Online real estate listing service Trulia took notice of recent wage growth statistics. Now, after crunching those numbers and matching it to home values available on their site, they say that bigger paychecks are outpacing home price appreciation in metros that traditionally earn less than the big cities.

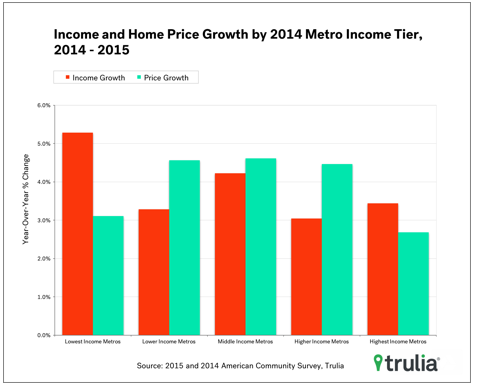

The 2015 American Community Survey showed that the metros with the lowest incomes experienced the highest income growth in 2015, according to the U.S. Census Bureau.

This is significant, considering that 2015 saw household incomes first significant increase in eight years, according to the U.S. Census Bureau.

Middle-income metros also saw solid growth, however a rise in home prices in these markets cancelled out any gains made. The same can’t be said for the low-income metros. Nationally, home values are rising, a trend that is several years going strong, as this graph shows.

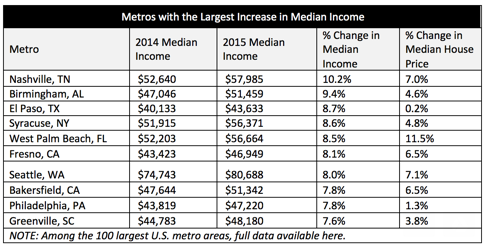

The below chart goes deeper and shows the change in income and in median home prices for the top 10 metros with the largest increase in median income.

Click to Enlarge

(Source: Trulia, U.S. Census Bureau)

As you can see from the list, while low-income metros such as Nashville, Birmingham and El Paso drove the significant income increase, metros such as San Francisco didn’t even make the list.

Also notable, is that income in nine of the 10 top markets outpaced the growth of home prices.

Click to Enlarge

(Source: Trulia, U.S. Census Bureau)

Trulia gives three different reasons that could be the cause for the surprising income growth.

“Income growth can rise for a few different reasons,” Trulia Chief Economist Ralph McLaughlin said. “First, incomes tend to rise as the unemployment rate drops, the unemployed land jobs, and employers raise wages to attract labor.”

“Second, incomes can increase because of increases in labor productivity, either because employees increase their skill base or because of advancements in technology help workers be more productive,” McLaughlin said. “Last, incomes can rise because of firm and labor migration.”

“As firms open new locations and bring new employees with them, the multiplier effect of local spending generates more opportunity for supporting business, even if new employees aren’t paid any more than existing ones,” he said. “While we can’t be certain which processes are dominating in individual markets, near full employment at the national level is certainly helping increase wages regionally.”