Appraisal volume, while small, still increased for the week of July 17, as the impact from Brexit continues to filter through the systems.

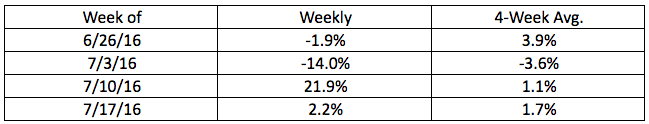

According to the latest National Appraisal Volume Index from a la mode, volume ticked up 2.2% from the previous week. This, as a result, helped push the four-week average up to 1.7%.

This chart shows appraisal volume, exclusive to HousingWire readers, over the last four week.

Click to enlarge

(Source: a la mode)

“For the week of July 17th, the National Appraisal Volume Index continued to creep up. While rates have turned upward, the ‘Brexit surge’ is still meandering through the underwriting process,” said Kevin Golden, director of analytics with a la mode.

The rise for the week, however, pales in comparison to the 21.9% rise for the week of July 10.

Golden noted that the rise will not last too much longer. “As August approaches, we expect the NAVI to start to slow as the ‘Brexit surge’ orders are processed,” he said.

Appraisal volume is an indicator of market strength and holds some advantages over weekly mortgage applications.

For example, fallout is less for appraisals since they are ordered later in the mortgage process, after creditworthiness is determined, and there are few multiple-orders, by the time an appraisal is conducted.

For example, mortgage applications, similarly, are starting to wane as refinance applications dropped in the latest report from the Mortgage Bankers Association.