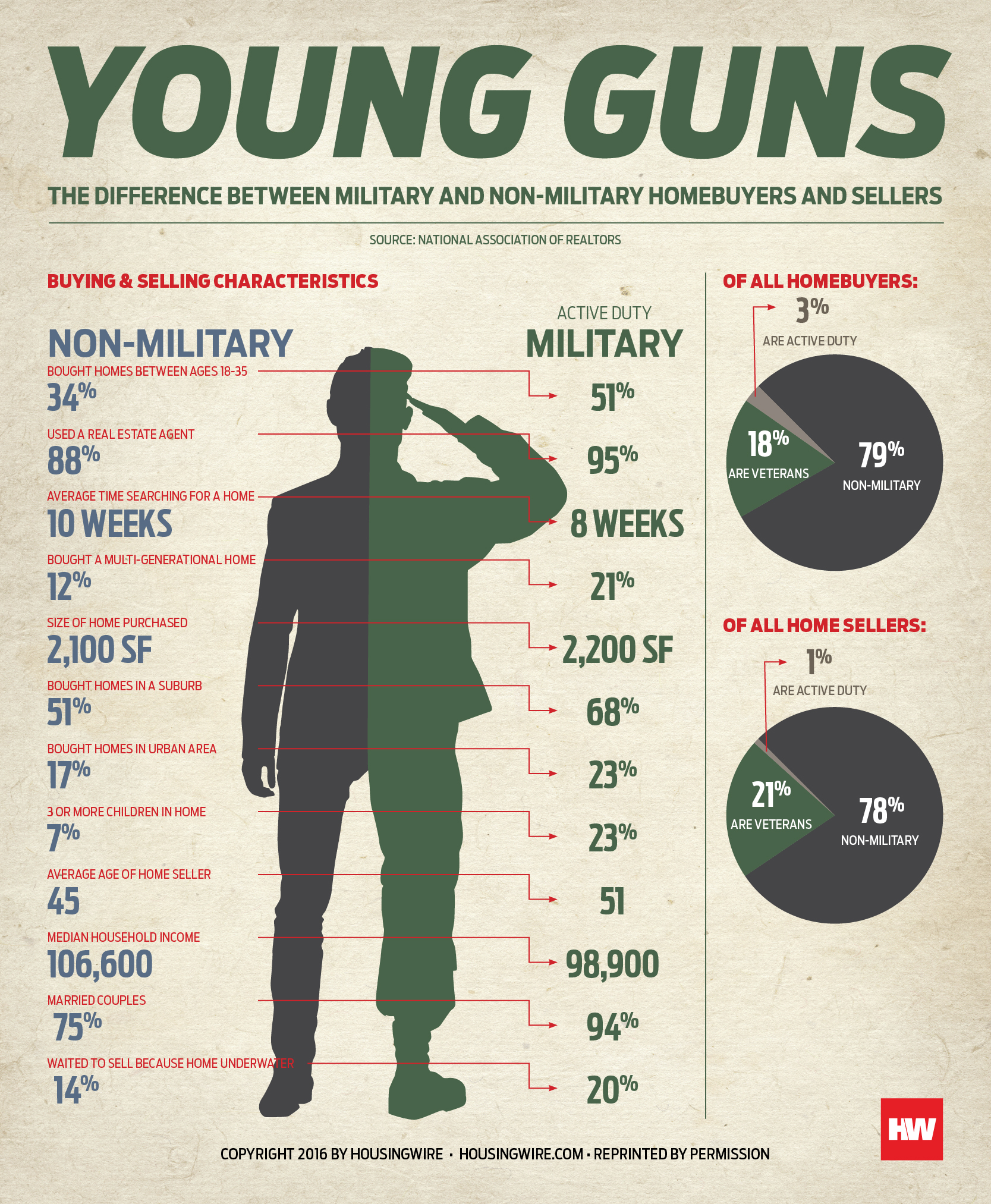

Serving in the military dictates many home buying and selling decisions for active-duty members, and continues to have residual effects — both positive and negative — for veterans.

For the first time, the National Association of Realtors included questions about military service in their 2015 Profile of Home Buyers and Sellers, and the results are telling.

Some findings were predictable: saving for a down payment was less of an obstacle for military members who can take advantage of Veterans Administration loans, which require no down payment.

Others were more surprising, like the 51% of military Millennials who bought homes, compared to only 34% of those who weren’t in the military.

This week's factsheet shows what this data turned up, feel free to download and share.

Click to enlarge

Here's a link to last week's: [Factsheet] An infographic of the 10 hottest housing markets that’s actually helpful