Mortgage credit loosened slightly in September, driven by a combination of refinance loans and low down payment loans.

According to September’s Mortgage Credit Availability Index from the Mortgage Bankers Association, which analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool, the index increased 1.4% to 167.0 in September.

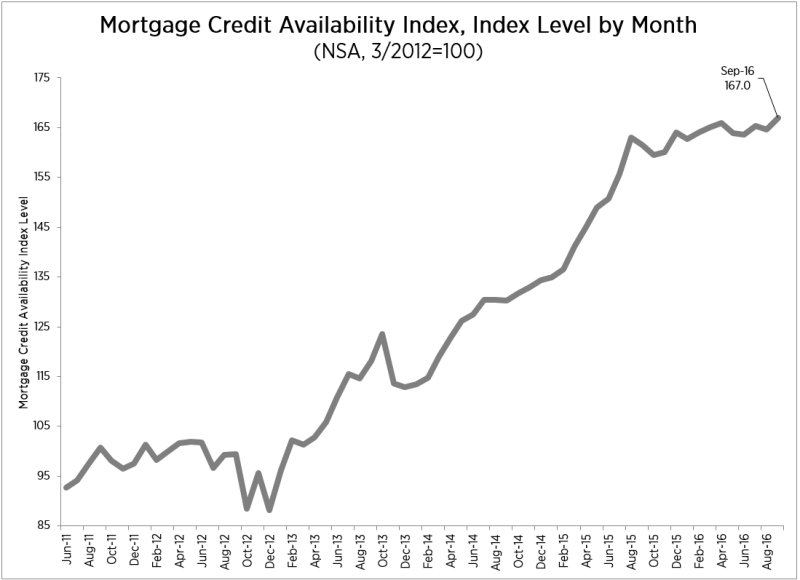

This chart shows the performance of the index since June 2011.

Click to enlarge

(Source: MBA)

To put this information into perspective, a decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

Lynn Fisher, MBA’s vice president of research and economics, explained that the increase in credit availability in September was driven by more investors offering streamlined refinance programs to borrowers with USDA and FHA loans.

“Streamline programs allow borrowers who have been consistently making their mortgage payments and meet other eligibility requirements to refinance their existing mortgage into a lower interest rate with reduced documentation requirements,” she said.

However, that wasn’t the only area driving growth.

“While these programs accounted for most of the increase, we also observed investors continuing their rollout of the new Fannie Mae and Freddie Mac low down payment (97 LTV) loan programs, and some increased availability of jumbo loans,” she added.

Fannie Mae and Freddie Mac introduced 3% down mortgages nearly two years ago, and the product has slowly made its way into both big and small lender offerings since then, as the shock and awe of the original announcement wore off.

Breaking apart the index, of the four component indices, the Government MCAI saw the greatest increase in availability over the month (up 1.9%), followed by the Conventional MCAI (up 0.7%), the Conforming MCAI (up 0.7%) and the Jumbo MCAI (up 0.6%).